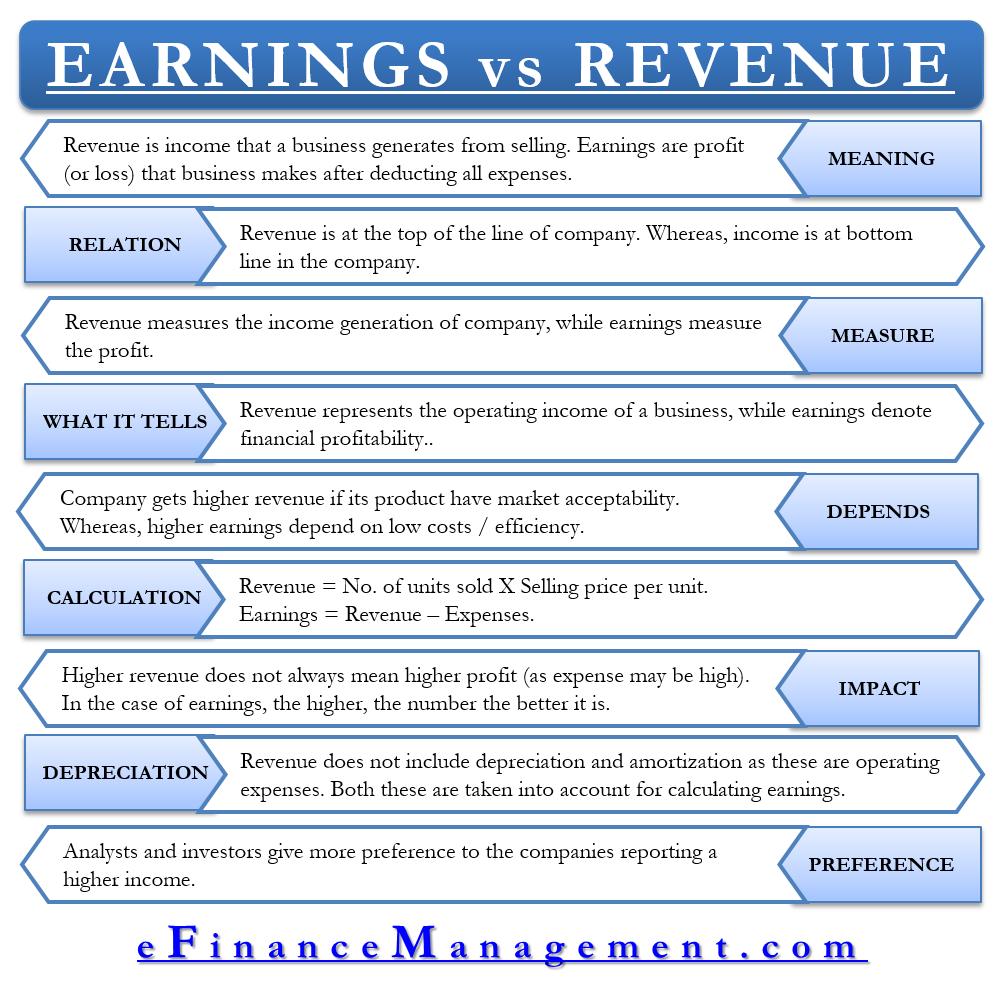

Often the terms earnings and revenue are used interchangeably, but they are very different from each other. To put it simply, revenue is the total sales made by a business during a period. On the other hand, earning is the profit that a business generates during a period. For a proper understanding of the financial statement, it is necessary to understand the relevance and difference between earnings vs revenue.

What is Revenue?

Revenue or income is the gross amount that a business earns from selling goods and services. It is the income that the firm generates from its daily business activities. In other words, it is the amount that a business earns before accounting for the cost of goods sold (COGS) and expenses. It comes as the first entry in the income statement and thus is referred to as the top line.

What are Earnings?

Earnings or net earnings or net income is the profit that a business makes after considering the expenses. Or, we can say it is the amount left after deducting the cost of goods sold and expenses. It tells how efficiently the company is managing its spending and operating costs. Companies also calculate earnings per share (EPS), or the income attributable to each outstanding share, along with the earning amount.

Earnings vs Revenue – Differences

Meaning

Revenue is the income that a business generates from selling its product or services. On the other hand, earnings are the profit (or loss) that a business makes after deducting all the expenses.

Also Read: Net Profit

What it is Related to?

One can relate revenue to the top line of the company, while earnings are the bottom line for the company.

What it Measures?

Revenue measures the income generation of a company, while earnings measure the profit of a business.

What does it Tell?

Revenue represents the operating income of a business, while earnings denote financial profitability.

What it Depends on?

A company will get higher revenue if its product has high acceptability and demand across the sector. On the other hand, higher earnings depend on low costs and how efficient the business is.

Calculation

One can calculate revenue by multiplying the number of units sold with the selling price. To calculate earnings, we have to deduct all expenses from the revenue.

Impact

Higher revenue does not always mean that a business is in good shape. A business may have expenses that exceed the revenue amount, thus resulting in a loss. In the case of earnings, the higher the number, the better it is.

Depreciation/Amortization

Revenue does not include depreciation and amortization as these are operating expenses. Both these are taken into account for calculating earnings.

Preference

Analysts and investors give more preference to the companies reporting higher earnings.

Example

Assume company A sells 1000 units at $100 per unit, and its total expenses were $60000. In this case, the revenue will be 100,000 (1000*100), and earnings will be $40000 (Revenue Less Expenses).

Also Read: EBITDA

Earnings vs Revenue – Why it is Important?

For stock analysts, two numbers, in particular, are very important. These are revenue and earnings per share (EPS) as it helps in outlining how successfully the management is running the business. Both these numbers help decide whether to go for stock or not by considering the beginning number (revenue) and end number (earnings).

Moreover, along with the current revenue and EPS numbers, analysts also look at the past numbers. Comparing the current revenue and EPS numbers with the past ones helps analysts to identify a trend. If the current EPS and revenue numbers are less than the last year, it is a negative sign. Analysts also like to see EPS numbers grow faster than the revenue numbers, which would mean the company is getting more efficient.

Final Words

Both revenue and earnings are important for a company. Without adequate revenue, it wouldn’t be possible for a company to generate earnings. When a company is new, it focuses on increasing its revenue. And later, generating profits becomes its primary goal. A business will not survive in the long run if it is not making a profit. Thus, both are important measures for a company and tell about the financial health of a company.