Accounts Receivable and Accounts Payable are business terms that are primarily used in accounting. The real difference between Accounts Receivable vs Accounts Payable is clear from the names themselves. When you buy any product as a business and don’t pay for it upfront, then the amount you owe is accounts payable. On the other hand, if, as a business, a customer buys from you, but did not pay immediately, then that amount is accounts receivable for you.

We can also say that account payable is the sum total of the amount that a business needs to pay to its suppliers. On the other hand, account receivable is the total amount a business has to receive from the customers.

Financial analysts keep a close watch on these two metrics in the company’s financial statement to analyze liquidity in the business. A wide gap between receivables and payable is not a good sign for the company in the long run. Take, for instance, if the customers of the company are not making timely payments, but the company has to pay to its suppliers. This would lead to a cash crunch. Even if a company is earning a profit, such a gap between accounts receivable and accounts payable could result in a company struggling to manage its day-to-day operations.

To better understand both the terms and their usage, let’s see the differences between Accounts Receivable vs Accounts Payable.

Accounts Receivable vs Accounts Payable – Differences

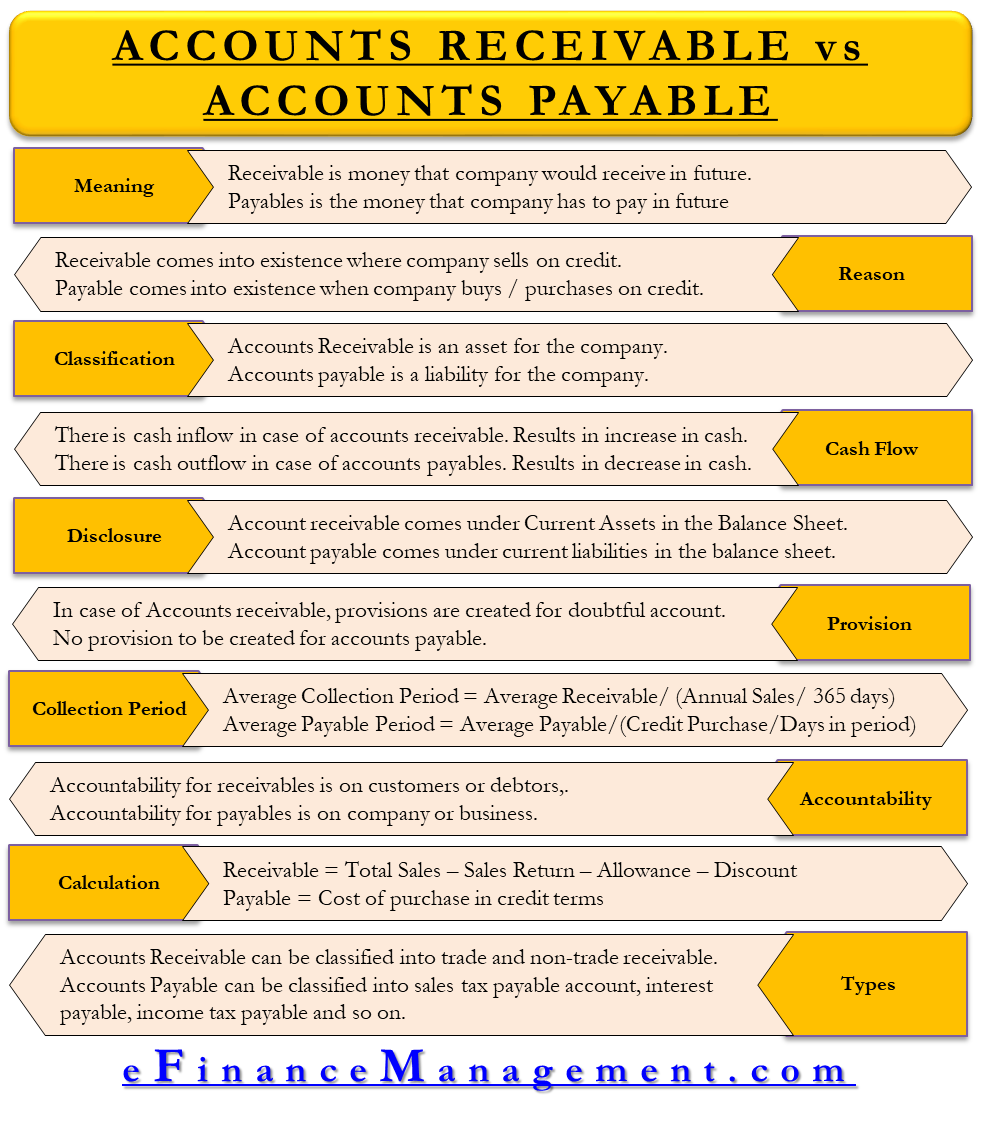

Following are the differences between Accounts Receivable vs Accounts Payable:

Meaning

The money that a company would receive from its debtors in the future is accounts receivable. Accounts Payable is the amount that a business or a company owes to its suppliers.

Also Read: Is Account Receivable an Asset?

Reason

Accounts receivable exist because the company sells goods and services on credit. Accounts payable are there because a company buys products or raw materials on credit.

Classification

Payments that customers owe to a company are an asset to the company. This is because it is an inflow that the company would receive in the future. Therefore, accounts receivable are an asset. On the other hand, Accounts payable come on the liability side because this is the money a company owes to its suppliers.

Cash Flow

In accounts receivable, there is cash inflow and thus results in an increase in cash flow. In accounts payable, there is cash outflow and thus resulting in a decrease in cash flow.

Where are They Shown?

Account receivable comes under Current Assets, while Account payable comes under current liabilities in the balance sheet.

Provision for Doubtful Accounts

Businesses should always keep an eye on doubtful accounts and create provisions against those. These accounts are created keeping in mind the customers who might not pay and default. Total accounts receivable is also recorded after deducting this allowance from the accounts receivables amount. This gives management a clear picture of the finance and also increases the financial accuracy of the company.

Also Read: Bills Payable

On the other hand, Accounts payable do not have any such allowance or provisions. A company does not plan in advance on defaulting on certain accounts. Even if it does create such a provision, this would be against the business ethics and affect the goodwill of the company as well.

Types

We can further classify accounts receivable as trade account receivable and non-trade receivable accounts. On the other hand, Accounts payable can be of various types such as sales tax payable account, interest payable, income tax payable, and so on.

Factors Affecting

In the case of accounts receivables, the company strives towards reducing collection time. The quest of the businesses is to ensure that they are receiving more cash upfront rather than putting it in the accrual account. This is the reason why companies even offer discounts on early payment rather than taking full payment later.

For account payable, companies consider factors such as interest savings and discounts that they get for upfront payments. For instance, if a company believes that it could earn more interest by investing the same amount now than making the payment, then it is better to pay later.

Calculation

To calculate accounts receivables, we need to subtract sales return, allowance, and discount to the customers from the total sales. Accounts payable is just the total cost of the purchase in credit terms.

Accountability

The accountability for accounts receivables is on the customers or debtors, while for accounts payable, the accountability is on the company or business.

Average Collection Period vs. Average payable Period

The average collection period is the average number of days that the company has to wait before the customers pay. An average payable period is the average number of days a company gets to pay its suppliers. The formula for average collection period and payable period is as follows:

Average Collection Period = Average accounts receivable/ (Annual Sales/ 365 days)

Average Payable Period = Average accounts payable/ (total credit purchases/Days in period)

Final Words

Both accounts receivable and accounts payable are part of double-entry bookkeeping and an essential tool in assessing the company’s overall health. A company should maintain a balance between the two to ensure it does not face a cash crunch.

Further, refer to Debit Note vs. Credit Note.

Please be sending these write ups to my email captured below.