Standalone Risk: Meaning

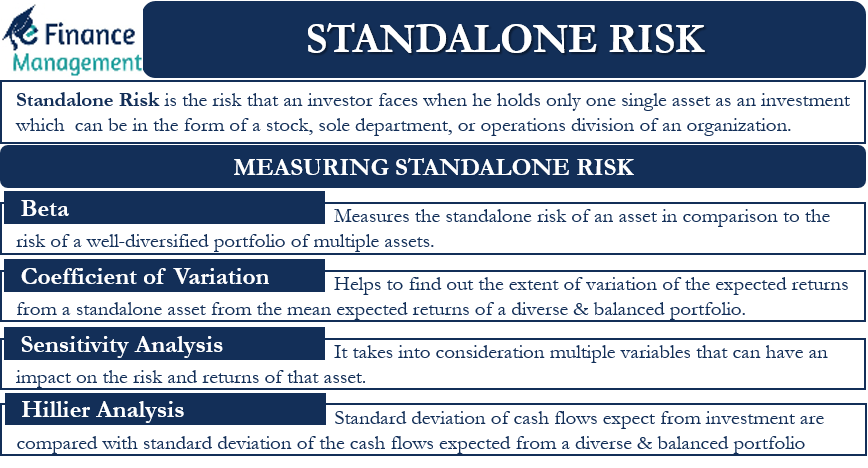

We can define “standalone risk” as the risk that an investor faces when he holds only one single asset as an investment. And this single asset holding or investment could be by any individual or a business organization. The asset in question can be in the form of a stock, sole department, or operations division of an organization. It can be any other similar asset of commercial value. Standalone risk arises when we go against the policy of diversification of portfolios. We just concentrate our resources on a single asset. We calculate this risk by assuming that all of the losses and gains will come from that one particular asset to an investor.

Hence, the key to mitigating such risks is the diversification of our portfolio. We should spread our investment between multiple assets or departments. This will minimize the unsystematic risks. Also, it will take care of risks that are specific to a particular company or asset.

There is an age-old proverb in the financial world “Do not put all your eggs in one basket.” This approach insists on a well-diversified holding of assets or investments by the investor/business organization/portfolio managers, etc. In the financial world, many times, investors treat their big investments or large divisions of a business as a separate entities. We then calculate the standalone risk of that individual entity. Investors can determine the extent of risk to expect from that asset in comparison to the expected return from that asset.

How do we Measure Standalone Risk?

We use a number of statistical techniques to assess the standalone risk of an asset. Let us have a look at them in detail.

Beta

Beta measures the volatility of an asset or an investment in comparison to the overall market. Specialists use beta to measure the standalone risk of an asset in comparison to the risk of a well-diversified portfolio of multiple assets. It helps an investor understand how volatile and risky the standalone asset is. Also, it helps him choose between the two options of investing. He can either invest in a standalone asset. Or go for a mix of assets in the form of a diversified portfolio. Again this depends upon his risk appetite, market trend perception, etc. Aggressive investors prefer to go with investments having a beta value of more than 1. In contrast, conservative or moderate investors would like to go with the assets having a beta lesser than 1.

Coefficient of Variation

The coefficient of variation is a statistical measure that investors use. It helps to find out the extent of variation of the expected returns from a standalone asset from the mean or average expected returns of a diverse and balanced portfolio. In case the coefficient of variation is low, an investor can expect to earn a high return with low risk.

On the other hand, if the coefficient of variation is high, an investor can expect to earn a lower return at a much higher risk. Thus, he can avoid investing in that particular standalone asset in this case.

Sensitivity Analysis

Sensitivity analysis is an effective way to adjudge the standalone risk of an asset. It considers multiple variables that can have an impact on the risk and returns of that asset. Analysts can create a “what-if” situation or a simulation. On this basis, they can evaluate the risks associated with a particular asset. They can evaluate the factors that can result in the change in price or returns of that asset. Investors can make an informed decision on the basis of a fair evaluation of the standalone risk of their investment, considering the impact of key factors.

Hillier Analysis

Investors can also use the Hillier model to assess the standalone risk of a particular asset or investment. This model calculates the standard deviation of the cash flows that we expect from the investment. We then compare it with the standard deviation of the cash flows that we expect from a diverse and balanced portfolio.

A high standard deviation of the cash flows from an investment will mean that the investor will have to bear a high level of risk and vice-versa.

Summary: Standalone Risk

There are many instances when investors are inclined to invest their entire investable surplus in one particular stock. He may also make a considerable investment in some particular asset with a financial value. This may be due to expectations of excessive returns from the investment. He may invest for some other benefit, such as enhanced safety, or not find any other investment opportunity. Investors have to be very cautious in such cases as they will have to face standalone risk with their investment. In case the company performs well, the return from the investment may match the expectations of the investor. It may even exceed his expectations in some instances. However, if the company’s performance is not on the expected lines, then the investor may lose a substantial portion of his investment. The same is true with investment in any other asset class.

Advantages of a Standalone Unit

In the case of companies, individual entities or departments may sometimes prove beneficial rather than being part of a group. In the case of a company that operates as a single structure, lenders and creditors can approach the main office and demand their money back, even if the default is caused by the negligence of one small branch. On the other hand, lenders’ and creditors’ claim is limited only to the assets of a particular department or branch if a company operates through separate smaller legal entities. Thus, the company will benefit from such an arrangement in such cases.

Investors should thoroughly assess the standalone risk of their investment. They can measure its beta, coefficient of variation, or use other measures as mentioned above. They may also minimize this risk by efficient diversification of their portfolio. Investors can include different kinds of stocks or assets and create a balanced portfolio. This will help them to mitigate the effect of standalone risk. They will be able to make profits even if a particular asset or stock underperforms or fails. The only caution here is that diversification should not be only for the namesake, i.e., investments in similar kinds of assets. Or there should not be too much diversification.

Frequently Asked Questions (FAQs)

It is the risk that an investor faces when he holds only one single asset as an investment. The asset can be in the form of a stock, sole department, or operations division of an organization.

Standalone risk arises when we go against the policy of diversification of portfolios.

Some statistical techniques to assess the standalone risk of an asset are:

1. Beta

2. Coefficient of variation

3. Sensitivity analysis

4. Hillier analysis