Top-down vs Bottom-up Investing: All you need to Know

Investors use various investment strategies to select the best investment vehicle which synchronizes with their investment goals. Out of many investment strategies, top-down and bottom-up are the most popular and generic ones. These both are the approaches to fundamental analysis. These strategies are different from one another, and so comes the question of Top-down Vs Bottom Investing. The ultimate goal of both these strategies is to find the best investment vehicle for the investor that directly matches the investor’s goal.

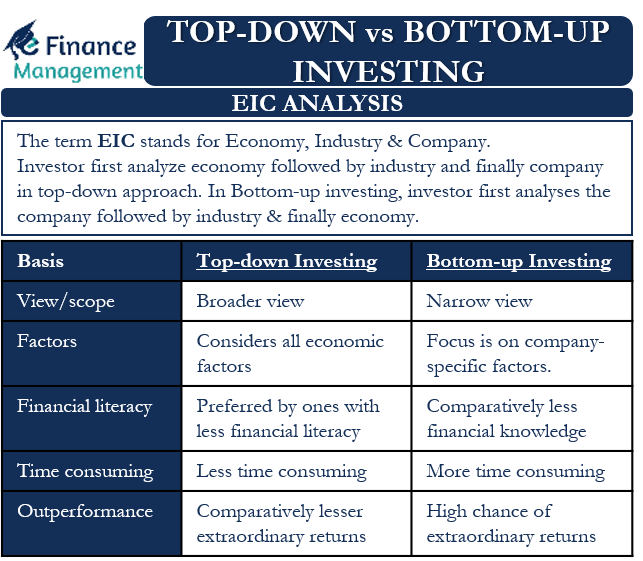

Top-down vs Bottom-up Investing: EIC Analysis

Top-down Investing strategy and Bottom-up investing strategy both are dependent on the concept of EIC Analysis. Here the term EIC stands for Economy, Industry, and the Company. When analyzing a company, if a top-down approach is followed, then the investor will first analyze the economy, followed by the industry, and finally the company.

Investors following the top-down approach believe that if the economic conditions are stable and the industry or the sector is progressive, the company will grow automatically. Whether the country is underdeveloped, developing, or developed, economic analysis plays an important role in Top-down investing. The economy and Industry create a positive impact on the health of the company.

Opposite to this is Bottom-up investing. Here the investor first analyses the Company, followed by the industry analysis, and finally the Economy analysis. Here the investors believe that if the company has good fundamentals, then the relevance of the industry and economy is secondary. They identify an undervalued company and make investments accordingly.

As the name suggests, a top-down investing strategy means you start from the top and later move down. And in a bottom-up investing strategy, you start from the bottom and later move up along the ladder. At each level, while moving up or down, on the basis of pros and cons, elimination takes place. In other words, we can say that in the Top-Down Approach, the investor moves from Macro to Micro and vice versa in the case of Bottom-up Investing.

Also Read: Fundamental Analysis

Understanding Top-down Investing Strategy

As the name suggests, the Top-down investing strategy starts from the top. Here the investor starts analyzing from the top level or a macro level. The investor will start analyzing the Economy, followed by the industry and later the company. At each level, elimination will take place according to the goals and risk appetite of the investor. In simple words, the focus of this strategy is on the macro elements. These investors identify attractive economies and later attractive industries within. Later from the respective industries, the best available company is selected. Here investors give due weightage to the economy and the industry segment, besides focusing on the best-performing companies in that segment/sector.

Understanding Bottom-up Investing Strategy

As the name suggests, the Bottom-up investing strategy starts from the bottom. Here the investor starts the analysis from the bottom level or from the micro-level. The investor conducts analysis at the company level, followed by the industry and at the end economy. This strategy focuses on the micro-level elements. The investor will analyze many companies on the basis of the fundamentals and will select the best suitable company. The investment vehicle’s goals should match with the investor’s goals.

Top-down vs Bottom-up Investing: Differences

Following are a few major differences between Top-down investing strategy and Bottom-up investing strategy:-

Broader View or Narrower View

One of the biggest differences between top-down investing and bottom-up investing is their vision while investing. In the top-down approach, the investor considers a macro-level picture while making an investment decision. In this strategy, the investor would not restrict themselves to a particular company but will have a broader look across the industry or economy.

The investors of the bottom-up investing strategy take a micro look while investing. Here more importance is given to a particular company or an investment vehicle rather than the whole industry, sector, or the economy. The whole analysis process starts at a ground level with a narrower view.

Economic Factors or Company-Specific Factors

In the top-down investing approach, the investor has to consider all economic factors, including the Gross Domestic Product (GDP) of the country. This method gives immense importance to the economic factors, monetary policies, inflation, and industry factors. They prefer a stable government and a stable industry. Thus the focus is on macro-level factors.

In the Bottom-up investing strategy, the investor focuses on company-specific factors. Starting from the company’s product portfolio, assets, financial statements of the company, demand-supply factor, financial and sales performance, the status of debts, etc. Thus the focus is on micro-level factors.

Financial Literacy

Investors mostly with sound financial knowledge go for the Bottom-up investing approach. With the help of the Bottom-up strategy, these investors identify undervalued investment options and make high profits. An individual with comparatively less financial literacy should prefer the Top-down approach over and above the Bottom-up approach.

A top-down approach is suitable for investors with comparatively less financial knowledge. This strategy will help investors make profits by selecting stable and less risky investment vehicles. And that selection will get support from the economic and industrial environment too.

Time Consuming

In comparison to the Top-down strategy, the bottom-up strategy requires an ample amount of time for analyses. According to the experts, Bottom-up Investors conduct a lot of research by investing an ample amount of time. At the same time, the Top-down investors invest a lesser amount of time in comparison to Bottom-up investors.

Outperformance

There are high chances of generating extraordinary returns with the help of a Bottom-up investing strategy in comparison to a Top-down investing strategy. As the goal of the Bottom-up strategy is to identify undervalued investments and take advantage of the market conditions, there are high chances of generating extraordinary returns. There are comparatively lesser chances of generating extraordinary returns with the help of the Top-down approach.

Diversification

The top-down investing strategy allows the investor to diversify across industries and countries. In comparison to the Bottom-up investing strategy, the Top-down gives more opportunities for varied diversification. The bottom-up strategy also allows for diversification, but the extent and opportunities are comparatively lesser.

Miss Out on Top Companies

Sometimes, the investor might overlook top performers in weak sectors by implementing a top-down approach. There are times when the sector is not doing well enough, but the company is growing immensely. In such a situation, these top performers in the weak sectors will never get a place in the portfolio under the top-down strategy.

In contrast, most such good performers won’t be overlooked in a Bottom-up strategy. This strategy gives an opportunity to identify such gems for investing.

These differences are non-exhaustive in nature.

Universe

A basic difference between the two approaches is the area/overall universe of research or identification, as the Top-Down Approach eliminates the industrial sector, which is not performing well. Or restrict itself to the performing sectors only; the universe remains limited. At the same time, such is not the restrictions or elimination in the case of the Bottom-up approach. Hence, in this strategy, the universe of companies remains very large.

Top-down vs Bottom-up Investing: Conclusion

Both Top-down investing strategies and bottom-up investing strategies are tried and tested investing strategies and have their own approach to investing. It is not possible to directly compare these investing strategies and decide which is better. They individually have their own relevance and methodology for ultimately generating returns according to the investor’s requirement. It would purely depend on the investor’s goal, investible amount, investment horizon, and risk appetite. However, few investors today mix and match both the strategies and create a holistic portfolio. They use a Top-down investing strategy while picking few companies and Bottom-up investing while picking few companies.