What is Pegged Exchange Rate?

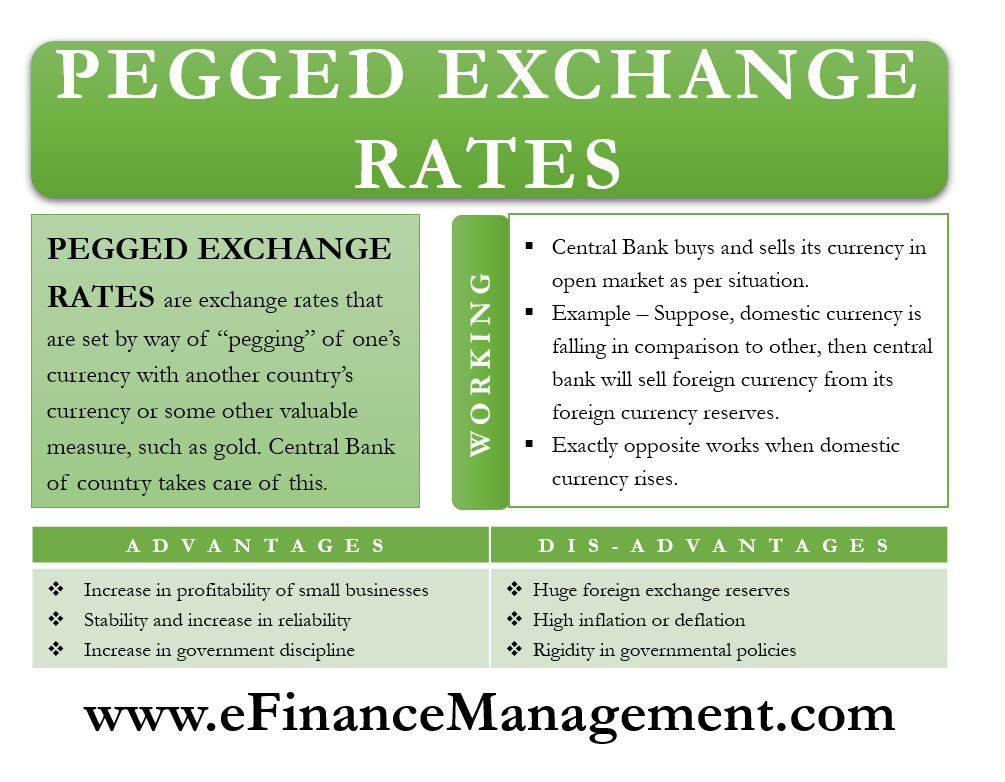

Exchange rates measure a country’s currency value vis-à-vis the currency value of other countries. A currency can be strong or weak, depending upon its comparison with the other currency one decides to choose. There are many factors that can affect a currency’s value- its supply and demand, inflation in the country, the stability of the government, etc. Pegged Exchange Rates are exchange rates that are set by way of “pegging” of one’s currency with another country’s currency or some other valuable measure, such as gold. The supreme monetary authority of a country or the Central bank, takes care of this task. It is also known by the name fixed exchange rate.

Pegging is done to maintain stability in the exchange rates and avoid any major fluctuations in the currency’s value. Moreover, a country’s currency value is set in accordance with a more stable and internationally acceptable currency of some other country. This results in the fixation of a ratio for value determination between two currencies. The value does not change by a change in internal market conditions and government and banking policies. Hence, this provides stability and reliability to a currency and makes it more acceptable in world trade.

How is Pegged Exchange Rates Maintained?

Maintaining the value of a currency according to the pegged exchange rates is the duty of the Central bank of the country. It has to buy or sell its currency by using the open market mechanism as the situation demands. Suppose the value of the domestic currency is falling in comparison to the foreign currency against which its pegging has been done. The Central bank will sell foreign currency from its foreign currency reserves. This brings in domestic currency in return, thereby increasing its demand artificially. The value of the domestic currency rises because of the increase in its demand.

The exact opposite happens if the value of the domestic currency rises more than the desirable limits. The Central bank starts buying foreign currency and adding to its reserves. This results in an overflow of domestic currency supply in the country. Excess supply results in a reduction in its value, thereby again bringing the equilibrium in foreign exchange rates. Thus, this process of open market operations lends strength and stability to the value of the domestic currency.

Benefits of Pegged Exchange Rates

Increase in Profitability of Small Exporting Countries

Pegging of Exchange Rates results in higher profits in real terms for exporters belonging to countries with a low exchange rate. Let us suppose that a relatively smaller nation like India exports goods to the USA. The current exchange rate is 74:1, which means that 74 Indian Rupees are equal to 1 US Dollar.

Due to the low exchange rate, the importing country (the USA in this case) will tend to buy more as it will find importing much cheaper and beneficial rather than manufacturing the same product at its home. Also, the traders from India will find it beneficial to export more due to the high demand and high value of their proceeds in real terms when they convert the USD back to Indian Rupees.

Stability and Increase in Reliability

The pegging of exchange rates results in stability in the value of currency for any country. This is very important for smaller countries, and the currency value does not fluctuate very much. Stability in currency value leads to an increase in reliability of that country in the world market. Hence, investors will not hesitate to invest in such countries. They will be confident that their investment value will not wipe out or deteriorate suddenly.

Increase in Government Discipline

Pegging of exchange rates results in the government taking a more serious approach in stabilizing the value of its currency. It will shape its monetary policies such that exchange rate fluctuations happen to the minimum. Thus, the government works constantly to check the volatility of its currency so that a currency crisis situation does not occur.

Also Read: Types of Exchange Rates

What are the Demerits of Pegged Exchange Rates?

Huge Foreign Exchange Reserves

Any country that adopts a Pegged Exchange Rate system has to maintain a huge foreign exchange reserve. This is due to the constant open market operations that it has to undertake. It has to stabilize the value of its currency with regard to the value of the pegged foreign currency. Therefore, to do so, it has to buy or sell the foreign currency for which it needs abundant reserves. Hence, a huge amount of government money gets stuck in the reserves, leading to an artificial money shortage.

High Inflation or Deflation

The open market operations of the government may result in a high supply of money in the domestic market. Hence, this will automatically lead to inflation in the economy. This is the case at the time of the rising value of the domestic currency with regard to the foreign currency against which it is pegged. The central bank or the monetary authority will interfere and start buying the foreign currency to supply more domestic currency in the economy, which in turn leads to a reduction in the value of the domestic currency.

The opposite will be the case when the government sells a foreign currency with a view to pull out domestic currency from the market. Hence, this can result in a shortage of domestic currency that can lead to a situation of deflation.

Rigidity in Government Policies

The government becomes rigid under the system of the pegging of exchange rates. Also, it has to always shape its monetary and fiscal policies in line with keeping the exchange rates stable and without any sharp fluctuations. Hence, it may lead to delays in policy formulation and implementation.

RELATED POSTS

- Dirty Float

- Real vs Nominal Exchange Rate – All You Need to Know

- Hard Currency – Meaning, Importance, Key Hard Currencies, and Qualification

- International Monetary System: Meaning, Evolution, Advantages, Criticisms and More

- Official Reserve Account – Meaning, Importance, and More

- Cross Currency Rate – Meaning, Importance, Calculation, and Example