Collateralized Debt Obligation (CDO) is a type of credit derivative and investment product. We can also call it a collection of pooled assets that help generate income. However, this investment product is more complex than other products around.

A bank gives a loan to the lender with a regular loan product. The borrower promises to make regular payments and keeps an asset as collateral. If the borrower makes defaults and fails to repay, the bank has all the rights to confiscate the collateral.

On the other hand, in the case of a CDO, a bank packages these loans together divides them into units and sells them to investors (institutional). So, a CDO is a type of derivative security because its price depends on the value of the underlying asset (collateral). One can also say that a CDO represents groups of receivables, which are backed by an asset.

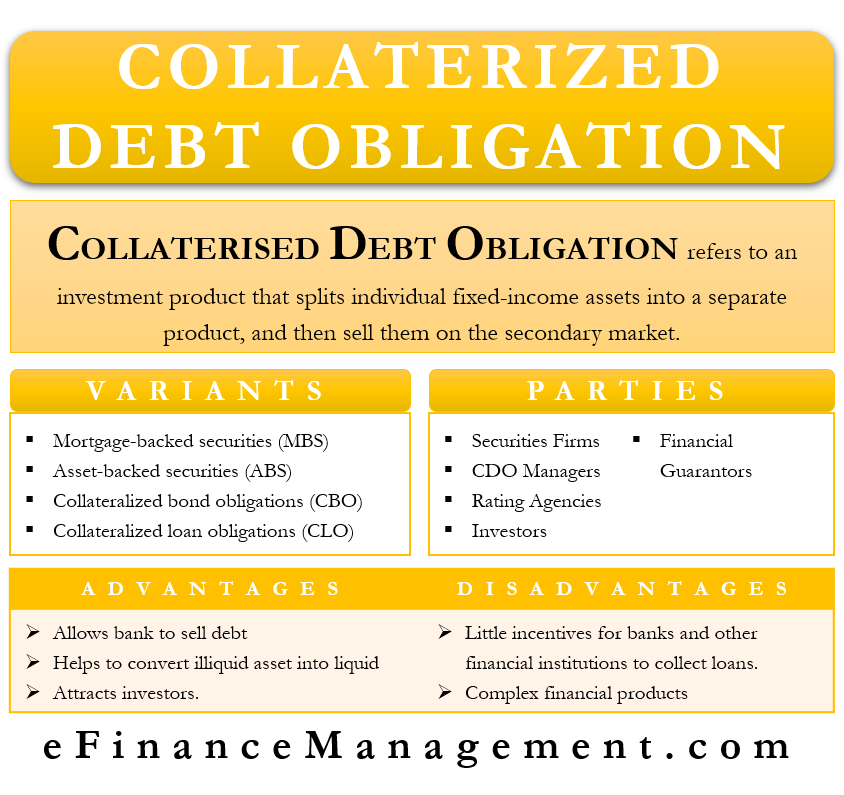

We can say that CDO is an investment product that splits individual fixed-income assets into a separate product and then sells them on the secondary market. Their name ‘collateralized’ comes from the fact that the security that original borrowers keep serves as collateral for the investors. In theory, an investor in a CDO can collect the loan amount from the original borrower after the due date.

Also Read: CLO vs CDO

Variants of Collateralized Debt Obligation (CDO)

The debt being packaged could be auto loans, corporate debt, credit card debt, or mortgages. We can call CDO by different names on the basis of debt. For instance, we call them mortgage-backed securities (MBS) if they include mortgage loans. Or, if they include auto loans or any other debt, they will be asset-backed securities (ABS). There are also CBOs (collateralized bond obligations) and CLOs (collateralized loan obligations).

Collateralized Debt Obligation – How it Works?

CDOs promise cash flows to the investors. However, the cash flows depend on the cash flows (or EMIs) from the original borrowers.

Usually, an issuer splits CDO into varying risk classes or tranches. Each tranche of CDO has different interest and principal payments such that the senior-most tranche has the minimum risk and gets priority when it comes to repayment. On the other hand, junior tranches have higher default risk and thus, offer higher interest payments as well.

For instance, the Class A senior tranche would have the highest S&P rating, but investors would have the lowest yield. The equity tranche would be the riskiest tranche, but the investor would have the highest yield.

Generally, CDOs tranches consist of senior debt (having AAA rating), mezzanine debt (having AA rating), junior debt (with BBB rating), and equity. The name of tranches generally reflects their risk level. For instance, there will be a tranche carrying the name “senior” or “mezzanine.”

Also Read: Credit Derivatives

Example

To better understand CDO’s work, lets’ take a simple example. Mr. A takes a mortgage loan of $2 million to buy a house. The lender, bank B wants to reduce its risk and thus packages Mr. A’s loan and several other similar loans. A pension company (Company A) was looking to diversify its investment portfolio, so it buys a CDO tranche from bank B.

Suppose Company A buys a tranche with higher risk because it was looking for more return. Now, the return for Company A would be the monthly EMIs that Mr. A and others will make on their mortgage loan.

Parties in a Collateralized Debt Obligations (CDO)

Several professionals are responsible for creating and selling a CDO. These parties are:

Securities Firms

These are primarily responsible for selecting collateral. They also structure the notes into tranches and then sell them to the investors.

CDO Managers

Also, play a role in selecting collateral. Also, they usually manage CDO portfolios.

Rating Agencies

They analyze the CDOs and then give them a credit rating.

Financial Guarantors

As the word suggests, this party act as insurance for investors. These guarantors reimburse investors in case of a loss involving CDO. Financial guarantors, however, charge premium payments to do so.

Investors

They are the institutions that invest in CDOs, like hedge or pension funds.

Benefits and Drawbacks Collateralized Debt Obligation (CDO)

Benefits

- The biggest benefit of CDOs is that it allows banks and financial institutions to sell their debt. This, in turn, free up their capital that they can re-invest or give as a loan.

- Another benefit is that it allows banks to convert a relatively illiquid asset into a relatively liquid asset.

- CDOs are attractive to investors as well. An investor can invest in a CDO that matches their risk tolerance. For instance, a conservative investor can go for a senior tranche of the CDO. Those who want higher returns should invest in a junior tranche.

Drawbacks

Talking of drawbacks, there are no such drawbacks for banks. However, CDOs do have drawbacks for investors.

- One drawback is that the banks or financial institutions, once they issue CDOs, have little incentive to collect the loans when they get due. The banks get complacent that it is the investors who now own the loans. Such an attitude also makes the bank less likely to follow strict lending standards.

- Another drawback of a CDO is that they are a complex financial product. The investors may not fully understand what they are investing in or whether or not the product is worth its price. Such complexity may result in a market panic, making it hard to market these securities.

Something similar happened at the time of the 2007 Sub-Prime Crisis. CDOs were the primary reason triggering the crises. At the time, investors lost confidence in CDOs, and thus, many banks had to write down the value of CDOs on their balance sheets.

CDOs and 2008 Financial Crisis

CDOs were regarded as safe investments before the 2008 financial crisis. However, later they were held responsible for the crumple of the housing market worldwide. The first CDO likely came in 1987, thanks to Michael Milken of Drexel Burnham Lambert (a former investment bank). At the time, Milken (or “junk bond king”) created a CDO using junk bonds of varying forms. Eventually, other firms also found the idea attractive. They improved the product by adding to it predictable income streams.

Collateralized Debt Obligation was a niche product until 2003–04 but got very popular during the mid-2000s. At the time, banks also had an incentive to market CDOs. This led to complacency in credit standards, whereby non-creditworthy borrowers also got loans. Moreover, banks gave loans assuming the housing prices will continue to rise.

However, when the prices peaked, and defaults rose, it resulted in a panic. This, in turn, led to a collapse in the housing market, as well as in the value of the CDOs. As a result, the investors in CDOs (mostly pension funds and corporations) lost billions of dollars.

Final Words

Despite their role in the 2008 financial crisis, banks and financial institutions still actively use CDOs. These institutions use it as a tool to lower their risk and free up capital. However, following the 2008 crisis, regulatory authorities have come up with several provisions monitoring the use of CDOs.