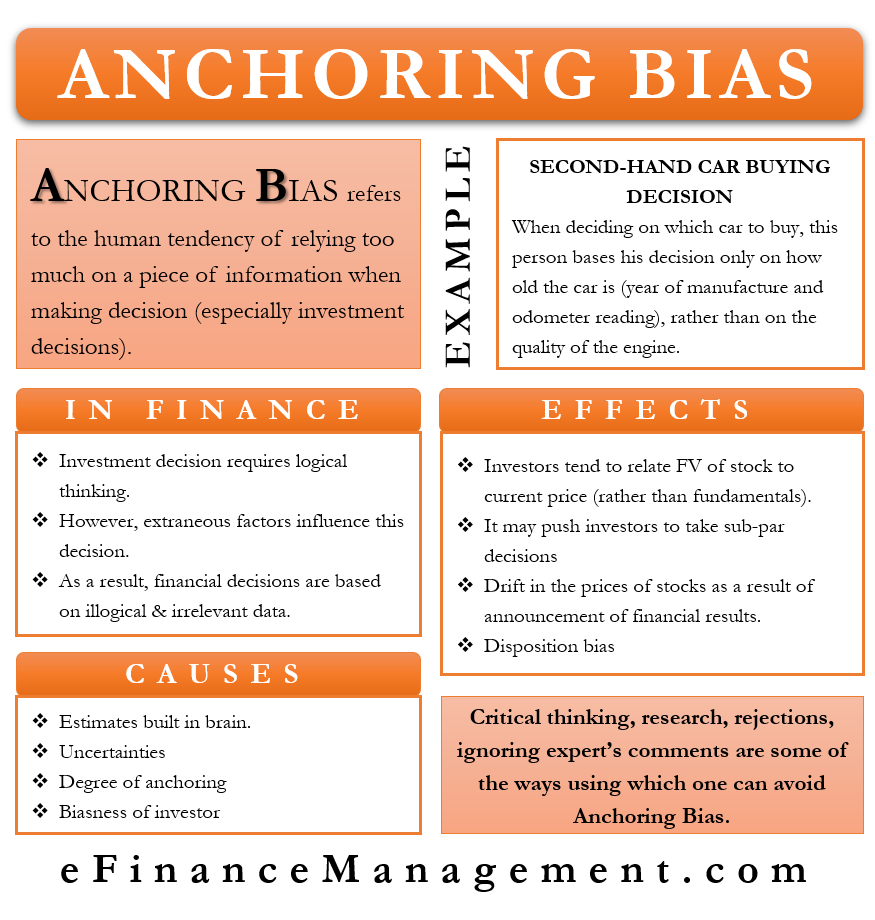

Anchoring Bias is a psychological term and is a crucial concept in behavioral finance. It talks about the human tendency to rely too much on a piece of information when making decisions. This piece of information on which people base their decision is “anchor.” And this anchor usually is the first price or value an investor or buyer sees. Moreover, this value or price ultimately influences the decision of the investor or buyer to go for that investment or purchase.

Practical Examples

For example, you plan to buy jeans, and see the first jeans costing $900, and then see another one costing $200. In such a case, it is very likely that you will assume that the second pair of jeans is of low quality, hence so cheap. Another example is if you only see only one pair of jeans costing $200, you are most likely to buy them and won’t view them as cheap.

In both examples, the first prices that investors saw influence their decision without them even knowing it. Usually, in an anchoring bias, an investor tends to have a bias towards that value once an anchor is set.

Let us take another example where a person is planning to buy a second-hand car. When deciding on which car to buy, this person bases his decision only on how old the car is (year of manufacture and odometer reading) rather than on the quality of the engine.

Anchoring Bias in Finance

The concept of anchoring bias is very relevant in the financial world. Normally, an investment decision requires logical thinking. However, many a time, extraneous factors influence an investor’s decision. This results in decisions being affected by illogical and irrelevant data. One such bias is the Anchoring Bias.

In this, investors take their decision on the basis of a reference point. But, this reference point may or may not hold any importance to the current decision. And usually, this reference point is the first information an investor gets or any pre-existing information.

A simple example of this bias in the financial world is when you ask someone to predict a stock price. Most people would predict the future price using the current stock price. They will see where the current stock price is and then decide its future price. In this case, the present stock price is the anchor, and people base their decision on this anchor.

Causes of Anchoring Bias

As said above, the anchoring effect is a behavioral concept, implying that it is inbuilt in our brains. In simple words, we can say that this effect comes into play because people feel the need to develop an estimate. Once they form an estimate, they use it to form another estimate. Though they form a new estimate, people still anchor to the initial one.

Uncertainties are also a cause of this bias. Since the financial world is full of uncertainties, they tend to cause an anchoring effect. So, when investors come face to face with an unfamiliar situation and are unable to find a rational outcome, they tend to base their decision on the initial or historical values (or anchors).

The degree of anchoring, or how bias an investor is toward the anchor, depends on the strength of the anchor. The more relevant an anchor is, the more the investors tend to base their decisions on it. Also, if valuing a product is complex, then people are more likely to depend on the anchor. For example, it isn’t easy to value currencies. So, anchors are common when it comes to valuing the currency.

Effects of Anchoring Bias

An anchoring bias, as one can expect, may influence an investor’s decision in several ways. These are:

• Due to the anchoring effect, investors relate the fair value of a stock to the current price rather than fundamentals. This may push them to hold on to the investment for more time than they should.

• Another effect is that it may push investors to make sub-par decisions. These decisions could be ignoring an undervalued investment or holding onto an overvalued investment for more time.

• The drift in the prices of stocks after the announcement of financial results or earnings is another common impact of anchoring. When a company announces its earnings, the stock price usually underreacts to this news. Thus, it moves to a new price using the earlier stock price as the anchor.

• Disposition bias is also regarded as an anchoring bias effect. In this, investors sell the shares whose prices go up and retain those whose prices go down. In such cases, it is the anchoring effect that pushes investors to the stock’s purchase price.

How to Avoid it?

It is clear that the anchoring bias influences the investment decisions, which may lead to a wrong investment decision. There are psychological and factual ways to avoid this bias. A few of them could be:

Critical Thinking

One issue with the use of anchors is that they do not always give intrinsic value. So, they may or may not help investors arrive at the right decision. Thus, a rational investor must always try to develop rigorous critical thinking.

Critical thinking means that if all are talking good about a stock or any other financial instrument, then one should try to dig out negative points as well. Such an approach would give investors a broader view of the market. One way of critical thinking is that an investor must use reasoning and valuation principles (such as DCF) rather than basing their decision on just the current stock price. Moreover, if the stock price goes up or falls, investors must also refer to the fundamentals to make decisions.

There are also cases when investors value a stock using the valuation technique, and the number they get is very different from the actual stock price. In such a case, an investor may try to change their valuation to be in line with the market. They do this because their decision gets influence by the anchoring bias, and they don’t trust their own due diligence.

Research

Another way to avoid bias is to conduct a lot of research. One major reason for a bias is the existence of uncertainties. So, carrying out thorough research is a good way to overcome bias.

Rejection

One can also overcome anchoring bias by rejecting some anchors. Certain anchors, such as valuation multiples and historical values, may mislead investors. So, it is better to reject them. If there is a situation when an investor needs to use anchors, then also it is best to replace or back them with quantifiable data.

Ignoring Experts Comments

You can also stay clear of this bias by being careful with the experts’ commentary. There are various researches that prove humans are extremely sensitive to the opinions experts offer on the news shows. So, for instance, if an analyst says that a stock is showing potential, then this might impact their decision.

Final Words

Anchoring bias is a common thing, and it is not always bad. However, it is best to avoid it in order to arrive at a rational and logical decision. Overcoming such a bias is not a difficult task. One can easily avoid it by being objective and having a practical approach. Moreover, investors basing their decision on data and research are less likely to fall for this bias.

RELATED POSTS

- Top-down vs Bottom-up Investing: Meaning, Differences and More

- Contrarian Strategy – Meaning, Execution, Advantages, and Disadvantages

- Arbitrage Pricing Theory

- Trend Analysis – What It Means, Uses, Types And More

- Bird in Hand Theory – Meaning, Formula, Assumptions, and Limitations

- How can a Capital Budgeting Decision Go Wrong?