Wealth maximization is a modern approach to financial management. Maximization of profit was once used to be the main aim of a business and financial management till the concept of wealth maximization came into being. It is a superior goal when compared to profit maximization as it considers a broader arena. The wealth or value of a business is defined as the market price of the capital invested by shareholders.

Wealth Maximization Concept: Definition

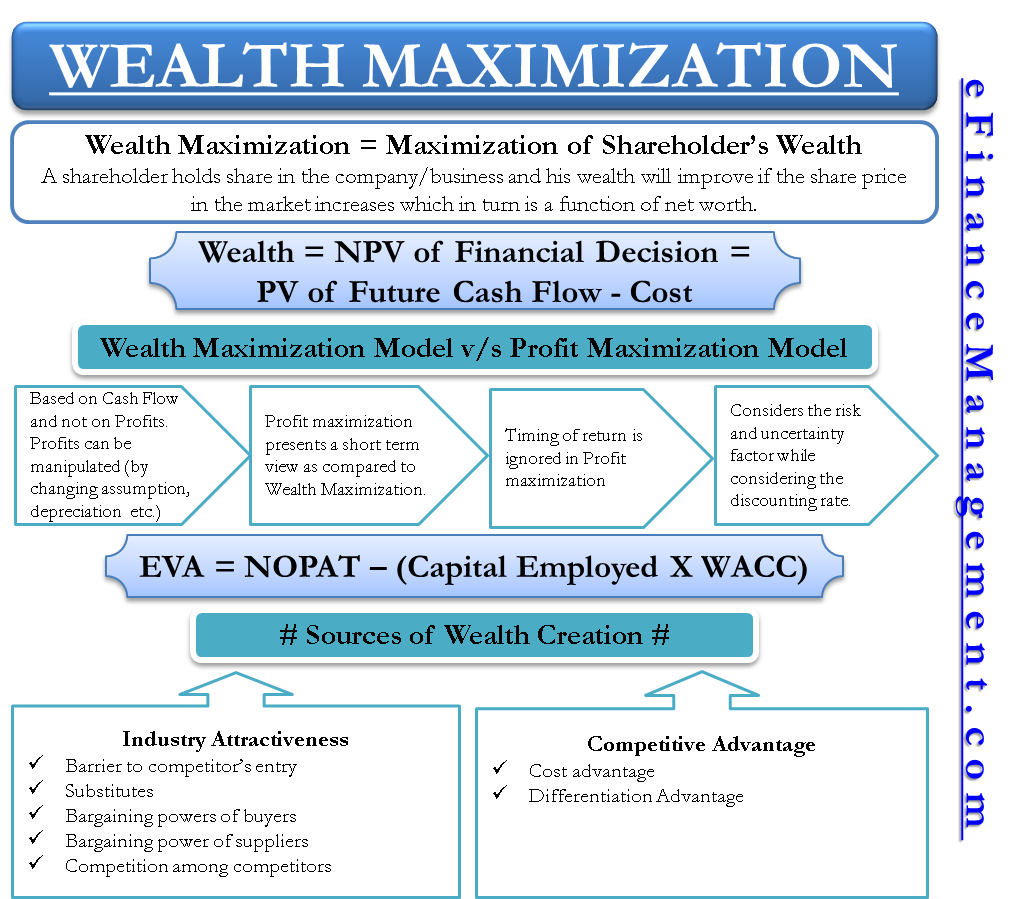

It simply means the maximization of shareholders’ wealth. It is a combination of two words, viz. wealth and maximization. A shareholder’s wealth maximizes when the net worth of a company maximizes. To be even more meticulous, a shareholder holds a share in the company/business, and his wealth will improve if the share price in the market increases, which is a function of net worth. This is because another name for wealth maximization is net worth maximization.

Finance managers are the agents of shareholders, and their job is to look after the interest of the shareholders. The objective of any shareholder or investor would be a good return on their capital and the safety of their capital.

Wealth maximization serves both these objectives very well as a decision criterion for business.

How to Calculate Wealth?

Wealth is said to be generated by any financial decision if the present value of future cash flows relevant to that decision is greater than the costs incurred to undertake that activity. An increase in wealth equals the present value of all future cash flows less the cost/investment. It is the net present value (NPV) of a financial decision.

Also Read: Profit vs. Wealth Maximization

Increase in Wealth = Present Value of cash inflows – Cost.

Where,

| CF1 | CF1 | CFn | ||||

| Present Value of Cash Inflows | = | ——— | + | ——— | +……….+ | ——— |

| (1 + K)1 | (1 + K)2 | (1 + K)n |

Advantages of Wealth Maximization Model

The wealth maximization model is superior because it obviates all the drawbacks of profit maximization as a goal of a financial decision.

- Firstly, wealth maximization is based on cash flows and not on profits. Unlike the profits, cash flows are exact and definite and therefore avoid any ambiguity associated with accounting profits. Profit can easily be manipulative, and if there is a change in accounting assumption/policy, there is a change in profit. There is a change in the depreciation method; there is a change in profit. It is not the case in the case of Cashflows.

- Secondly, profit maximization presents a shorter-term view as compared to wealth maximization. Short-term profit maximization can be achieved by the managers at the cost of the long-term sustainability of the business.

- Thirdly, wealth maximization considers the time value of money. It is important as we know that a dollar today and a dollar one year later will not have the same value. In wealth maximization, the future cash flows are discounted at an appropriate discounted rate to represent their present value. Suppose there are two projects, A and B. Project A is more profitable; however, it will generate profit over a long period of time, while project B is less profitable however it can generate a return in a shorter period. In a situation of uncertainty, project B may be preferable. So, profit maximization ignores the timing of returns and considers wealth maximization.

- Fourthly, the wealth-maximization criterion considers the risk and uncertainty factor while considering the discounting rate. The discounting rate reflects both time and risk. Higher the uncertainty, the discounting rate is higher and vice-versa.

Economic Value Added

In light of a modern and improved approach to wealth maximization, a new initiative called “Economic Value Added (EVA)” is implemented and presented in the companies’ annual reports. Positive and higher EVA would increase the shareholders’ wealth and thereby create value.

Economic Value Added = Net Operating Profits after tax – Capital Employed x Weighted Average Cost of Capital.

In summary, wealth maximization as an objective to financial management and other business decisions enables the shareholders to achieve their objectives and therefore is superior to profit maximization. It is a decision criterion for financial managers being used for all the decisions. For more clarity, refer to Profit Maximization vs. Wealth Maximization.

How to Maximize Shareholder’s Wealth?

Capital investment decisions of a firm have a direct relation with wealth maximization. All capital investment projects with an internal rate of return (IRR) greater than the cost of capital or having a positive NPV create value for the firm. These projects earn more than the firm’s ‘required rate of return.’ In other words, these projects maximize the shareholders’ wealth because they are earning more than what they can earn by investing themselves.

By analyzing the projects with the methods of capital budgeting, we know whether wealth will or won’t be created in a particular project. But, what is the real source of wealth creation? What characteristic of the project becomes the root cause for value creation?

Source of Wealth Creation

Normally, the two types of environment that we face are – the external environment and the internal. If both the conditions support an organization, it tastes the success. The most important external factor which creates value is industry attractiveness, and a similar internal factor is the competitive advantage of the firm.

Two main sources of wealth creation or value creations are the industry attractiveness and competitive advantage of the firm. Let us discuss them in little more detail.

Industry Attractiveness

One of the most important factors for a firm is to make profits is its industry attractiveness. Explained by Michael Porter, there are five forces of industry attractiveness which are as follows:

Barriers to Competitor’s Entry

The higher the entry barrier, the higher are the chances for a firm to sustain itself for the long term.

Substitutes

Lower the substitutes, lesser are the chances of consumers switching the products.

Bargaining Power of Buyers

Lesser the bargaining power of buyers, the firm becomes in a better position to dominate terms.

Bargaining Power of Suppliers

Lesser the bargaining power of suppliers and buyers, the firm becomes better positioned to dominate terms.

Competition among Competitors

It emphasizes the degree of competition between the current competitors of the industry. Amicable conditions among the competitors would make the firms enjoy a better position.

Competitive Advantage

There are two elements of competitive advantage as per Michael Porter, let us see both of them below:

Cost Advantage

Cost advantage means the cost at which the competing firms cannot produce the goods at which the other firm is producing. Due to this advantage, the firm can sell products at a lower price than the competitors and still earn profit. Customers are cost-conscious, and therefore, the firm’s product attracts them. The firm enjoys good sales, which lead to more profits and better cash flows and therefore achieve wealth creation.

Differentiation Advantage

Differentiation advantage means the product offered by the firm can be easily differentiated from other competitors’ products. The customers are convinced with a different product available only with the firm under consideration. In such cases where the product is unique, firms enjoy higher prices, and therefore, this becomes the real source of value creation for those firms.

Frequently Asked Questions (FAQs)

Wealth maximization means an increase in the shareholder’s wealth. A shareholder’s wealth increases when there is an increase in the net worth of the company.

Yes, wealth maximization is better than profit maximization. Wealth maximization is based on cash flows not on profits. It considers the time value of money and risk and uncertainty factors while considering discount rates.

The best way to operationalize shareholder wealth maximization is to invest capital in those projects where the company earns more than the firm’s ‘required rate of return’. The internal rate of return of the project must be greater than the cost of capital or have a positive NPV to create value for the firm.

Hello to all, the contents present at this site are actually amazing for people knowledge, well, keep up the good work fellows.

It is very useful for management students. Thanks

Very well brought out discussion. Found it useful for Management scholars.

Well done, it is a good guide for management scholars.

Well done, it is a good guide for scholars.

Wow.. well done. highly useful for management scholars

With the threatening global economic shifts that are in most cases unpredictable to some extent, the information provided on this site becomes very relevant not only to financial mamagement scholars or students but for everyone who is so passionate with wealth creation and wealth maximisation. Keep at it

Vary nice

nice work brother. im in Tanzania BA in ACC

I just wanted to type a brief word to appreciate you for that lovely information you are giving at this site. My extended internet investigation has finally been compensated with awesome knowledge to write about with my family and friends. I would believe that many of us readers actually are extremely lucky to exist in a good network with many lovely individuals with beneficial tricks. I feel somewhat lucky to have discovered your web pages and look forward to plenty of more entertaining minutes reading here. Thanks once again for all the details.

This i like. Cheers!

Interesting. I really love the content. And I have learn more things, especially Economic Value Added.

Really helpful , as it clarify both the profit and wealth maximization separately , very precisely