Value Additivity: Meaning

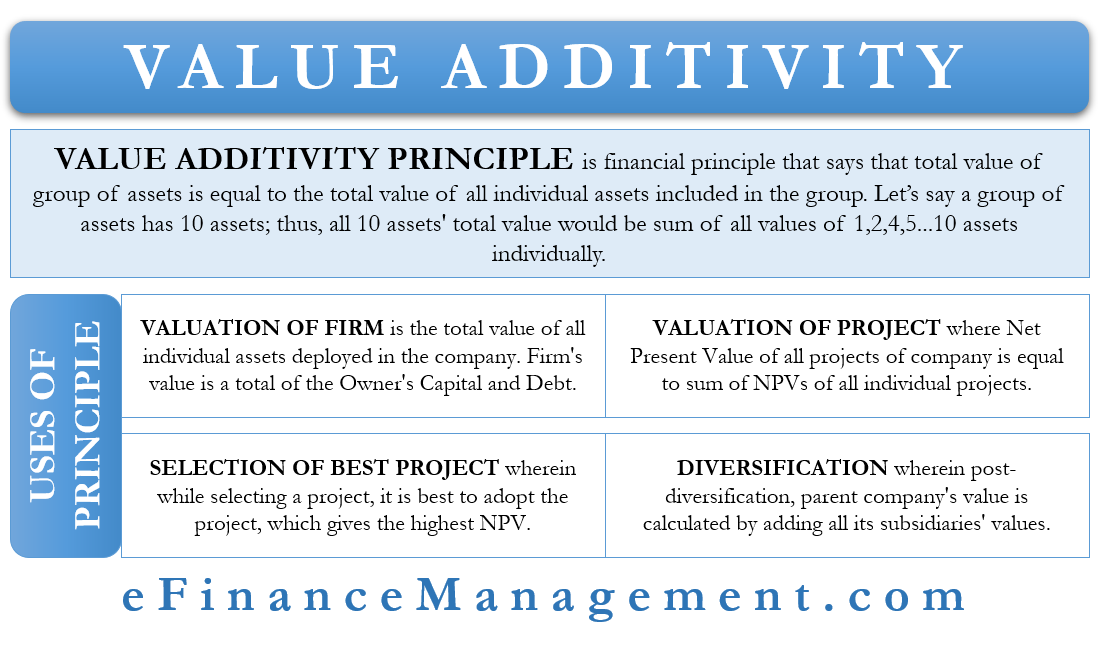

The Value Additivity Principle is a financial principle that says that the total value of a group of assets is equal to the total value of all individual assets included in the group. According to this principle, a portfolio’s total value would be a summation of the values of all the securities/assets taken together. This principle also says that the Net Present Value (NPV) of a group of independent projects would be equivalent to the NPV of all the individual projects. Thus this principle collects smaller components to make it a bigger one collectively.

Let’s say a group of assets has 10 assets; thus, all the 10 assets’ total value would be the sum of all values of 1,2,4,5…10 assets individually. Therefore as the name suggests, it depicts the Value by adding (involving) all the respective assets in the group. Here the value determined can be a Present Value, Future Value, or Book Value. It will rely on the respective asset and scenario.

Uses of Value Additivity Principle

Valuation of Firm

The Value Additivity Principle is often used to compute the value of the firm. The Value of the firm is the total value of all individual assets deployed in the company. These assets help generate cash, which further helps to repay Equity holders and Debt holders. Thus, in the end, the firm’s value is a total of the Owner’s Capital and Debt.

Let’s say, Value of Firm: V

Equity in the business: E

Total Debt liabilities: D

V = E + D

Thus the justification of the RHS side of the equation is possible with the help of the Value Additivity Principle, where the firm’s value is its Equity and Debt.

Also Read: MVA vs EVA

Valuation of Projects

This principle widely helps in computing the total Net Present Values (NPV) of all future cash flows. According to this principle, the Net Present Value (NPV) of all projects of the company is equal to the sum of the Net Present Value (NPV) of all individual projects. The company’s total projected future cash flow is the total of individual cash flows. Here consideration of both risky and risk-free cash flows takes place.

Selection of Best Project

According to the Value Additivity principle, the NPV of the firm is a total of all NPVs of its entire project. Thus while selecting a project, it is best to adopt the project which gives the highest NPV. If there are two similar projects, then the project which offers higher NPV is to be selected to get incremental cash flows. Thus according to this principle, individual higher NPVs will ultimately increase the NPV of the firm, thus valuing the firm at a higher value.

Diversification

Companies extensively use this principle at the time of diversification. According to financial analysts, post-diversification, the parent company’s value is calculated by adding all its subsidiaries’ individual values. Here the Market Value of each subsidiary is computed to come up with the firm’s total value. Thus it helps compute the exact value of the firm before and after diversification.

Example:-

Cash Flows from Project A: A

Cash Flows from Project B: B

Valuation function: V

Therefore, V (A + B) = V (A) + V (B)

Limitations of Value Additivity Principle

One of the biggest limitations of this principle is that, at times, double counting of assets occurs due to overlapping. This can be intentional or non-intentional. Sometimes, Individual assets, NPV of a project, or cash flows from a particular source are calculated twice to increase the firm’s value. Thus sometimes, this principle encourages fraud or misrepresentations of data.

Also Read: Value of a Firm

Conclusion

Valuation Practices widely use Value Additivity Principle. We may consider this principle as the base for determining and arriving at various other valuation metrics. This principle is useful only if all variables in the study are accurate. Starting from the inclusion of a particular asset to the market value of assets. Many analysts also use Non-Additivity principles as a replacement. It is impossible to claim which is better; it can vary from one business to another. One needs to see and take particular care that while summing up or adding up the various assets, duplication does not creep in at any level because that will distort the value and the consequent decision.