Impairment and Depreciation are two very important concepts in accounting. Both concepts apply to assets, especially fixed assets. And both refer to the drop or reduction in the value of the asset. However, the two concepts are completely different from each other. However, some get confused between them and use them interchangeably. To use the two terms correctly, it is important that we are aware of and understand the difference between Impairment vs Depreciation.

Before detailing the differences between Impairment vs Depreciation, it is important to know what these two concepts mean.

Impairment

It is a permanent reduction in the value of the asset. It can be due to permanent damage or technological issues because of which it can no more deliver the performance it used to deliver earlier. Thus, Impairment arises when the benefit that a company expects from that asset is less than its book value. In this case, the benefit means the gain, cash flow, or other benefits that a company expects from the asset to generate. In other words, an impairment loss is due to a substantial difference in the carrying value of the assets being lower than its market value or realizable value. Therefore, to show the fair value, the entity needs to reduce the value of that assets in its books of account by providing for impairment losses.

We can say that an impairment loss is a substantial reduction in the value of the asset. The value here means the recoverable amount or market value or the sum of its undiscounted expected future cash flows. There may be many reasons for an impairment loss, including legal, economic, and natural.

For example, a transport company experiences significant impairment in the value of its truck following an accident.

Depreciation

It is a process of systematically reducing the cost of the asset on the company’s books until the value becomes zero or insignificant over its useful life. The idea is that every asset has a useful life, and therefore its cost should be recovered over its useful life through a constant yearly charge or provision for depreciation. Under accounting principles, it is mandatory for a company to reduce the value of its fixed assets. Depreciation usually applies to all fixed assets, except for the land (value of land, which appreciates over time).

For example, a company buys a transport van for $50,000 and expects its useful life to be five years. So, one simple way to charge depreciation on this asset is to charge $10,000 each year. This was the book value of the asset will reduce to zero after five years.

Now that you know what the two concepts mean let’s look at the differences between Impairment vs Depreciation.

Impairment vs Depreciation – Differences

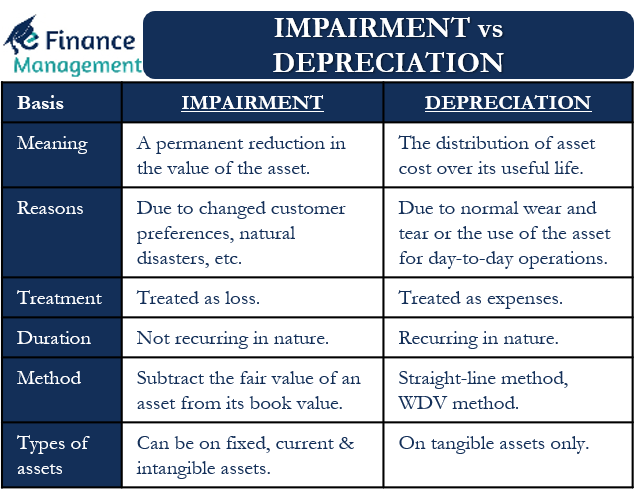

Following are the differences between Impairment vs Depreciation:

Meaning

Impairment is a sudden and substantial decline in the fair or recoverable value of assets. On the other hand, depreciation is the method of distributing the cost of the asset over its useful life.

Reasons

Impairment of an asset can occur for various reasons, such as a disaster, legal, economic or operational reasons. In contrast, depreciation arises due to normal wear and tear or the use of the asset for day-to-day operations or obsolescence.

Or we can say that impairment occurs when there is a significant change in the physical condition of the asset. Or there is a change in the technical, environmental, or economic aspect related to the asset. If one or more of these causes a drastic decrease in the market value of the asset, we call it an impairment.

Also Read: Impairment of Long-Lived Assets

This does not apply to depreciation, which is due to normal wear and tear in the normal course of its use.

Treatment

The income statement includes both impairment and depreciation. Secondly, both go to reduce the net earnings of the entity. But there is a difference in the accounting treatment of both as impairment is taken as a loss on the asset, while depreciation comes as an expense.

Duration

An impairment is primarily a one-off event, or it is not a recurring one. Normally, an accountant periodically checks for impairment, but there may or may not be any impairment.

On the other hand, depreciation is a recurring expense recorded monthly, quarterly, or yearly by a company in line with its accounting practice.

Method

An accountant calculates impairment losses by subtracting the fair value of an asset from its book value. In contrast, there are many methods to calculate depreciation, such as the straight-line method, diminishing balance method, and much more.

Types of Assets

Impairment extends to more asset classes in comparison to deprecation. This means that impairment can be on fixed assets, current assets, as well as intangible assets. For example, goodwill, receivables, investments, and more.

On the other hand, depreciation usually applies to tangible assets such as machinery, plant and equipment, and more.

Loss or Gain

Impairment is a loss for a company because it means a reduction in the value of an asset due to an internal or external factor. Depreciation is an expense, but it also helps the company to save on taxes. Depreciation is not an actual cash outflow, but it reduces the net income of the company.

Impairment vs Depreciation – Example

The following example will help to clarify the difference between the two concepts.

Suppose Company A owns a building, which it purchased three years back at the cost of $100,000. So far, the accumulated depreciation on the building is $30,000 using the straight-line method and assuming no scrap value. Thus, the book value of the building now is $70,000.

Now, a hurricane damages this building significantly. So, the company arranges for the inspection for impairment. After inspecting the damages, the survey and assessment conclude that the building is now worth just $40,000. Therefore, the value of the building has to be written down on the balance sheet to ensure the reflection of its true value in the books.

The accounting entry for this will be “Loss from Impairment” debit and the building account or “Provision for Impairment Losses” account credit. The amount of impairment, in this case, will be $30,000.

“Loss from Impairment” will appear in the income statement, while the credit to the building account will reduce the amount for building in the balance sheet.

Final Words

Both impairment and depreciation are very important as well as useful accounting concepts. By applying these concepts fairly, companies can achieve some benefits, such as a reduction in their taxable income.

Frequently Asked Questions (FAQs)

Impairment is treated as a loss, while depreciation is treated as an expense.

Some reasons for impairment include changes in customer preferences, natural disasters, changes in legal or economic conditions, etc.

No. Impairment is non-recurring in nature.

The impaired asset is written at its reduced valued on the balance sheet.

LOVE THIS SITE; VERY EDUCATING.