Meaning of Circular-Flow Diagram Model

A Circular-flow diagram model is an economic visual model of macroeconomics that represents the movement of goods, services, and money within the various sectors of the economy. The model is named so because goods, services, and money move in a circular and never-ending circle. Manufacturers produce goods or service providers render their services to society and households. They get money in return for it which they again use for providing more goods and services. They also make payments to their workers in the form of wages and salaries. The workers, in turn, buy various goods and services for which they pay money. This money again reaches the manufacturers and service providers. Therefore, the flow of all three components is circular in nature. It does not stop, though the frequency and volume may go up and down as per the situation of the economy.

Labor, as a part of the resource market, works endlessly to help in the production of multiple goods and services. Households purchase these goods and services through the product market. Producers endlessly use the resource market and the product market to generate money for their activities, pay the labor to produce more, and again generate money by selling those goods and services.

How does the Circular-Flow Diagram Model Work?

The Circular-flow diagram model is basically a two-way system that moves in opposite directions. Goods and services flow from producers to households and consumers through a marketplace. Households and consumers provide labor services and expertise for manufacturing these goods and services.

Money flow takes place from the producers’ end as payment for the services that the individuals offer to it for production activities. Again, this money moves in a circle when the same individuals pay for the goods and services in the marketplace and again reaches back to the manufacturers.

Two-Sector Model

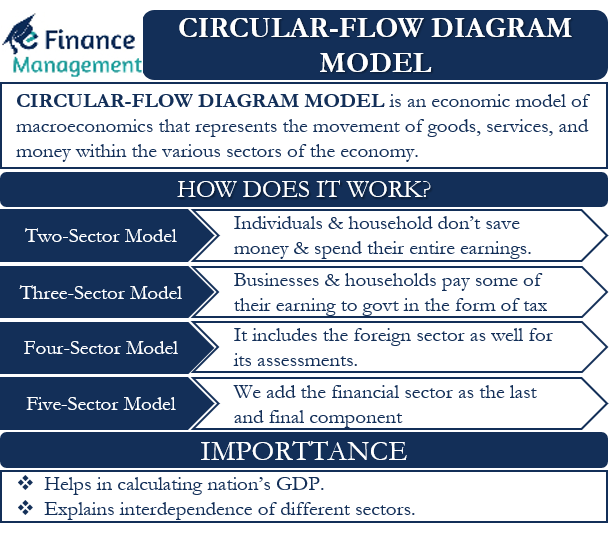

The above model is a two-sector model and is the simplest one. In this model, the economy has two types of decision-makers – households and firms. Further, according to this model, individuals and households do not save money and spend their entire earnings. They buy goods and services from whatever they earn. Also, taxes and new investments are also absent. On the other side are the manufacturers and service providers that sell all their goods and services through the marketplace to these individuals.

This is the simplest form of circular flow model and is straightforward for understanding the concept and money flow in the economy.

Three-Sector Model

In the real world, however, the two-sector model is incomplete. In the next level of the model, besides these two segments, it brings the government also into the picture. Individuals and households, on the one hand, and firms, on the other hand, both pay various taxes to the Government. And thus, this is the third channel where money flows to the government by way of taxes, surcharges, etc., from both these segments – a three-sector model. Apart from receiving money, the government also pays back money to businesses and individuals too in various forms.

It provides subsidies and gives back a portion of its expenditure for the general welfare of the participants of the economy. It may share a part of the project cost or share a portion of the total cost of an item of essential use. The government also pays back to the members of the economy by engaging in public expenditure and services and providing multiple benefits programs. Hence, in this model, there is a three-way movement of money in the economy.

Four-Sector Model

With globalization being the norm now, we can not rule out the foreign sector. So, the foreign sector or the international trade gets included in the four-sector model diagram. The foreign sector also adds to the movement of goods and services through the marketplace through exports and imports. It results in a flow of foreign exchange in the economy. The factors of production also get involved and either get paid for their services or pay for consuming the goods and services.

Five-Sector Model

For efficient and successful running of all these four segments, one crucial segment or part is the financial market/segment. All three segments of the economy – individuals, businesses, and the Government has to depend on the financial sector. This could be for deploying savings, borrowing loans, buying foreign exchanges, buying or selling financial instruments, etc. We, therefore, add the financial sector as the last and final component in the circular-flow model and make it complete – a five sector model. Banks and financial institutions come into play and lend money to the general public, which increases the money in their hands. They can engage in consumption and investment activities with that money. Also, they borrow from the public, which may have a reverse effect. Businesses and individuals save from their income and deposit it with these banks and financial institutions.

Importance of the Concept of Circular-Flow Diagram Model

The Circular-flow diagram model is an important macroeconomic concept. Let us look at its importance in detail.

Calculation of the Gross Domestic Product (GDP)

The components of the circular-flow diagram model help in the calculation of a nation’s Gross Domestic Product. We add total consumption expenditure, government expenditure, private business investment, and exports less imports to arrive at the GDP figure.

GDP= C+G+I+(X-M)

For calculating a country’s GDP, as we discussed above, each segment and component of this equation is very important. If you miss anything, then the results will not be proper. The government can keep track of the growth rate of GDP by keeping a check on the above components. It can immediately adjust its fiscal and monetary policy in case it finds that any of the parameters is underperforming continuously for a few quarters. Therefore, detailing or break-up of each component of the equation is important and can trigger corrective action in time.

The circular-flow diagram model also gives us another important equation. It tells us that till the time total money infusions in the economy are greater than the total money outflows, the country’s GDP is positive and growing. Money infusions include government expenditure (G), private business investments (I), and exports (X). Money outflows are made up of various taxes, imports, and private savings. When the money outflows are greater than the inflows, it is a cause of concern for the government and the economy.

Interdependence of Different Sectors

The circular-flow diagram model explains how various sectors of the economy are interdependent upon each other. It highlights the need to maintain a proper balance between each one of them for the growth of the economy. For example, suppose the production of some goods goes down in the economy. Lesser quantity of those goods will reach the marketplace, and people will have lesser to buy. This will result in lower income for the manufacturers.

Also, the labor and workers that participate in the manufacturing process will have lesser work in their hands because of a reduction in production activities. Hence, they will have lower disposable incomes in their hands. Their purchases will also eventually go down, which will mean lesser money will reach the manufacturers. So we see how each sector and market are interdependent. Poor performance of any sector directly impacts the flow of goods, services, and money in the economy and vice versa.