Greater Fool Theory is a popular concept in the financial world. This is the theory that experts will not recommend anyone to follow. Still, many investors use it, probably unknowingly.

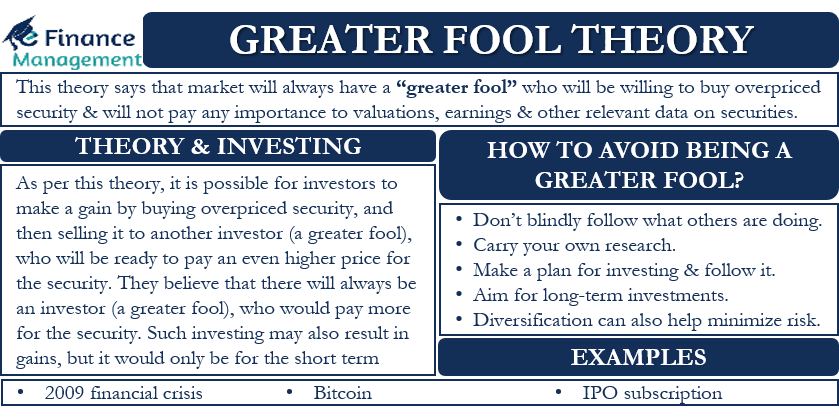

This theory talks about securities having a higher valuation than their intrinsic value. And still, these are traded at even more higher prices. Basically, this theory says that the market will always have a “greater fool,” who will be willing to buy overpriced security from the investor. So, this theory primarily means that these “greater fool” do not pay any importance to valuations, earnings, and other relevant data on the securities. They are obsessed with the valuations and demand and go with the concept that someone will be there whom they can sell at even higher prices.

Basic Concept

Therefore, as per this theory, it is possible for investors to make a gain by buying overpriced security and then selling it to another investor (a greater fool). And this investor will be ready to pay an even higher price for the security.

This concept goes on and on, and this other buying investor also thinks in a similar way that he will also be able to sell that security at further higher prices to another investor expecting the existence of another greater fool in the system. And that another investor would also be willing to pay a higher price, and thus, he will be able to make a decent gain out of this.

In all, all the investors are comfortable and look forward to remaining profitable with what they are paying for that security. This is due to this basic concept and assumption that there will always be an investor (a greater fool) who would pay more for the security.

Investing in overpriced security is usually on the basis of market sentiments, irrational beliefs, and expectations. Sudden-focused demand euphoria generates, and all follow the trend with a herd mentality. And try to go for a kill while the demand push is there. Such investing may also result in gains, but it would only be for the short term. Moreover, those investing on the basis of the market sentiments may incur heavy losses in case of a correction in the price and the bubble goes bursts.

Greater Fool Theory and Investing

As per the Greater Fool Theory, an investor will buy questionable security without overthinking about its quality. Still, that investor would be able to sell the security to another “greater fool,” who would also have the same plans.

Though investing on the basis of the Greater Fool Theory is not recommended, one may use this investing strategy for short-term gains. Those using this strategy believe that they would be able to sell a security (to a greater fool) at a price higher than what they paid for it.

Also Read: Financial Bubble

Primarily, the followers of this theory speculate on the security prices. This is because they believe they would find a greater fool who will pay a higher price, even if they (the seller) paid more for the same security on the basis of its intrinsic value.

These investors may or may not know that eventually, the bubble will burst, and there will be a price correction. Thus, the key to ensuring that you always gain from this strategy is to ensure you are not that fool at the last leg of the trade. And thus left with the security when the bubble bursts.

It will not be wrong to say that the Greater Fool Theory is a variant of the Game Theory. This is because, like the Game Theory, the greater fool theory also speculates other persons’ reactions.

Examples of Greater Fool Theory

Every investor knows that a bubble growing on the basis of just expectations will burst sooner or later. Still, everyone wants to gain out of that bubble. And when this bubble bursts, it may result in a financial crisis. Thus, the 2009 financial crisis is the biggest example of the Greater Fool Theory.

Home Mortgage Bubble

At the time, people took on loans to purchase homes with expectations to sell them in the future at a higher price to a greater fool. Such a practice carried on for a long time. But, after that, people began to realize that the prices were too high.

Then the sellers were unable to find the buyers who were willing to pay a higher price for their asset. This triggered a series of mortgage defaults, forcing banks to write off these loans from their balance sheet. This led to a banking emergency and, in turn, the worst recession in decades.

Status of Bitcoin

Bitcoin is another big example of this theory. Many believe that this crypt does not really have any intrinsic value. However, it still has a lot of attraction, and a lot of investor communities are behind this asset. Bitcoin’s price hit $20,000 at the end of 2017 and still continues to reach new highs. Its price hit $60,000 in 2020-21, and this frenzy continues to attract new investors.

Most investors put money in Bitcoin with the hope of making quick money by selling it soon after buying it. Thus, many believe the Greater Fool Theory is pushing up the price of Bitcoin.

Dot.com Bubble

It is the same theory that leads to the dot-com bubble between 1995 to 2000. At the time, the share prices of almost every IT firm were rising and were over-valued. Since the IT sector was hot at the time, no one really cared about the fundamentals and true value of these stocks. Most investors were going with the herd and were buying expensive IT shares with the hope of selling them at a profit to another greater fool.

However, after many IT companies were unable to perform as per the expectations, it led to a series of bankruptcies. This, in turn, led to the bubble burst and massive losses for the investors.

IPO Frenzy

IPO subscription is also an example of this theory. In the case of a popular IPO, every investor tries to participate, hoping to sell the shares in the secondary market at a profit. Things, however, get problematic if the share price does not go up after listing on the secondary market. Or suddenly, after listing starts to decline substantially. And in the bargain, the investors are left high and dry and may run with high losses and settle with lots of overvalued stocks in their portfolio.

How to Avoid Being a “Greater Fool”?

Using such a strategy may result in short-term gains, but it must not be our go-to strategy. There may be times when we could be following this strategy to earn profits even when we do not want to do it. However, one should avoid it to its best and concentrate on long-term investment plans. Avoiding such a practice is not so easy, however, and we need to keep in mind the following points:

- Do not blindly follow what others are doing; instead, come up with your own reasons.

- Carry your own research, evaluation, and analysis before deciding to invest or not.

- Make a plan for investing, and make sure to follow it.

- Always aim for long-term investments to avoid bubbles.

- Diversification can also help you to minimize risk from this strategy.

- Do not be too greedy and avoid the temptation of making massive profits in a short time.

Final Words

The Greater Fool Theory does not primarily aim to guide investors on a trading strategy. Instead, its main objective is to explain the speculative bubbles and how to avoid them. Though it is possible to earn returns with this strategy for some time. However, it could lead to massive losses as well when the market reacts. The profit (and its amount) by following this strategy depends majorly on your timing and market momentum. Financial wizards will not recommend this strategy. But if you are using this strategy, then it is better to back it up with your own research and study of fundamentals. Summarily, this could be used to remain in trend for a short period of time and as a satellite strategy. It should not be our core strategy or investment.

Frequently Asked Questions (FAQs)

The basic assumption under this theory is that there will always be an investor (a greater fool) who will buy overpriced security, assuming to sell it at an even higher price to make a profit.

The greater fool theory can be used to make a short-term profit because the investor should know that eventually, the bubble will burst. Thus, the key to ensuring that you always gain from this strategy is to ensure you are not that fool at the last leg of the trade.

RELATED POSTS

- Contrarian Strategy – Meaning, Execution, Advantages, and Disadvantages

- Bird in Hand Theory – Meaning, Formula, Assumptions, and Limitations

- 4 Most Important Factors Influencing Investor Preference

- Intrinsic Value of Stock

- Strong Form of Market Efficiency

- Anchoring Bias – Meaning, Causes, Affects and More