Organizations always rely on comparative performance to understand where they lack and the places where they excel. A Budgeted Income Statement, a type of financial budget, serves the same purpose. Also called a pro forma income statement is a financial report that compares the estimated revenue and expense numbers with the real numbers. Simply put, it is a report that puts the estimated numbers side-by-side with the real numbers to gauge the performance of the company.

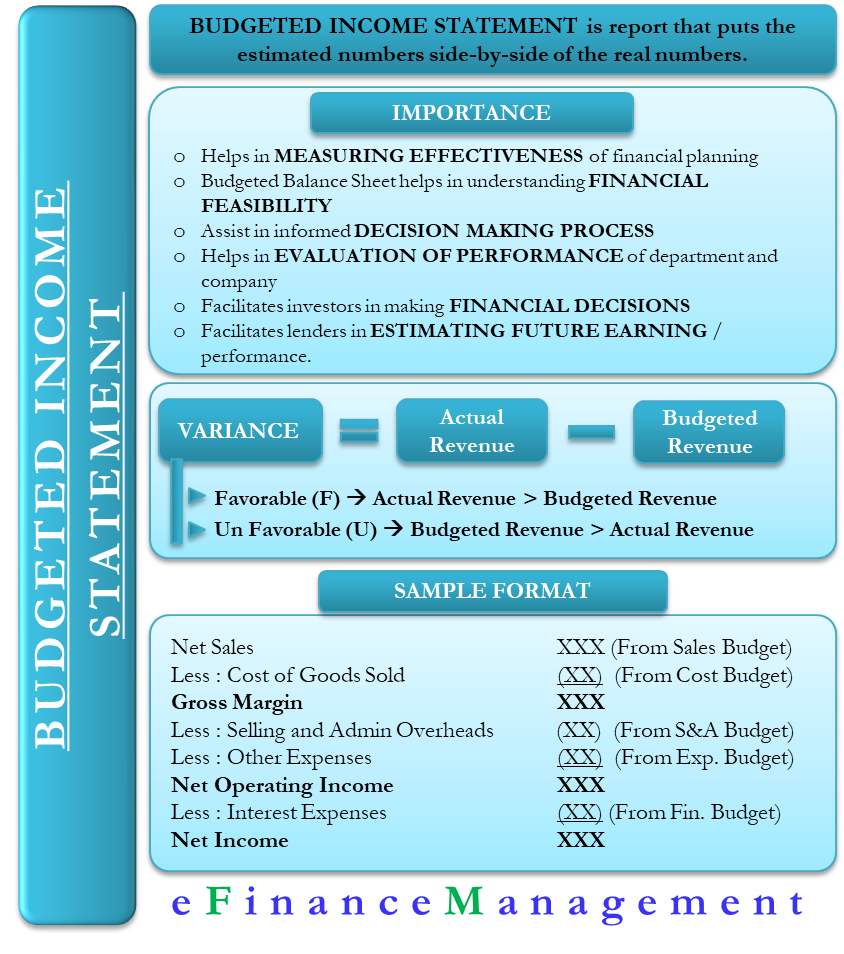

Importance of Budgeted Income Statement

It becomes important to prepare a budgeted income statement for a business in order to measure the effectiveness of the financial planning process. Companies also prepare a budgeted balance sheet along with the income statement to understand the plans that are financially feasible. Moreover, some companies also make more than one projection on the basis of different scenarios. This helps them to understand possible outcomes and thus, make decisions accordingly.

Management use budgeted income statement report to evaluate the performance of the departments and the company as a whole. The company usually sets budget and performance goals at the start of the year. These goals are based on past performance and growth expectations.

A Budgeted Income Statement does not just benefit the company but also makes sense from the point of view of the investors and lenders. Existing and potential investors would always want to know where the company is standing financially. And also how confident the company is when it comes to its performance in the financial period.

Also Read: Why is Budgeting Important?

On the other hand, Lenders would not bet on a company that does not estimate its income and future performance. Before extending the loan, the lenders would want to know the capacity of the company to pay it back with interest. Therefore, budgeted financial statements are necessary and help the lenders and potential investors to decide if they want to invest in a company or not.

Budget Variance

As said above, the budgeted income statement is just an estimate from the company. On the other hand, the real income statement represents the actual numbers that a company report at the end of the reporting period.

The difference between the actual and budgeted income statement is known as variance. Budget variance is known to be favorable when the actual revenue is higher than the estimate. On the other hand, the budget variance would be negative (or unfavorable) when the actual revenue is lower than the estimate. In the report, managers often place “U” next to the unfavorable variance for the line item and “F” for the favorable variance. This helps to identify the areas that need improvement easily.

In some cases, although rare, the company can show the variance between the actual and budgeted assets and liabilities.

Usually, a budget variance is the outcome of inaccurate assumptions or improper budgeting. Managers can control the budget variances by controlling the expenses. Though the majority of the expenses can’t be avoided (or are committed expenses), some are discretionary expenses as well. Managers must try to avoid such expenses as these won’t have an immediate adverse impact on profits.

Also Read: Financial Budget

On the other hand, some parts of the budget variance might not be in the hand of the managers. Such variances occur in the marketplace. A few instances could be when customers don’t buy the products of the company in large quantities or at a price set by them. Such instances can lead to actual revenue varying largely from the budgeted revenue.

How to Prepare a Budgeted Income Statement?

To prepare such a report, you need to pay attention to items like revenue, expenses, and net income. First, start by setting revenue goals and then estimate other revenue items, such as investment gains, interest income, and vendor refunds. For example, you can set revenue thresholds for the upcoming quarter at 150% of the last quarter.

Next, lay down the expense goals by following the same criteria as you did for the revenue. Estimate the three types of expenses separately – material expense, operating outlays, and non-operating costs. Determine the amount of money that you would want to spend depending on the company’s goals and economic condition

Lastly, highlight the net income (or loss) on the basis of the above revenue and expenses.

Budgeted Income Statement Sample

Sample Budgeted Income Statement of XYZ for the Year Ended December 31, 20XX

| Line Item | Amount | Source |

| Net sales | $9,000,000 | Sales budget |

| Less: cost of goods sold (COGS) | 5,500,000 | Cost budget |

| Gross margin | 3,500,000 | |

| Less: Selling & admin. expenses | 3,000,000 | Selling and admin. expense budget |

| Less: Other expenses | 400,000 | Other expense budgets |

| Net operating income | 100,000 | |

| Less: interest expense | 50,000 | Financing budget |

| Net income | $50,000 |

To ensure the accuracy of the estimates, the company must use the best assumptions based on unbiased estimates. After that, the company should go through several iterations of the budget model to draw the budgeted income statement as close to the expectations as possible. Attention to detail is important because it makes it easier to understand what the company can achieve in financial and operational terms.

After arriving at the final estimate, the company puts the budget information in the budget field for every line item in the income statement. The final module would also have the budget, actual, and variance.

Now, it is the responsibility of the accounting staff to analyze and understand the reasons for the difference or variance. The findings come in a separate report accompanying the financial statements. Businesses that do not produce annual budgets do not follow the practice of budgeted incomes statement. Instead, they can use a short-range forecast to create the forecasted income statement, mostly for the upcoming quarters.

Budgeted Financial Statement

As said before, the companies do not just make the budgeted income statement. Instead, they estimate other metrics as well, such as the balance sheet, cash flow, as well as retained earnings. To prepare such reports, the company pulls information from the annual budgeting model of a business. These statements help in understanding and estimating the financial results and estimate the cash flow of the business. Budgeted Financial Statements are usually concerned with the summary level income statement and balance sheet.

Final Words

A budgeted income statement is most useful when representing all budget periods in one report. This way, it becomes easy to compare the results of all periods and also identify anomalies. To make it easier, the number of line items in a budgeted income statement should be similar to the ones in the actual income statement.

Read more about Financial Budget.

which type of budgets are not feed in pro-forma income statement?

a)cash budget

b)factory overhead budget

c)direct material budget

d)sales budget

and why?

Dear Rajani, a cash budget will not be fed in the Proforma income statement. As the name suggests Income Statement shd have only revenues and expenses. Thx

Cash budget, because it includes entire budgeted inflows and outflows activity but income statement considers only revenue items so options b,c,d gives base to income statement numbers but cash budget does not give numbers to income statement by itself.

For e.g rent paid at once for six months advance or later will find place in budget but not in income statement whereas monthly rent will be shown in income statement but not in cash budget.