The statement of income and the statement of comprehensive income are both part of financial statements used to report the company’s performance and financial position to the users of financial statements. One significant difference between both statements is income. Let’s have a look at how income differentiates the two statements.

Income Statement Vs. Statement of Comprehensive Income

Meaning

The income statement, also known as a statement of profit and loss, is a financial statement that shows the company’s expenses and revenue for a specified period.

On the other side, the statement of comprehensive income is a financial statement that reports the company’s expenses, revenues, and other comprehensive income over a specified period.

Purpose

The primary purpose of the statement of income is to report the company’s net income/net loss, which is the difference between its revenue and expenses. The income statement is used to evaluate the company’s financial performance in terms of profit and loss through regular business activities such as selling products or services.

The statement of comprehensive income is a tool to provide a more comprehensive and complete picture of a company’s performance financially than the income statement. The shareholders can see the full range of factors impacting the company’s financial performance.

Other Comprehensive Income

The basic difference between the income statement and a comprehensive income statement is of other comprehensive income. Other than the components of an income statement, a comprehensive income statement includes the followings:

- Unrealized gains or losses

- Foreign currency translation adjustments

- Pension and post-retirement benefit adjustments

- Revaluation of property, plant, and equipment

- Change in the fair value of financial and market instruments

Inclusion and Exclusion

The income statement only includes the realized gains and losses. In contrast, the statement of comprehensive income includes both the realized and unrealized gains and losses, foreign currency translation adjustments, pension, and post-retirement benefit adjustments, revaluation of property, plant, and equipment, and change in the fair value of financial and market instruments.

Events and Transaction

Another difference is that the statement of income only includes transactions and events that are completed and took place. In contrast, the comprehensive income statement consists of both completed and incomplete transactions and events. The statement of comprehensive income provides a more current view of the company’s position and performance.

Table of Difference

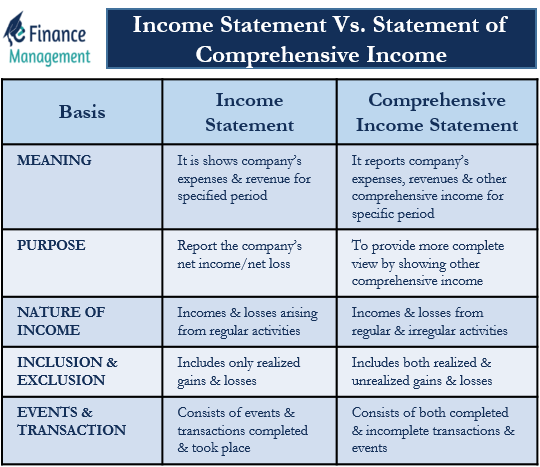

To summarize, we have the following table:

Basis | Income Statement | Comprehensive Income Statement |

|---|---|---|

| Nature of Income | It includes incomes and losses arising from regular activities of the business. | It includes incomes and losses from regular as well as irregular activities of the business. |

| Components | It only includes the revenues and expenses of the company. | It includes revenues, expenses, and other comprehensive income of the company. |

| Realized and Unrealized Profit and losses | It only includes realized gains and losses of the company. | It includes both realized as well as unrealized gains and losses. |

| Types of Transaction | It only includes completed transactions. | Along with completed transactions, it includes transactions that are yet to take place. |

Which Statement is Better?

However, both statements provide valuable information and insights to the users of financial statements about the company’s performance and financial positions; the comprehensive income statement provides a more complete and competitive view in comparison to the income statement alone.

But the question here is, “if the comprehensive income statement is more complete, why does it not replace the income statement?“

The reason is even though a comprehensive income statement includes a more extensive set of items, it is still not as widely used as the income statement as it is considered more of a supplement than a replacement because the ‘other comprehensive income’ section is usually less significant to most of the stakeholders and some of the standards required to produce the statement separately.