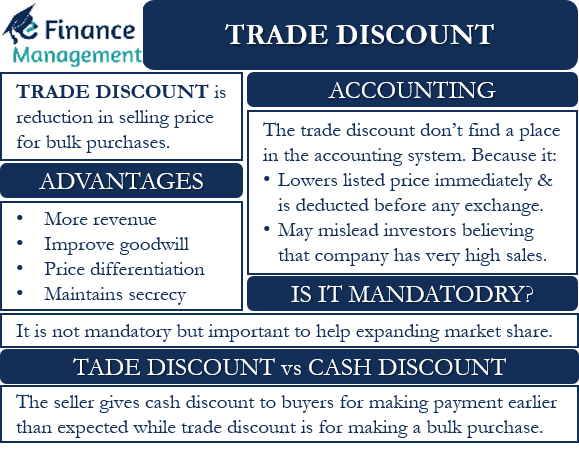

Trade Discounts, as the word suggests, is a reduction in the selling price. This is the discount that a manufacturer or wholesaler gives to a reseller, or it is the discount that a seller provides for bulk purchases. Or, we can say that it is a certain percentage that a seller deducts from the list price in case of bulk purchases.

It can be expressed either in absolute amount or in percentage terms on the MRP, Selling Price, or List Price. For instance, a $2 discount on the list price or a 10% discount on the list price. We can also call this discount a functional discount.

A manufacturer or a distributor usually has a catalog that it distributes among the resellers. This catalog shows the list price of the products. The manufacturer or a distributor gives the trade discount after the resellers have registered their order. This discount is usually on the basis of the quantity that a reseller orders, the relationship between the manufacturer and reseller, the total order amount, etc. Also, the size of the trade discount could be large if a manufacturer is new and is working on setting up a distribution channel. The trade discount will be lower comparatively for an established one or a product in demand.

Quantum of trade discount usually remains the profit margin of the reseller, distributor, retailer, etc. For a reseller, the maximum profit margin is the amount of trade discount that they get from the manufacturer. This means a reseller can sell the product at the full list price. In the real world, however, the reseller doesn’t sell at the list price, instead gives some discount to the buyers in order to gain more market share. Since MRP is mentioned on the product, or the List Price is usually available for consumers to see, hence, the trader margin remains the trade discount minus what further discounts over the list price the trader offers to the customer.

Accounting of Trade Discounts

So, in its books, a seller records the sales at an amount after deducting the trade discount. Or at sale price less the trade discount amount. The same is the treatment by the buyer in his books of accounts, purchase at the net price after deducting the trade discount. In the accounting world, we record such transactions in the sales book or purchase book at the net amount, i.e., Gross Amount Less Trade Discount. It won’t be wrong to say that the trade discount does not find a place in the accounting system.

We can attribute two key points for having no accounting records for the trade discounts. And these are:

- A trade discount is applied instantly, even before the closure of the transaction. The Invoice and Debit Notes etc., are raised at net prices only. This is why it does not become a part of an accounting transaction and does not get any accounting record as well.

- If a seller records the sales at the list price and the trade discount, it could inflate the gross sales for the seller. And this may mislead investors into believing that the company has very high sales.

But there do exist exceptions, where some firms prefer to record the spend on account of trade discounts separately also.

Now we will see the exact accounting entries and treatment for trade discounts through an example.

Suppose Company A sells 100 mobiles to Company B. The mobile has a retail price of $100, but Company A gives a 20% trade discount to Company B. So, the final price is $80, or $8,000 for 100 mobiles.

Company A will record the sale using the following journal entry:

| Accounts Receivable Dr. | $8,000 |

| Sales Cr. | $8,000 |

Company B will record the purchase using the following journal entry:

| Purchases Dr. | $8,000 |

| Accounts Payable Cr. | $8,000 |

If we would like to understand it for the exceptional cases, then the entries would be as below:

Company A will record the sale using the following journal entry:

| Accounts Receivable Dr. | $8000 |

| Trade Discounts Dr. | $2000 |

| Sales Cr. | $10000 |

Advantages of Trade Discounts

Following are the advantages of trade discount:

More Revenue

Trade discount acts as an incentive to order more quantities. Thus customers are encouraged to order more, which helps increase revenue and production.

Improves Goodwill

A business that gives higher trade discounts is more popular among the resellers. Such businesses also earn the loyalty of the resellers. And this, in turn, improves the goodwill of the business.

Price Differentiation

A trade discount allows wholesalers to maintain one catalog for all resellers and even for consumers. Despite having one catalog, the wholesalers or distributors are able to differentiate on price by offering trade discounts separately to each party.

Maintains Secrecy

The trade discount negotiations take place secretly. This ensures that customers do not know the discount that others are getting. Such a practice is positive for a business and helps to increase profitability as well.

Is Giving Trade Discount Mandatory?

A trade discount is not mandatory. But, it is important in the business world as it helps to expand the market share. Also, it helps a reseller to maintain loyalty and establish a strong distribution channel.

A manufacturer may bypass giving a trade discount. They can do this by selling directly to the consumers, such as through a website. However, this may disrupt the distribution network and may also not necessarily increase the profit for the manufacturer. This is because the manufacturer will now be responsible for offering after-sales service and logistics.

Trade Discount vs. Cash Discount

Trade discounts are different from the early-payment discount or cash discounts. The early-payment discount or the cash discount is the discount that a seller gives to buyers for making payments earlier than expected. On the other hand, a discount is to a reseller or even to a customer for making a bulk purchase. And it has no relation to the early payments.

Moreover, there is no separate account, both with buyer and seller, to record a trade discount generally. Or, we can say that trade discounts do not reflect in the accounting system of both buyer and seller. In contrast, the seller records the cash discount as “Sales Discount.” Similarly, the buyer records the cash discount as “Purchase Discount.”

A seller gives a cash discount on the basis of their payment plans, and usually, it is the same for all buyers. In contrast, a trade discount usually depends on the relationship between a buyer and seller. A seller may give more trade discounts to one seller for the same product and quantity than to another seller.

Another difference between the two is that the manufacturer deducts the trade discount before any exchange takes place. In contrast, a cash discount is after the exchange of goods between the two parties.

Moreover, unless and until it is early and instant payment, the invoices and debit notes do not mention the cash discounts. And these are raised at the collectible amount, net of trade discounts, if any. The cash discount is thus a future event and is applicable at the time of payments.

To know more about the differences between trade and cash discounts, you can refer to our article: Differences between Trade Discounts and Cash Discounts.

Final Words

Trade discount is an important tool that helps a company to boost its sales and market share. This discount may vary depending on the purchase quantities. Even though it reduces the selling price, it does not impact the profit margin on paper. This is because such discounts are not recorded in the accounting books.

Frequently Asked Questions (FAQs)

Trade Discounts are a reduction in the selling price for bulk purchases.

No, generally, trade discounts don’t find a place in the books of accounts.

The reasons for not recording trade discounts are:

a. It lowers the listed price immediately and is deducted before any exchange.

b. If a seller records the sales at list price & the trade discount too, this may mislead investors into believing that the company has very high sales.

The seller gives a cash discount to buyers for making payments earlier than expected, while a trade discount is for making a bulk purchase.