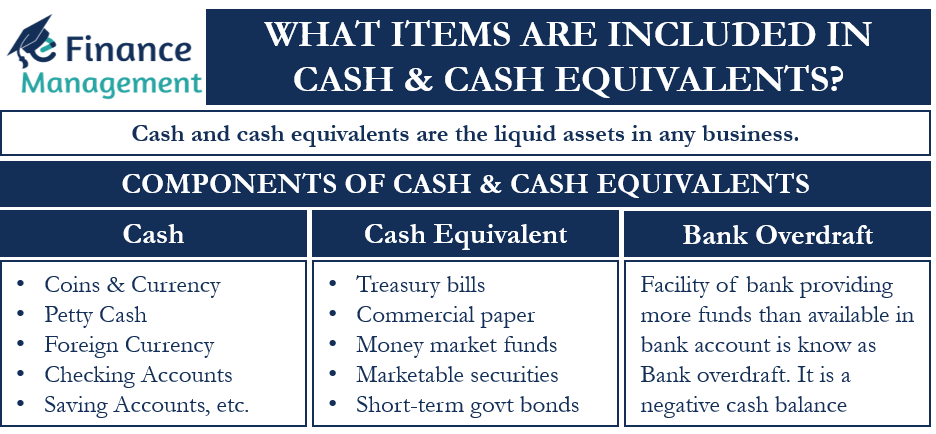

Cash and cash equivalents are the liquid assets in any business. The purpose of keeping cash and cash equivalents is to meet daily expenses, pay off current liabilities on time, or meet any emergencies. In this article, we will read what are the all components that we include in cash and cash equivalents.

There are majorly three broad heads:

- Cash

- Cash Equivalents

- Bank Overdraft

Let us understand all these in detail.

Cash

It is the most liquid asset. It is useful in meeting the unforeseen needs of the business such as the occurrence of any unexpected event. This includes:

- Coin and currency: The local currency of the country the company is operating in.

- Petty cash: Petty cash is the amount available in hand to meet the daily requirements of the business.

- Foreign currency: Any currency which is not the home currency of the company operating.

- Checking account: These are the bank accounts from which frequent transactions are made as these are considered more active in terms of making transactions.

- Savings accounts: The main purpose of these accounts is to save or put some cash aside.

- Change funds: An amount used at the cash counter to return to the customers for the goods they buy.

- Negotiable instruments: These are endorsable instruments such as money orders, cashier checks, and personal checks.

Cash Equivalents

These are readily convertible securities or bonds with a maturity of fewer than 3 months at the time of issue. There is a very low risk of loss in value when the company sells it or converts it. Some of the best examples are:

- Treasury bills

- Commercial paper

- Money market funds

- Marketable securities

- Short-term government bonds

Bank Overdraft

When the business writes a check for more than the available balance or uses more funds than the available then it is a bank overdraft. This facility is given to customers who maintain a good CIBIL score. It is worth noting that it is set off against the cash deposit in the account of the same bank. A bank overdraft is a negative cash balance.

Also Read: Liquid Assets

Conclusion

The above-mentioned form cash and cash equivalents of a business. These help in maintaining the appropriate liquidity balances. They are important so the company or a firm does not face difficulty in fostering any unforeseen as well as predictable events as and when they occur.