What is Variance Analysis?

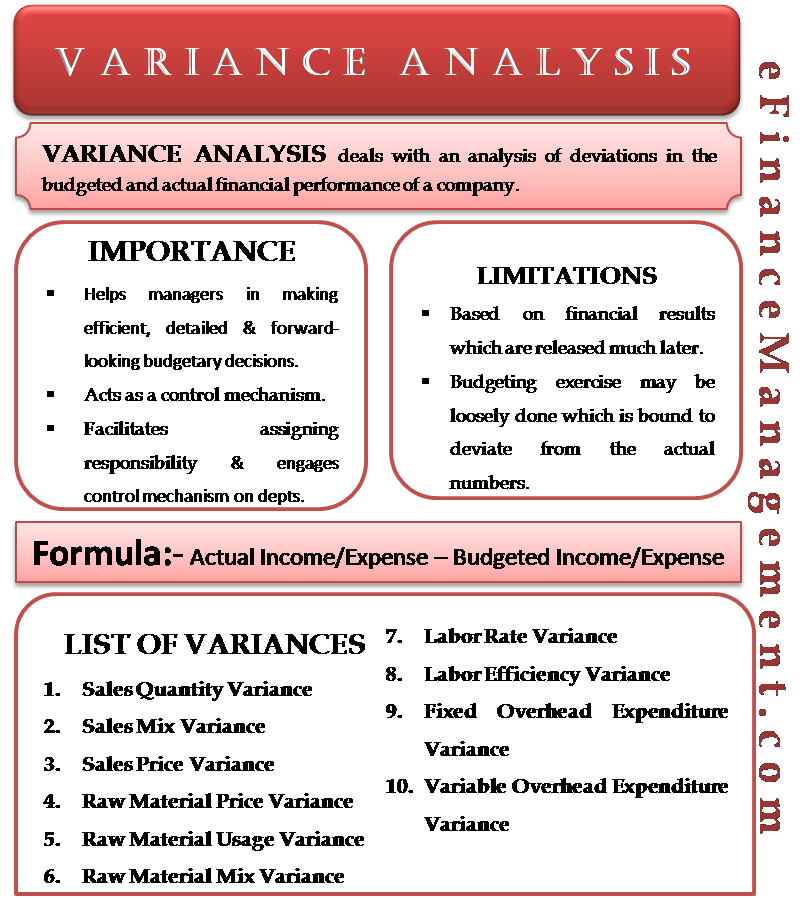

Variance Analysis deals with an analysis of deviations in the budgeted and actual financial performance of a company. The causes of the difference between the actual outcome and the budgeted numbers are analyzed to showcase the areas of improvement for the company. At times, it is also a sign of unrealistic budgets; therefore, budgets can be revised in such cases.

In other words, variance analysis is a process of identifying causes of variation in the income and expenses of the current year from the budgeted values. It helps to understand why fluctuations happen and what can / should be done to reduce the adverse variance. This eventually helps in better budgeting activity.

A variance in management accounting may be favorable (costs lower than expected or revenues higher than expected) or adverse (costs higher than anticipated or revenues lower than expected). Either positive variance or negative variance reflects negatively on the budgeting efficiency unless caused by extreme events.

Variance Analysis Formula

Variance = Actual Income/Expense – Budgeted Income/Expense

Read more at Variance Analysis Formula with Example

Now, let us look at the need and importance of variance analysis:

Need and Importance of Variance Analysis

- Variance analysis aids efficient budgeting activity as management wishes to have lower deviations from the planned budgets. Wanting a lower deviation usually leads managers to make detailed and forward-looking budgetary decisions.

- Variance analysis acts as a control mechanism. Analysis of significant deviations on essential items helps the company know the causes, and it allows management to look into possible ways of how much deviation can be avoided.

- Variance analysis facilitates assigning responsibility and engages control mechanisms in departments where required. For example, suppose labor efficiency variance is seen to be unfavorable, or procurement of raw material cost variance is unfavorable. In that case, the management can enhance control of these departments to increase efficiency.

Limitations of Variance Analysis

The variance analysis is of immense use to corporations; however, it comes with its own set of limitations as follows:

- Variance analysis as an activity is based on financial results, which are released much later after quarterly closing; there may be a time gap that may affect the remedial action-taking ability to a certain extent. Also, not all sources of variance may be available in accounting data, which makes acting upon variances difficult.

- Suppose the budgeting is not made, considering the detailed analysis of each factor. In that case, the budgeting exercise may be loosely done, which is bound to deviate from the actual numbers—after that, analyzing variances may not be a useful activity.

Forms of Variances

Variances could occur due to changes in one or many items of the budgeted list, and hence we can have various types of variance to be analyzed. Let us look at some of the common types of variances as tabulated below:

Also Read: Variance Analysis Report

| Sr. No | Forms of Variance | Variance in | Special Note / Formula |

| 1 |

Sales Quantity Variance |

The quantum of sales. | (Actual Quantity Sold – Budgeted Quantity) X Profit per Unit This is directly affected by a sudden rise/fall in demand for the products or services offered by the company. |

| 2 |

Sales Mix Variance |

The proportion of various products sold, i.e., the sales mix. | This may happen due to shifts in the demand curve. |

| 3 |

Sales Price Variance |

The selling price of the products. This may happen due to higher competition/ achievement of higher market share. | (Actual Selling Price – Standard Selling Price) X Quantity Sold |

| 4 |

Raw Material Price Variance |

The direct cost of raw materials used. | (Standard quantity Of Raw Material * Standard Cost Per Unit) – (Actual Quantity Of Raw Material *Actual Cost Per Unit) This may happen due to changes in external factors, e.g., cheaper imports due to changes in taxation, etc. |

| 5 |

Raw Material Usage Variance |

The quantity of raw materials used up. | (Budgeted Quantity – Actual Quantity) * Standard Price Many reasons could cause this deviation, including sales volume. |

| 6 |

Raw Material Mix Variance |

The cost of the standard proportion of raw materials used by the company to produce goods. | |

| 7 |

Labour Rate Variance |

Costs of labor paid to produce the goods. This may happen due to economies of scale or due to unplanned recruitments. | Labour rate variance helps the management in optimizing labor cost, which is one of the key components of direct cost |

| 8 |

Labour Efficiency Variance |

The number of hours utilized by the labor resource of the company. | (Standard/Budgeted Hours –Actual Number of Hours) * Budgeted Hourly Rate |

| 9 |

Fixed Overhead Expenditure Variance |

Fixed cost expenditure incurred by the company like rent, electricity, machinery, land, etc. | Usually, these do not deviate much unless expansion plans come up or expansion plans which were planned get delayed or halted due to some problem, some unplanned losses happen, or natural calamity occurs. |

| 10 |

Variable Overhead Expenditure Variance |

Variable costs like indirect material cost | Deviation in this measure could be on the favorable side if costs reduce due to economies of scale or could be on the unfavorable side due to reasons such as an increase in idle time, reduction in sales, etc. |

Conclusion

The widely used types of variances that are analyzed by management are given above. Apart from these, the management may also use the variance analysis on other variables like direct cost yield variance, fixed overhead efficiency variance, variable overhead efficiency variance, fixed overhead capacity variance, fixed overhead calendar variance, and fixed overhead total variance, among many others. However, it is important to understand that it is not necessary to track all variances; it may be sufficient to track a few important ones depending upon the nature of the company, the life cycle, and the industry profile.

Also, read Cost Variance.

Quiz on Variance Analysis

This is more helpful. Assuming we have a positive variable overhead expenditure variance. Is there any need for one to post it in the general ledger. or should it affect our cost of sales.