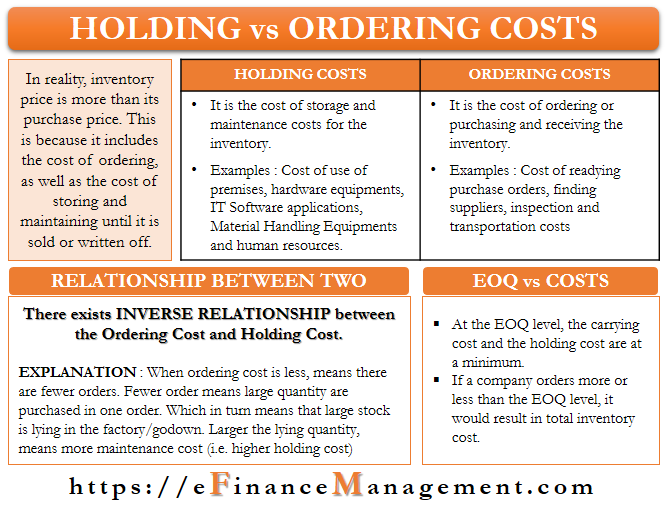

Most businesses overlook their real inventory cost. In reality, the inventory price is more than its purchase price. It is because it includes the cost of ordering, as well as the cost of storing and maintaining until sales happen, consumed, or disposed of. For assessment of the total inventory value, every business must consider carrying or holding costs and ordering costs, together with the purchase price.

Ordering Cost

As the name suggests, it is the cost of ordering or purchasing and receiving the inventory. It includes procurement and logistics costs. Some examples of ordering costs are the cost of readying purchase orders, cost and time that a company spends on finding suppliers, inspection cost, cost of transportation, and more.

Carrying or Holding Cost

It includes the storage and maintenance costs for the inventory. The costs could be of in-house facilities or external warehouses for which the company has to pay rent. In both cases, the carrying cost would include using premises, hardware equipment, IT Software applications, Material Handling Equipment, and human resources.

Holding costs include two types of costs:

- Inventory Storage Cost

It usually includes the cost of rental and facility maintenance and other related costs. It will also cover the costs of human resources, communication costs and utilities, operational costs, and more.

Also Read: Carrying Cost: Why You Shouldn't Avoid It?

- Cost of Capital

It includes the costs of investments, taxes on inventory, insurance expenses, and interest (if any) on the working capital. It would also cover any cost of legal liability.

Holding cost vs Ordering cost – Relation

Holding and ordering costs have an inverse relationship. It means if one of the two rises, the other cost would drop. Suppose the ordering cost is less; it would mean the company is giving fewer orders in a period. Fewer orders, in turn, would mean the quantity of each order is larger. It would result in more inventories lying with the company, and thus, there would be an increase in the carrying cost. Similar will be the case if the carrying cost is low. In such a situation, the ordering frequency and related costs are higher.

Let us take an example to understand the relationship between Holding cost vs Ordering cost.

Company A needs 100 units of mobiles every month. It can order these units in several ways. For the sake of simplicity, we will discuss here two options.

In the first option, Company A orders once a month. It will order 100 units in one go. Its ordering cost will be less, but it would have to incur a holding cost on the full 100 units.

Also Read: How EOQ helps in Inventory Management?

In the second option, Company A order five times a month, or 20 units per order. Since it needs to place five orders, its ordering cost would rise. On the other hand, its carrying cost would drop as at a time, and it would have to worry about just 20 units.

Holding cost, Ordering cost and EOQ

We can better understand the relationship between the Holding cost vs Ordering cost using the concept of EOQ (Economic Order Quantity). At the EOQ level, the carrying cost and the holding cost are at a minimum. Or, we can say it is the inventory level at which the sum of carrying and ordering costs is minimal. A company that orders more or less than the EOQ level will incur more inventory costs.

Let us understand this with the help of an example. Company A sells mobiles. On average, its annual sales are 10,000 units. The cost per order is $200, while the carrying cost is $5 per unit. Here, we first need to calculate the economic order quantity (EOQ).

Example (Cont.)

The formula for EOQ is

√¯‾ (2*D*O)/C

D is the total demand, C is the carrying cost per unit, while O is the cost per order.

EOQ =√¯‾ (2* 10,000 * 200)/5 = 894.43 or 895 units.

Since the annual demand is 10,000 units, the company will have to place approx. 11 orders annually.

Total ordering cost will be $200 * 11 = $2,200.

We need to find the average inventory first to calculate the carrying cost. Average inventory is opening stock plus purchase divided by 2. We have no opening stock, so that the average inventory would be 895/2 = 447.5 units. So, the total carrying cost is (447.5 * 5) $2,237.5

Total inventory cost for company at EOQ is the ordering cost plus holding cost or $2,200 + $2,237.5 = $4,437.5.

Now, let’s see what happens if Company A orders more than the EOQ. Assume Company A orders 1,000 units at a time. The total number of orders will be 10 (10,000 / 1,000), and the average inventory will be 500 (1,000/2). Now, total inventory cost would be (($200 * 10) + (500 * $5)) $4,500.

If Company A orders less than EOQ, say 800 units. The total number of orders will be 12.5 (10,000 / 800), and the average inventory will be 400 (800/2). Total inventory cost will be (($200 * 12.5) + (400 * $5)) is $4500.

In both cases, the total inventory cost is the same, but it is still more than the EOQ level. Thus, it is now clear that a company should aim to minimize both costs and use the EOQ model.

Refer to Economic Order Quantity(EOQ) for a detailed article.

Final Words

We can say the study and analyses of both Holding costs vs Ordering costs help a business to decide how much to order and when to order. There is always a tradeoff between both costs. Hence, the objective of the company should be to minimize the total of both costs, and for that, it should make use of the economic order quantity (EOQ) model.

Quiz on Holding Cost vs Ordering Cost.

I come from the field of Supply Chain and your write up is correct and absolute clarity on the concept. However , no one is really following these micro calculations which in my experience matters a lot in the final P&L of the organization, impacting Supply chain Accounting.

Keep Sharing as I read all your posts & they are very insightful.