Understanding the Bird in Hand Theory

A Bird in Hand Theory talks about the importance of having the benefits in the current times vs. having the benefits in the future years. Here we would review this theory with regard to dividends, or we can say it is a dividend relevance theory. As per this theory, investors are more likely to prefer stock dividends than capital gains from their stock investment. This theory rests on the premise that investors would choose certain returns (dividends) over uncertain flows (capital appreciation).

This dividend theory assumes that investors would always prefer dividends due to the uncertainty over capital gain. As per the theory, investors would prefer safer and certain returns over uncertain capital gain investments even if they promise higher returns in the future. So, this theory states that investors would prefer stocks paying more and regular dividends even at the cost of higher capital gains in the future. That being uncertain on the first hand and the impact of compounding on the other hand.

Origin of Bird in Hand Theory

Myron Gordon and John Lintner came up with this theory. This theory is in response to the theory of Modigliani and Miller, who came up with the dividend irrelevance theory. Modigliani and Miller’s theory implies that a company’s dividend policy does not have any impact on the company’s value or its capital structure. That theory further propounded that the investors see the overall returns and remain indifferent between returns from dividends or capital gains.

There is one more theory that ignores the relevance or otherwise of the regular dividends. And that theory is the tax preference theory. This theory asserts that investors care about saving taxes and thus, prefer capital gains. It is because dividends generally attract higher taxes than capital gains. Also, taxes on dividends need to be paid whenever it is received. But, the tax on capital gains comes into play only when selling the stock. So, this helps to defer taxes. So, these are the reasons why this theory implies that investors prefer capital appreciation over dividends.

On the other hand, the bird in hand theory implies that a company’s regular dividend-paying policy does impact the company’s share price and investors’ behavior. The theory reasons that a low dividend payout increases the cost of capital of a firm. This is because the investor expects that more retained earnings will lead to higher growth and higher dividends in the future. And a higher dividend payout boosts the share price.

This theory is based on an old saying – ‘a bird in hand is worth two in the bush.’ The dividend from stock is the “bird in hand.” And the expectation of a big rise in the share price, which may or may not happen, is the “two in the bush” – capital gains.

Examples

The study shows that the dividends, on average, account for around 40% of the stocks’ total return over the long run. Coca-Cola is the best example of a bird-in-hand theory-based investing. It has been regularly paying quarterly dividends since the start of the 1920s. Moreover, Coca-Cola has raised its dividend payment every year since 1964. McDonald’s and PepsiCo are also good examples of dividend stocks.

Explanation

Capital gains are subject to a massive amount of uncertainty. This is because no metric can accurately estimate the amount of capital gain for a stock. In reality, the amount of capital gain depends on several factors, and many of these factors are unpredictable and uncontrollable.

Also Read: Gordon’s Theory on Dividend Policy

Thus, capital gains are uncertain and carry a higher risk. They may offer higher rewards as well, but there is no guarantee. So, the actual return may also be significantly lower or no returns at all as compared to the regular dividends.

In contrast, the dividend payments are relatively certain and, thus, are safe investments. Moreover, they are easier to forecast and calculate as well. Such features of a dividend make them less risky for the investors. But, the dividend return may sometimes be less than the capital gains.

Further, the theory says that the more the proportion of capital gain in the total return, the more is the required rate of return that the investor wants. So, as per Gordon and Lintner, a drop in dividend by 1% would require investors a corresponding increase of 1% in capital gain.

Formula

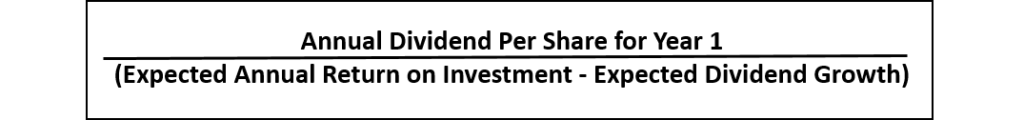

Gordon, in order to prove that dividend has an impact on the share price, developed a formula or a model. This model helps to come up with the share’s intrinsic value using the dividend that a firm pays.

This formula takes into account three variables. The first is the annual dividend payment for year 1, the expected annual return on investment, and expected dividend growth.

Gordon Growth Model formula or intrinsic value of a share is:

This formula implies that the more a company’s dividend per share is, the more is the expected dividend growth and the higher is the stock’s intrinsic value.

Assumptions of Bird in Hand Theory

This theory has certain assumptions. Those assumptions are:

- A firm should have equity only, or it must not have any debt.

- Retained earnings should be the only available source of finance.

- The firm must have a constant retention ratio.

- The growth rate of earnings must be constant.

- The firm’s CoC (cost of capital) should be constant and be more than the growth rate.

- There are no corporate taxes.

Limitations of Bird in Hand Theory

Below are the limitations of the Bird in Hand Theory:

- It does not support the general perception that investors always aim to maximize their returns.

- In the short term, dividend investing may lead to more returns. But, in the long run, the capital gains are more likely to be more than the dividends. For instance, the DJIA (Dow Jones Industrial Average) and S&P 500 average up to 10% in the long term. Stocks giving such a high dividend are difficult to find, even in high-dividend industries.

- This theory may not represent all investors, as some investors would be okay taking more risk in anticipation of more return.

- It is possible that in the long run, dividend income may fail to keep pace with inflation.

- More dividends could mean a higher payout in terms of taxes.

- Preference for dividends could go against firms with profitable growth prospects. This is because it is better for such companies to retain their earnings to fund growth than to pay dividends.

- And ultimately, the investor re-invests the dividends received. So unless a greater return opportunity is not available, the investor will be poorer, at least to the extent of taxes. Plus all the exercises of receiving, searching for a good opportunity, and re-deploying the funds.

Final Words

Companies can use the Bird in Hand Theory to develop their own dividend policies. This is because it takes into account investors’ perceptions when investing. But, it does not represent all investors. Some investors may want higher returns in the short term as well and thus, are willing to take more risk for it. Moreover, this theory may not hold in the long term, where capital gains are more likely to exceed dividend returns. Investors nowadays are more akin to seeing the overall returns than a regular dividend. Of course, investors looking for regular income do prefer regular and increasing dividend-paying companies.