Meaning of Public Debt

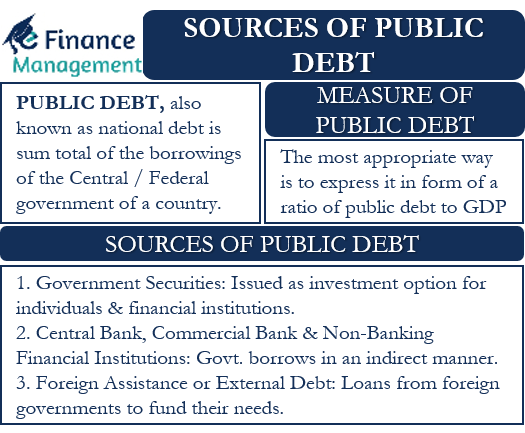

Public debt is the sum total of the borrowings of the Central/Federal government of a country. We also call it Sovereign debt or National debt. There are multiple sources of public debt. Governments across the world borrow through these sources to meet their expenses for day-to-day operations as well as for the development of the nation. The amount of public debt of a country tells a lot about its financial health and stability. In reality, the expenditures of all the governments mostly exceed their income. In other words, the budgets of most governments have a budget deficit. Hence, they have to rely upon various sources of public debt to meet the budget deficit.

We often classify public debt by the time period of its repayment, like for non-government firms. A debt of one year or lesser is known as short-term debt. However, the debts for which the repayment period goes beyond one year but for less than ten years are generally called a Medium-Term Debt. While in the case of Long-Term Debts stretch beyond 10 years, and it can go up to 25 to 50 years. The governments have to pay interest on such debts. Short-term debts generally have a higher interest rate and hence are costly. Long-term debts have the lowest rates of interest.

What are the Various Sources of Public Debt?

A government can raise debt either internally from domestic sources or go beyond the boundaries of the nation for external debt. Debt can be from individuals, organizations and businesses, financial institutions, and even from other governments. The most common sources of public debts are:

Government Securities

Governments issue government securities and as an investment option for individuals and financial institutions. These securities are in the form of treasury bonds, notes, market securities, cash management bills, and treasury bills and are generally sold by way of auctions. They have a definite maturity period, pay interest, or make coupon payments at regular intervals. People and organizations invest in such securities because they have the complete backing of the government. Their repayment is assured; hence they are treated as risk-free securities. The returns are also generally reasonable, better than the FDs of banks. Also, they can hold them till maturity or sell them in the secondary markets and exit.

Governments use the proceeds of these securities to fund their day-to-day operations. Also, they can allocate the proceeds to some special developmental and welfare projects. By doing so, they can raise urgent money for the project and avoid disturbing their budget. They need not implement any additional taxes or cut spending in other sectors to fund such impromptu expenditure.

The government, along with the Central bank of the country, often uses these government securities to perform open market operations. In times of inflationary trends with excess money in the economy, they sell these securities in the open market. People and institutions buy them, reducing the money supply in the market, and thus excess liquidity and wasteful spending are controlled. Similarly, they purchase back these securities from the market in order to increase the money supply in times of deflationary trends and a low supply of money in the market.

The Central Bank, Commercial Banks, and Non-Banking Financial Institutions

Governments borrow from the Central bank, commercial banks as well as specialized non-banking financial institutions in an indirect manner. Commercial banks buy government bonds from the government instead of money. They generally maintain deposits with the Central bank of the country and use these deposits for such a purchase in times of urgency. The same is the case with other non-banking financial institutions.

In normal times, the Central bank generally does not buy the bonds directly from the government to fund its needs. But in times of a distressed and troubled economy, there are no takers for the government bonds. It is then that the Central bank comes into action. The central banks are vested with special powers that entitle them to buy the government bonds directly from the government rather than buying the same from the market. The government gets money in return as public debt.

Also Read: Public Finance

Foreign Assistance or External Debt

Governments also take loans from foreign governments, banks, and other financial institutions to fund their needs. They also arrange funding and aids from various international bodies for welfare programs or developmental projects. Such international bodies are International Monetary Fund (IMF), World Bank, Asian Development Bank, and so on. These debts can be given for a specific purpose like building a power plant or building a Special Economic Zone (SEZ), etc. There may be conditions in the loan agreement that may compel the borrowing nation to buy inputs or materials for the project from the loan-providing nation, make necessary changes in their various business policies and regulations, and keep the budget deficit in a certain range, and so on.

Also, governments take external aid in cases of natural disasters, famines, medical catastrophes, etc., when they are unable to finance their basic survival needs. Such assistance is generally for the long term and at a low-interest rate. Delay in repayment or refusal to repay foreign aid is a matter of grave concern for any country. Such defaults are sovereign defaults. They tarnish the country’s reputation in the international community. Also, it will hamper its chances of getting further financial aid from any other country in the future.

How do we Measure Public Debt?

The most appropriate way to measure the amount of public debt of a country is to express it in the form of a ratio of public debt to GDP. We can also calculate it as a percentage of the GDP of the country. The important point to note here is that the quantum of public debt is a number and does not convey anything in itself. What matters or where one should focus is this ratio or percentage. And that makes it much easier to understand the severity or concern, whether the quantum is comfortable or otherwise.

For example, if we say that the public debt of country A is $1 billion, we cannot interpret if it is high, low, or moderate for that country. But if we say that the debt-to-GDP ratio of that country is 75%, it will be a matter of grave concern for the nation as well as the lenders.

The larger the GDP of a country, the more has the debt repayment capacity. A larger GDP may suggest a lower ratio of debt to GDP. A big economy will mean bigger business opportunities and a high growth rate in the capital markets. This will result in higher National Income, and it will be in a comfortable position to repay its debt.

A government can bring down its public debt by increasing its earnings and making its repayments faster. It can increase taxes in the country or reduce its expenditure. Also, it can opt for debt restructuring in case it is facing difficulty in repayment of the principal amount as well as the interest amount.

Quiz on Sources of Public Debt

This quiz will help you to take a quick test of what you have read here.