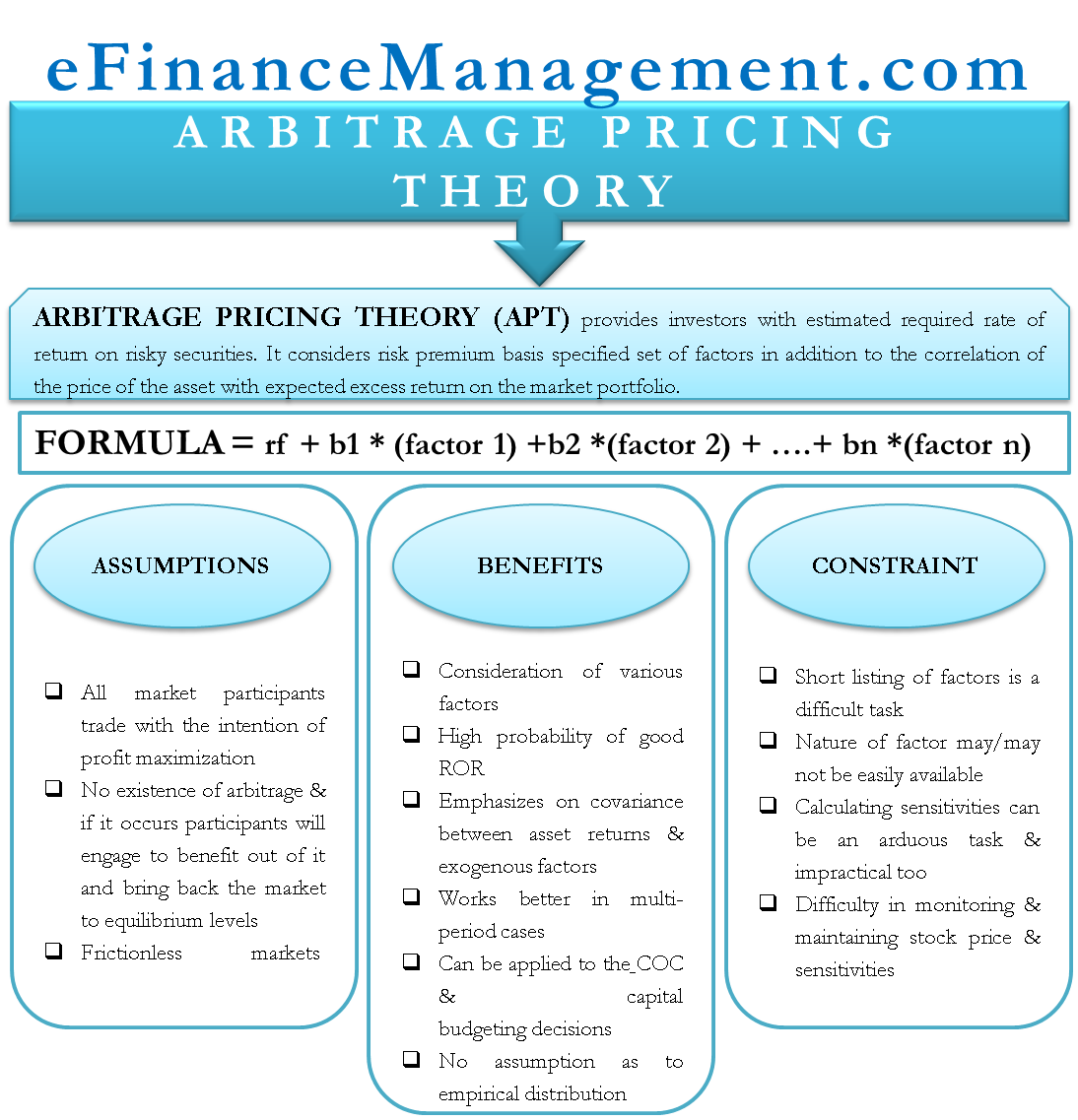

Arbitrage Pricing Theory (APT) is an alternate version of the Capital Asset Pricing Model (CAPM). This theory, like CAPM, provides investors with an estimated required rate of return on risky securities. APT considers risk premium basis a specified set of factors in addition to the correlation of the price of the asset with expected excess return on the market portfolio.

As per assumptions under Arbitrage Pricing Theory, return on an asset is dependent on various macroeconomic factors like inflation, exchange rates, market indices, production measures, market sentiments, changes in interest rates, movement of yield curves, etc.

The Arbitrage pricing theory-based model aims to do away with the limitations of the one-factor model (CAPM) that different stocks will have different sensitivities to different market factors, which may be totally different from any other stock under observation. In layman’s terms, one can say that not all stocks can be assumed to react to a single and same parameter always and hence the need to take multifactor and their sensitivities.

Calculating the Expected Rate of Return of an Asset Using Arbitrage Pricing Theory (APT)

Arbitrage Pricing Theory Formula – E(x) = rf + b1 * (factor 1) +b2 *(factor 2) + ….+ bn *(factor n)

Also Read: Advantages and Disadvantages of CAPM

Where,

E(X) = Expected rate of return on the risky asset

Rf = Risk-free interest rate or the interest rate that is expected from a risk-free asset

(Most commonly used in U.S. Treasury bills for the U.S.)

B = Sensitivity of the stock with respect to the factor; also referred to as beta factor 1, 2

N = Risk premium associated with respective factor

As the formula shows, the expected return on the asset/stock is a form of linear regression, considering many factors that can affect the asset’s price and the degree to which it can affect it, i.e., the asset’s sensitivity to those factors.

If one is able to identify a single factor that singly affects the price, the CAPM model shall be sufficient. If there is more than one factor affecting the price of the asset/stock, one will have to work with a two-factor model or a multi-factor model depending on the number of factors that affect the stock price movement for the company.

To understand APT, it is important for us to learn the underlying assumptions of this theory as given below.

Arbitrage Pricing Theory Assumptions

- The theory is based on the principle of capital market efficiency and hence assumes all market participants trade with the intention of profit maximization.

- It assumes no-arbitrage exists, and if it occurs, participants will engage to benefit from it and bring back the market to equilibrium levels.

- It assumes markets are frictionless, i.e., there are no transaction costs, no taxes, short selling is possible, and an infinite number of securities is available.

Let us now look at some arbitrage pricing theory advantages and disadvantages summarized as under:

Arbitrage Pricing Theory Benefits

- APT model is a multi-factor model. So, the expected return is calculated by considering various factors and their sensitivities that might affect the stock price movement. Thus, it allows the selection of factors that largely affect the stock price.

- APT model is based on arbitrage-free pricing or market equilibrium assumptions which, to a certain extent, result in a fair expectation of the rate of return on the risky asset.

- The apt-based multi-factor model places emphasis on the covariance between asset returns and exogenous factors, unlike CAPM. CAPM places emphasis on the covariance between asset returns and endogenous factors.

- The APT model works better in multi-period cases than against CAPM, which is suitable for single-period cases only.

- APT can be applied to the cost of capital and capital budgeting decisions.

- The APT model does not require any assumption about the empirical distribution of the asset returns, unlike CAPM, which assumes that stock returns follow a normal distribution; thus, APT is a less restrictive model.

Arbitrage Pricing Theory Limitations

- The model requires a short listing of factors that impact the stock under consideration. Finding and listing all factors can be a difficult task and runs the risk of ignoring some or the other factor. Also, the risk of accidental correlations may exist, which may cause a factor to become a substantial impact provider or vice versa.

- The expected returns for each of these factors will have to be arrived at, which depending on the nature of the factor, may or may not be easily available always.

- The model requires calculating the sensitivities of each factor which again can be an arduous task and may not be practically feasible.

- The factors that affect the stock price for a particular stock may change over a period of time. Moreover, the sensitivities associated may also undergo shifts that need to be continuously monitored, making it very difficult to calculate and maintain.

Conclusion

Arbitrage Pricing Theory-based models are built on the principle of capital market efficiency and aim to provide decision-makers and participants with estimates of the required rate of return on the risky assets. The required rate of return arrived using the APT model can be used to evaluate if the stocks are over-priced or under-priced. Empirical tests conducted in the past have resulted from APT as a superior model over CAPM in many cases. However, it has arrived at similar results in several cases as the CAPM model, which is relatively simpler in use.

Read Arbitrage for more details.

Good morning sir, please I want to know if arbitrage pricing policy is the same with arbitrage pricing Theory. I need more insight please.

Hi Joseph,

Thanks for writing in.

I believe there is only one ‘arbitrage pricing theory’ known in financial management which is explained in the article above. If there is some other arbitrage pricing policy in any other discipline like in economics or so, we are not aware of the same.

Hey Sanjay,

What common factors are considered as inputs?

a thousand thanks.

moreover, how would you approach measuring the sensitivity of a factor and translating it into a value?

one more thousand thanks

Hi dear

your work is appreciable and tremendous. i want some other explanation while calculating the expected return of the stock on the basis APT model. practical examples from the stock exchange

thanks