Impairment of long-lived assets is one of the key accounting decisions taken by a company. This decision impacts the company’s profitability, classification of the cash flows, financial ratios, and various trends. International Financial Reporting Standards (IFRS) and U.S. Generally Accepted Accounting Principles (GAAP) provide guidance on the impairment of assets. It is important to understand when an asset is to be impaired and how to treat the impairment.

Definition of Impairment

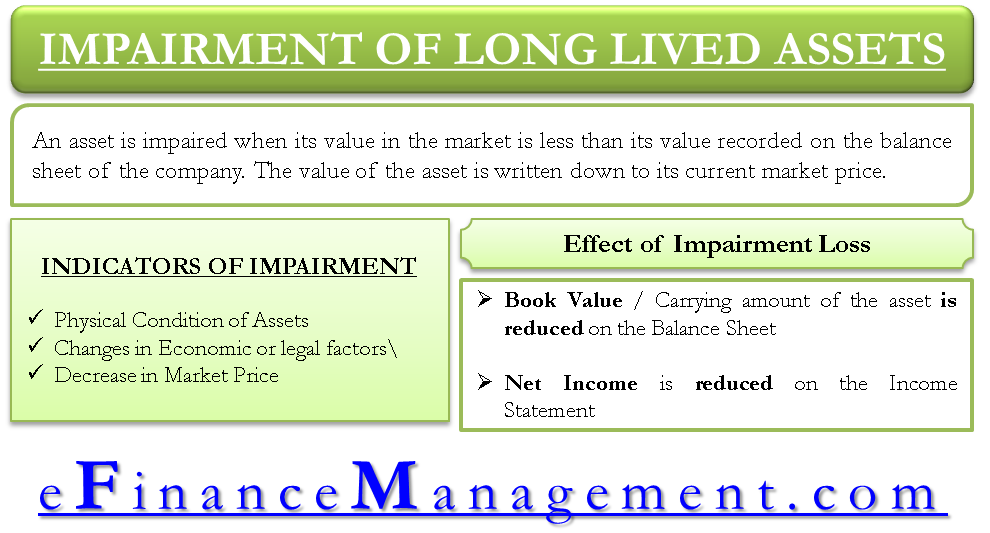

An asset is impaired when its value in the market is less than its value recorded on the company’s balance sheet. If found to exist for sure, such a difference is accounted for in the books. The value of the asset is written down to its current market price. Long-lived assets are generally categorized into three categories. A tangible asset includes property, plant, equipment, etc. An identifiable intangible asset may be a patent, trademark, or license. A non-identifiable intangible asset is mostly the goodwill of the company. All these assets are prone to impairments.

Indicators of Impairment Test

Companies need to assess their external environment to determine whether an asset needs to be impaired. Several indicators may lead to an impairment of the asset; some of the indicators are:

- The physical condition of the asset may have changed significantly.

- Economic or legal factors may have changed significantly.

- The market price may have decreased significantly.

Impairment under IFRS

Under IFRS, IAS 36 is the primary source of guidance on the impairment of tangible assets. The major points covered under this regulation are:

- Impairment losses need to be recognized when the asset’s Book Value > the asset’s Recoverable amount.

Where Asset’s Recoverable Amount = higher of (Fair value – Selling costs) OR value in use.

The value in use is calculated by discounting future cash flows expected from the asset’s continued use.

- IFRS requires the companies to assess the indications of the impairment annually by keeping an eye on the several indicators mentioned above.

- For identifiable intangible assets that cannot be amortized and goodwill, the companies are required to test these for impairment at least annually.

- The impairment loss is allowed to be reversed if the asset’s value recovers later.

Impairment under U.S. GAAP

Under U.S. GAAP, the most important source is ASC 360-10, which regulates the impairment of tangible assets. The impairment of assets is treated as follows:

- U.S. GAAP has a two-step test to determine if the asset is impaired or not.

- The first step is defined as the recoverability test in which the asset’s book value is tested. The asset’s book value is not recoverable when it is higher than the undiscounted cash flows expected from the continuous use of the asset.

- The second step is defined as the measurement of impairment loss. If the asset’s value is proven to be unrecoverable in the first step, then the impairment loss is calculated. Impairment loss = asset’s book value – asset’s fair value (or the present value of the future cash flows expected).

- Companies are advised to carry out the impairment test only when they are sure that the asset’s carrying/book value cannot be recovered permanently.

- U.S. GAAP also requires goodwill and other identifiable intangible assets to be tested at least annually for impairment.

- No reversal of loss is allowed.

Effect of Impairment Loss

Impairment loss indicates that the company has overstated its earnings by not recognizing enough depreciation/amortization expenses in the past. The impairment loss has the following effect on various financial statements and ratios:

- The book value/carrying amount of the asset is reduced on the balance sheet.

- Net income is reduced on the income statement.

Since it reduces the book value of the fixed assets, the fixed asset turnover ratio and the debt-to-total assets ratio will improve.

Also read – impairment vs depreciation.

Conclusion

The impairment of long-lived assets needs to be determined correctly as it affects the financial statements, the asset turnover ratio, and other ratios of the companies. It is advised to figure out the right indicators of the impairment and subsequently account for the impairments in a regulated way.

Continue reading – Impairment Cost.

Awesome article and very well described.Really appreciate your work for Management accounting and increase knowledge for the people.