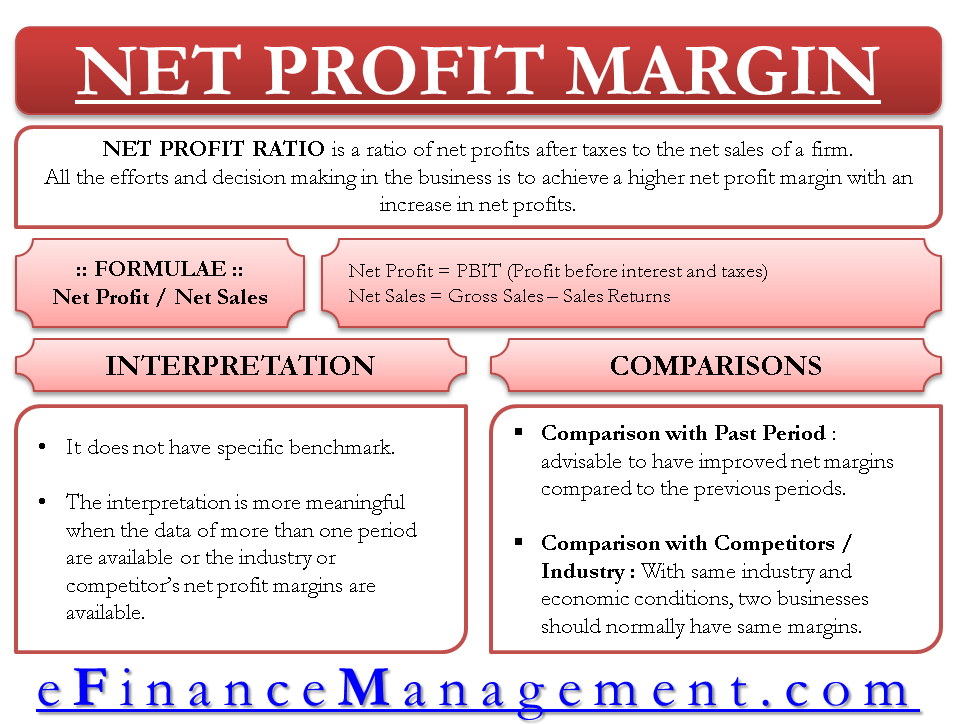

Net profit margin (NP Margin) is one of the profitability ratios and an important tool for financial analysis. It is the final output any business is looking for. The net profit ratio is a ratio of net profits after taxes to the net sales. All the efforts and decision-making in the business are to achieve a higher NP margin with an increase in net profits.

Definition of Net Profit Margin

Net profit margin shows the margin left for the equity and preference shareholders, i.e., the owners. Unlike the gross profit, which measures the business’s operating efficiency, it measures the overall efficiency of the business. An adequate margin of net profits will be generated only when most activities are being done efficiently. The activities may be production, administration, selling, financing, pricing, tax management, or inventory management. Even if any of these perform poorly, management can check the effect on net profits and their margins.

For example, inventory management had some problems in a particular year, and profit margins fell. The management needs to focus on that part to regain the same ratios. One way of helping to ensure profit margins is to use a third-party logistics company to help manage inventory. Once the said problem is resolved, the company can again see a rise in its margins.

How to Calculate Net Profit Margin Ratio with Formula?

The formula for this is as follows:

| Net Profit Margin Ratio = Net Profit / Net Sales |

The calculation of net profit margin does involve too many calculations but deciding which profit to consider for calculation is a concern. The different levels of profits can be

Also Read: Operating Margin Ratio

Profit before Interest and Taxes (PBIT)

There are many authors of financial management books who are in favor of using PBIT for the calculation of net profit margins because it nullifies the effect of modes of finance. This is particularly useful when the purpose of calculating the NP margin is to assess the operating efficiency of the business. The ratio can be comparable to the industry and competitors with this profit.

Profit after Taxes (PAT)

This profit is taken in the conventional way of calculating the ratio. When calculated with PAT, the margin shows the effect of all the business activities, considering that the financing of assets is not a separate activity but a vital activity of the business.

Interpretation of Net Profit Margin / Net Margin / Net Profit Ratio

The percentage shown by the net profit margin does not have any specific benchmark. It is because the net profit margin of a small business and a big steel plant cannot be the same, and therefore a standard benchmark cannot be set. The interpretation is more meaningful when the data of more than one period are available or the industry or competitor’s net profit margins are available.

Comparison with Past Periods

It is usually advisable to have improved net margins compared to the previous periods. If the margins do not improve, it calls for careful analysis to determine the reasons for the decline since the net margins are dependent on many factors starting from the cost of production to the taxes paid in a profit and loss account.

Also Read: Gross Profit Margin and its Interpretation

Comparison with Competitors or Industry

If the margins are not as good as the competitors have, there is undoubtedly some deficiency in the business operations. Two businesses should generally have the same profit margins with the same industry and economic conditions. A significant negative deviation in the profit margins is a serious matter to handle with extensive care. Since profits are the lifeblood of any business, any compromise in profits may raise a question mark on the sustainability of the business.

To know more about such other types, read PROFITABILITY RATIOS.

I was wondering what the downside of using the net profit ratio was. As in a weakness, such as it doesn’t take into consideration the cash flow that is entering the business but takes only the profit. I am doing this for a school project and could really use an insight.

Hi Izzy,

The weakness of Net Profit Margin as a Ratio is as follows:

1. It ignores Cash Flow.

2. It also ignores Absolute Figures in Terms of Dollars which are also equally relevant.

3. It may be misleading when there are some non-operating revenues contributing heavily to the net profits.

4. Just relying on this ratio standalone won’t make sense. There are 2 ways to make it effective – one, compare it with the industry average and two, look at the trend of the last 3 to 4 years.

5. This ratio should be combined with other ratios like asset turnover ratio, gross margin, etc.

Hope it helps you understand better.

Thank you so much, this helps a heap.