What is Enterprise Value?

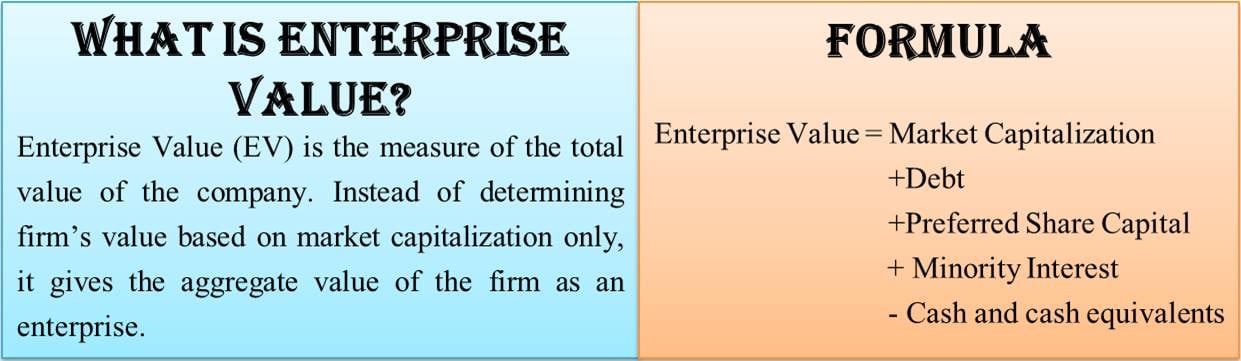

Enterprise Value (EV) is the measure of the company’s total value. Instead of determining a firm’s value based on market capitalization only, it gives the aggregate value of the firm as an enterprise.

In simple words, the EV of a company is a theoretical price at which it can be bought. It is significantly different from market capitalization and considers many other factors to arrive at the correct valuation of the business. For example, if a firm has some debts and another organization takes them over. In such a case, the firm taking over shall take over the debt of the firm, too and the same has to be paid by the taking over the firm. The EV considers all the factors, including the debt; this is not the case while determining the value as per the market capitalization method. Thus while sizing up, the investors get to know the actual valuation of the organization.

There is a formula to calculate the EV of the private company. Let us have a look at the formula.

Enterprise Value Formula

The EV of the firm is calculated with the following formula:

Enterprise Value = Market Capitalization + Debt + Preferred Share Capital + Minority Interest – Cash and cash equivalents

Let us take an example to see the calculation of Enterprise Value

Example

Calculate the EV of ABC Ltd. from the following data:

Number of Shares Outstanding: 2,000,000

Current Price of the Share: $ 10

Total Cash: $ 1,000,000

Total Debt: $ 200,000

We shall calculate EV using the above formula

Enterprise Value = (2,000,000 * $ 10) + $ 200,000 – $ 1,000,000 = $ 19,200,000

Therefore, the EV is $ 19,200,000

Let us see why the EV is important.

You can also use our calculator for a quick calculation: Enterprise Value Calculator

Importance of Enterprise Value

Investors invest in a company when they know its true value. The highest investment comes in those companies that generate higher cash flows and high enterprise value. EV is very critical for the value investors who consider the value of a company beyond the outstanding equity. Debt and cash have a huge impact on finding the correct valuation of a company. Both the components do not form part of market capitalization to find the company’s true value.

On the other hand, the EV acknowledges such aspects and helps find the enterprise’s actual valuations. To sum up, Enterprise Value helps the investors know the company’s accurate value and determine whether it is undervalued or not.

Read more about Other Market Value Ratios.

Conclusion

Enterprise Value plays a significant role for the investors to find the actual value of the company. It helps in the comparison of companies having different capital structures. During the takeover of the company, along with the assets, the liabilities are also taken over. The liabilities include debts and other components. It is obvious that now the debt will have to be paid by the new organization that is taking over the firm. Thus, the actual value of the company comprises not only market capitalization but also the other components. In the future, the concept of EV will become more relevant, and more organizations, as well as investors, will opt for this method to know the true value of the company.

Continue reading – EV to EBITDA.