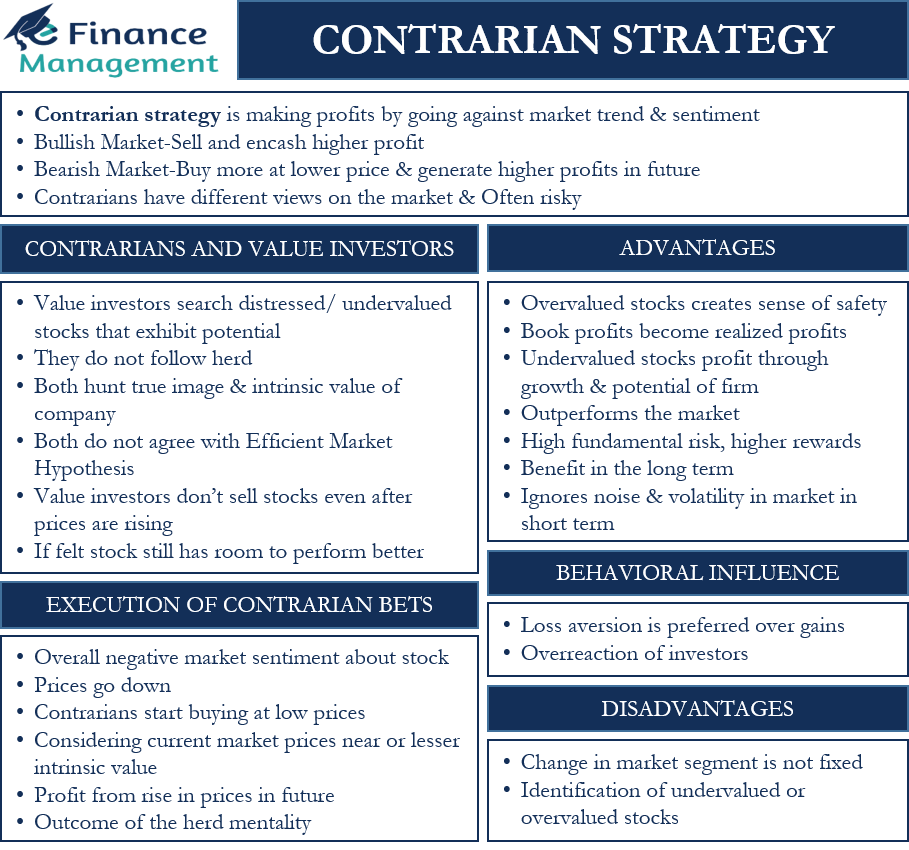

Contrarian strategy is making profits by going against the market trend and sentiment. That is, if the current trend in the market is to buy security – volumes and prices are up, contrarians will take the benefit of rising prices by selling the security. Contrarians have different views on the market. If a stock X in the US market is bullish, but the contrarians believe the increased price is not justified. Then they will choose to sell high and encash the profits. It is often a risky game as the trend may not reverse for long. Or the trend may continue its journey. Hence contrarians have to be sure of what they are thinking, pursuing, and finally executing.

Execution of Contrarian Bets

In another scenario, if the overall market sentiment is negative about a stock, then investors are generally in a hurry to sell off their holdings. While the market is pessimistic, contrarians will enter the market as they see the stock in an optimistic light. Because the market is selling the stock, the prices go down, and contrarians start buying at low prices. They consider that the current market prices may be near to or lesser than their intrinsic value.

One thing to note here is that such stocks have a high potential in the future, and hence contrarians will profit from the rise in prices of the stock in the future. They look for distressed stocks and buy and hold them. And sell them off when the market starts buying the stock due to its potential. The whole idea of contrarian investment is an outcome of the herd mentality prevailing in the market. That is when the majority of investors conduct their actions by looking at what others are doing. Or follow the actions of the majority. No individual thought is put, and a herd is created where everyone performs the same action.

We can well sum up the contrarian strategy and concept in the words of one of the best investors of our time, Mr. Warren Buffet. He says, “Be fearful when others are greedy, and greedy when others are fearful” For example, entering a market in a recession seems scary, and most investors avoid doing so. But contrarians will enter the market and enjoy their benefits in the coming years. The S&P 500 grew by 200% after the housing bubble crisis.

Behavioral Influence

There are many behavioral concepts of investors which are the reasons for the existence of contrarian strategies:

- One such influence is the basic human tendency of ‘loss aversion.’ That means any trader or investor avoids or dislikes losses and does all that is possible at his level. Therefore, in general, loss aversion is preferred over gains.

- Another behavioral influence that results in contrarian investors profiting is the overreaction of investors. Looking at profitable/high-priced stocks, investors will overreact and will be driven by glamor. The same applies to underperforming stocks. Investors create panic in the market and start selling their positions. The contrarians work on these overreactions and do exactly the opposite of what the majority does. So they buy when the market is falling, and they sell when the market is rising.

Advantages of Contrarian Strategy

- In the case of overvalued stocks, it creates a sense of safety as contrarians will take up a selling position and book profits become realized profits. Similarly, in the case of undervalued stocks, they profit through the growth and potential of the firm, which is yet to be recognized by the market investors.

- Harvard wrote a research paper on Contrarian Strategy, mentioning value investors (following contrarian strategy) outperforms the market. One of the reasons is the behavioral influence, and the other being the fundamental risk of the firms. The companies fundamental risk (a risk intrinsic to the state of being) is high, and hence this risk is rewarded by the profits earned.

- Contrarians are long-term investors. Ignoring the noise and volatility in the market in the short term, contrarians will benefit in the long term as the benefits accrue gradually for an undervalued firm.

Disadvantages

- A common problem is what if the market sentiment does not change for a considerable period? That is, when investors are buying distressed or undervalued stocks, the market does not react, and prices continue to remain low. At the continued low prices, the contrarians will not be able to generate profits similarly if the market sentiment is bullish for a ‘hot stock’ (a stock high in demand) that the contrarians would sell. And the price is constantly increasing; then contrarians will miss out on the profits of increased prices. Therefore, contrarians can make profits and survive only and only when the market reacts in an anticipated way as thought by them.

- To be able to identify undervalued or overvalued stocks, contrarians have to invest significant efforts in studying a market, industry, and its exposure to other factors. It requires practice, patience, and skill to master an industry and identify stocks.

What is more fun than learning concepts through a movie? The big short is a movie based on Michael Burry, an investor who foresaw overvalued mortgage market in the US just before the subprime crisis. Scion capital, his hedge fund, shorted the assets and earned profits in crisis. This is when an investment strategy backed by solid research reaps benefits. The big short, a book was written by Michael Lewis, included this strategy. Netflix currently premiers ‘Big short,’ a movie based on this book.

Contrarians and Value Investors

There are quite a few similarities between a contrarian and a value investor. Value investors are searching for distressed or undervalued stocks that exhibit potential. Many value investors follow the contrarian strategy and possess the features of contrarians.

One of them is value investors do not follow the herd. Secondly, both types of investors hunt for the true image and intrinsic value of the company. Thirdly, they both do not agree with the Efficient Market Hypothesis. This hypothesis suggests that all information relevant to the stock reflects in the current stock prices. In the real world, this is not so always. Hence there exist arbitrage opportunities too. It’s logical as they make profits when the stock price moves to the intrinsic value of the company. There is not much difference between value and contrarian investors.

To sum up, contrarians make profits by identifying firms that are overvalued or undervalued. They act against the market and are often confident in their thought process. It takes surety in one’s assumption to make profits when it comes to being contrarians.

A slight difference is there when the value investors do not sell the stocks even after rising prices, and the market is bullish; the majority is buying. This is because they keep a target, and despite a substantial rise in the price, they will not sell the stocks as their target is still to achieve. Additionally, they do not lose out on profits, which sometimes can be an issue with the contrarians.