Trade Discounts and Cash Discounts: Meaning

Discount is any reduction that a seller offers on the price of its products or services. Sellers provide discounts on their offerings in order to boost their sales and make their deal look better than what the competition is offering. Sometimes sellers offer deep discounts on products that have minor defects like scratches, dents, color variations, quality problems, etc. The main purpose of discounts is to facilitate higher sales volume and generate more revenue. Moreover, it is also applicable for the liquidation of items with a minor fault or the inventory lying idle for quite some time. In the business world, there are two types of discounts that prevail- trade discounts and cash discounts.

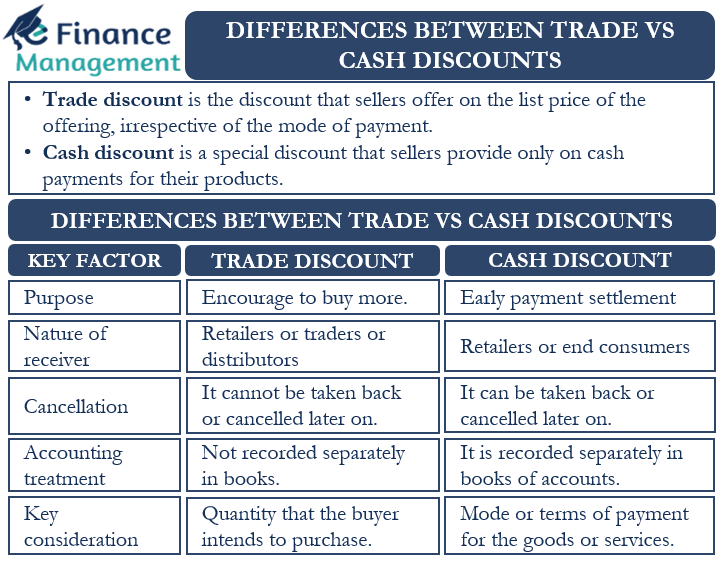

Trade discount is the discount that sellers offer on the list price of the offering, irrespective of the mode of payment. On the other hand, a cash discount is a special discount that sellers provide only on cash payments for their products. Thus, though both are discounts and reduce the ultimate cost to the purchaser, however, there are lots of differences between trade discounts and cash discounts.

Trade Discounts

Trade discounts help a supplier to sell a higher quantity of the product. Sellers may increase the percentage of trade discounts with higher purchase quantities and vice-versa. Thus, it acts as an incentive for a buyer to buy more quantity of the product. Such discounts are usually applied at the time of the purchase of the product. Hence, sellers deduct the trade discount from the price of the product first and then bill it. However, sometimes it may be applicable on reaching a certain sales volume.

Cash Discounts

A cash discount is generally available over and above the trade discount. It is a special type of discount that works as an incentive for buyers to make cash payments for the product early, rather than waiting for the credit period or due date. Sellers may also mention relaxation of a few days before which the buyer should pay to avail this type of discount. We mention it as an additional deduction in a bill or invoice.

Key Differences between Trade Discounts and Cash Discounts

Both types of discounts differ in many ways. Let us have a look at the key differences between the two.

Purpose

The manufacturers and sellers offer trade discounts to encourage the buyers to buy more quantities of the product. Also, trade discounts may be a general trade practice in many businesses, and sellers have to follow it/offer them.

Sellers offer cash discounts as an incentive to the buyers to make payment for the goods as early as possible. The sole objective of giving it is to motivate the buyers to pay for their purchase instantly or within the stipulated time frame.

Basis for Calculation

The basis for the calculation of trade discounts is the catalog price. Sellers provide discounts on the catalog price of the products that they offer. The price mentioned in an invoice is generally inclusive of the trade discount, or we can say it is a net of trade discount. As a standard practice, usually, the trade discount does not appear in the bill as a separate item.

On the other hand, the basis for calculating cash discounts is the final invoice price. Sellers provide cash discounts on the amount they print on the sales invoice. It is shown separately in an invoice. Sellers deduct cash discount from the invoice value to arrive at the amount which a customer has to finally pay for the product or service.

Key Consideration

The key consideration when a seller offers a trade discount is the quantity that the buyer intends to purchase. Hence, the range or quantum of trade discount also usually varies with the volume of purchase, and for each slab, there can be a different level of discount that may be applicable. The higher the purchased quantity, the higher the trade discount and vice-versa. Another important point to note is that the trade discount is applicable for both types of transactions – cash or credit. Hence, whether a cash discount is also available does not alter the quantum of trade discounts.

The key consideration in the case of cash discount is the mode or terms of payment for the goods or services. Cash discount, by default, is provided only when the payment for goods is made in cash or equivalent instantly at the time of purchase or within a stipulated time as the seller may state. It is not available in the case of credit transactions.

Accounting Treatment

We do not record a separate entry for a trade discount in the books of accounts. A seller gives a trade discount before the preparation of the sales invoice. Hence, he considers the trade discount while preparing the invoice and does not mention it separately in the bill. And thus, there is no separate accounting entry for the trade discounts. The sales value/turnover is the value that is net value.

We recognize cash discounts separately in the books of accounts as an expense in the income and expenditure statement. A seller provides this discount at the invoice value while making the sale. Thus, it has to be accounted for while preparing the books of accounts.

Nature of Receiver

The end-user or consumer is usually not the beneficiary in case of a trade discount. Big companies, manufacturers, and wholesalers offer trade discounts to the retailers/traders/distributors of their products. The credit risk is low, and the main focus is to increase the quantity of sales.

The receiver of cash discounts may be retailers as well as end consumers. The credit risk increases when the focus is on a large number of end-users of a product or service. Hence, the sellers offer to receive payments for their products in cash.

Revocation or Cancellation

A buyer will enjoy a trade discount if the seller provides it at the time of sale. It cannot be taken back or canceled later on.

A seller may cancel or revoke the cash discount that he offered at the time of sale if the buyer fails to meet the payment deadline.

Example to Show the Differences between Trade Discounts and Cash Discounts

Let us understand the differences between trade discounts and cash discounts with the help of an example.

Company XYZ Inc. is into the wholesale business of fans. It enters into an agreement with a retailer of fans, ABC International, to supply 1000 units of fans in a year with a list price of $100 per fan. The wholesaler agrees to offer a 10% trade discount on the fans keeping in mind the volume of purchase. The buyer is motivated to sell more of these fans over fans of other brands as he gets the fans at a good trade discount.

Total purchase price of fans at catalogue price= 1000 units x $100= $100000.

Trade discount= $100000 x 10%= $10000.

Total invoice value or billing for the buyer= $100000 – $10000= $90000.

The trade discount of $10000 will not be shown in the books of accounts as this is given before the preparation of the invoice.

Now suppose the retailer starts delaying the payment of the fans. The wholesaler senses some credit risk. He wants the retailer to pay for the fans in cash within a period of 15 days from the date of purchase and introduces a cash discount for the same. He proposes that he will give a cash discount of 2% over and above the 10% trade discount that he is offering.

The invoice value for the buyer= $90000

Cash discount- $90000 x 2%= $1800

The total amount that the buyer has to pay if he makes the payment within the stipulated time of 15 days of purchase is $90000- $1800= $88200.

The wholesaler will pass a journal entry to record the cash discount as an expense in his books of accounts. Also, he will not be liable to honor this discount if the buyer does not make the payment for fans within 15 days of making the purchase.

Conclusion

Sellers commonly offer both trade discounts and cash discounts to buyers in the business world. Further, though there are many differences between the trade discounts and cash discounts, the net effect and goal remain the same. The price to the end consumer/trader/distributor gets reduced by these discounts. The discounts help the sellers to achieve a higher turnover of goods and money and thus higher profits. The buyers benefit by getting the goods and services at a cheaper rate than the competitors. This, in turn, helps them too in increasing sales volume and turnover, and eventually profits.

Frequently Asked Questions (FAQs)

The offering of trade discounts is to encourage buyers for buying more quantities. And the cash discount is for ensuring early payments.

Trade discount is calculated on catalogue price, while cash discount is calculated on the price after deducting the trade discount.

Yes, a seller may revoke the cash discount that he offered if the buyer fails to meet the payment deadline.