What is a Capital Budgeting Decision?

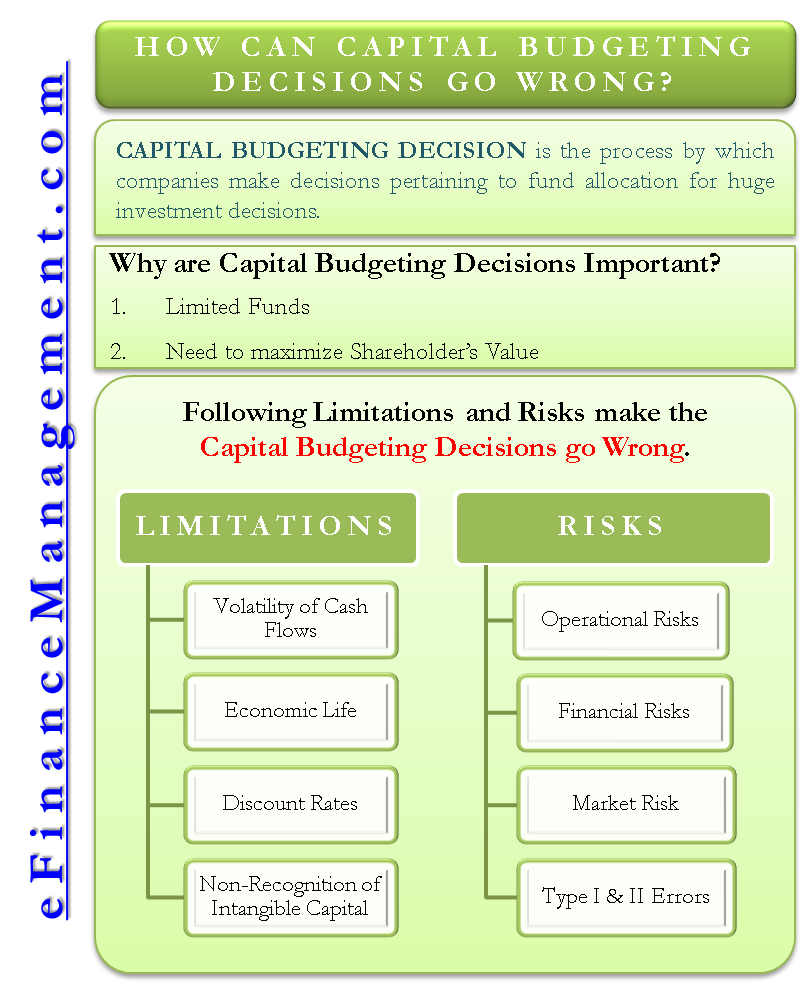

Capital budgeting decision is the process by which companies make decisions pertaining to fund allocation for huge investment decisions. Instances of capital budgeting decisions include the purchase of new machinery, expansion schemes, acquisition of new land, etc.

Why is Capital Budgeting Decisions Important?

The need to make an informed capital budgeting decision arises because capital is available only in a limited amount with the company. Were a corporation to be in possession of a boundless amount of funds, the need to choose and allocate among different projects would never arise. The company could then mindlessly pursue any venture, which increases the shareholder value even slightly. The management must, therefore, carry out rigorous deliberations and checks. They must ensure that they earn the best possible returns with a wise investment of their limited capital.

Capital budgeting decisions are not some new age or modern tool for evaluating the profitability of a potential venture. Every household makes capital budgeting decisions routinely on a day-to-day basis. To take that Hawaii vacation now or during the off-season, buy the latest iPhone or make an addition to little tom’s college fund, fix the leak in the roof, or upgrade the family car. These are all examples of a capital budgeting decision.

Whether in a multi-million-dollar corporate office or our very own household, the driving force behind a good capital budgeting decision always remains the same; “increase in value.” The board of directors strives to take a capital budgeting decision that ultimately increases the shareholder value. Similarly, at home, the purchase adding greater value to well-being and quality of life will be pursued before any other want that can be postponed or does not add as much satisfaction.

How can Capital Budgeting Decisions Go Wrong?

Capital budgeting decisions involve an outlay of huge sums of money. And these transactions are typically irreversible. Therefore, it is important to get the whole process right in the first step itself. No trials and errors are affordable at this stage.

However, the very nature of capital budgeting decisions is such that flaws are sewn into its fabric. Miscalculations and second-guessing are inherent to capital budgeting. The very basis of a capital budgeting decision is an array of assumptions. Therefore, the real picture may often tend to be far from the anticipated one.

Elaborated below are some of the limitations of the capital budgeting process.

Volatility of Cash Flows

Any capital budgeting decision will be based on future cash flows. They represent the net cash expected to be generated from undertaking the project. However, they are future cash flows, and the capital budgeting decision must be made in the present. Therefore, this number is only an estimate. Consequently, the actual results may demonstrate stark variations. The quantum of cash flows accruing is the most dominant determinant in computing the NPV of the project.

Economic Life

The time horizon and economic life of the project also have a significant bearing on the results of capital budgeting. The economic life is normally a reference to the life of the machinery or plant forming the subject matter of the capital budgeting decision. The longer the time horizon, the more room there is for uncertainty and unexpected elements to creep in.

Also Read: Process of Capital Budgeting

As is the case with most capital-intensive projects, they are undertaken to be carried on into the foreseeable future. A lot may change during the lifetime of the project—legal and regulatory requirements, economic climate, or a technological change that renders the existing CAPEX obsolete.

Discount Rates

A discount rate is the interest rate used to compute the present value of future cash flows. Often, the WACC is used as the discount rate in a capital budgeting decision. Again, the concept of the perfect discount rate does not exist. It is just an estimate based on the cost of capital and the prevailing risk-free rate. A high discount rate may underestimate the NPV. Conversely, a lower discount rate may overestimate the NPV.

Also, projects with different lives may not respond to the same discount rate. Therefore, there must be separate discount rate computations for every project under evaluation.

Non-Recognition of Intangible Capital

Another flaw of capital budget decision-making is that it only accounts for “quantifiable” or “monetary” elements. According to it, only the financials involved can justify the success or failure of the project. Therefore, it does not consider the non-financial elements that play a significant role in the success of a venture. The goodwill and reputation enjoyed by the firm, employee skill sets, loyalty, patents held, market share dominated, etc., are some “off the books” items that, even though unaccounted for, contribute directly to making any project a hit.

Risks in a Capital Budgeting Decision

The risk is the possibility that the chosen action will not result in the desired outcome. A capital budgeting project involves numerous risks. Below mentioned is a brief risk classification.

Operational Risks

Risk that the operational effectiveness or the controls involved will not function as per specification. For example, frequent breakdowns, higher than planned manning, increased storage and maintenance costs, less output rate, etc.

Financial Risks

In simple words, financial risk is the risk of losing money already at stake. Changes in monetary terms and conditions during the project may cut off the lifeblood, thus endangering the very existence of the project. For example, a change in credit rating impacts the ability to borrow, insufficient margins to cover operating costs, buyer’s failure (or delay) to pay for the product sold, etc.

Market Risk

Market risk is the changes in the market that could adversely impact the sale of output. We live in an ever-changing and highly competitive environment. Therefore, technologies are quickly outdated, and consumer preferences rapidly shift. Any drastic change in the wrong direction can render the entire capital outlay useless. For example, reduced demand for the product, price cuts by competitors, increase in taxes and duties on the product.

Type I & II Errors

Mainly derived from statistics, the connotations of type I & II also find application in capital budgeting.

Type I Error

The passing on of a profitable capital budgeting venture causes a Type I Error. This leads to an opportunity loss.

Type II Error

The taking up of a potential loss-making venture causes a Type II Error. This leads to a real loss.

Type II errors have greater consequences than Type I errors since the organization ends up losing actual money.