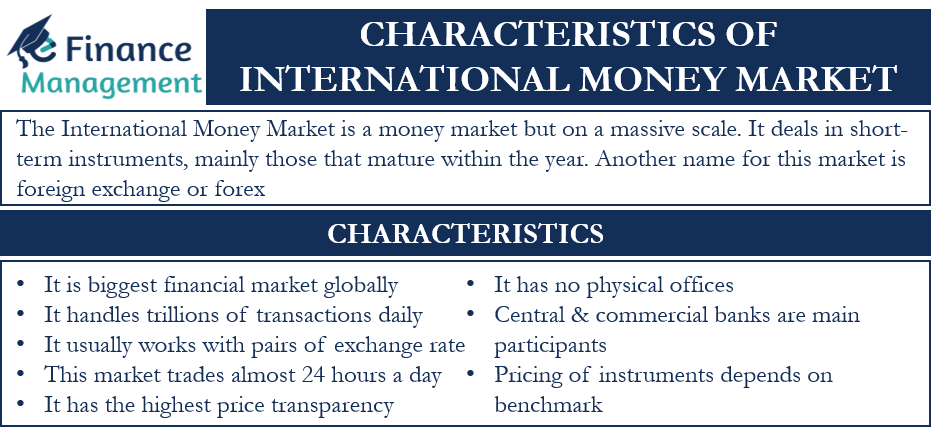

The international money market is a money market but on a massive scale. This market enables investors, usually central banks of different countries, to lend and borrow money. Central banks and major commercial banks are the main participants in the international money market. This market deals in short-term instruments, mainly those that mature within the year. Another name for this market is the foreign exchange or forex. In this article, we will take a look at the characteristics of the international money market.

Characteristics of International Money Market

Below are the primary characteristics of the international money market:

Global Market

It is likely the biggest financial market globally as it handles trillions of dollars of transactions on a daily basis. Also, it is the most liquid market.

Participants

Central banks and major commercial banks are the main participants in this market. Individuals also participate in this market, but they typically transact small amounts.

Having an international network of dealers is another characteristic of this market. And most of these dealers are commercial banks and investment banks. These dealers are usually in different countries with branches around the globe.

Also Read: International Money Market

Exchange Rate Pairs

The international money market usually works with pairs to determine the exchange rate between currencies. For instance, GBP/USD tells about the exchange rate between British pounds and U.S. dollars. Similarly, EUR/USD measures the rate between euros and U.S. dollars. Since the U.S. dollar is the most active or popular currency, most pairs measure the value of one currency against the U.S. dollar. Some currencies, however, do use currencies other than the USD as well.

Even though the U.S. dollar is the most active currency, the United Kingdom accounts for the highest amount of foreign exchange trading

Number of Transactions

It is a very big market that trades almost 24 hours a day. Thus, this market trades every second, giving rise to constant small fluctuations. These small movements could be as tiny as up to eight decimals. Such movements may appear small, but when you are dealing with millions of dollars, it could result in thousands in profit or losses.

Trading In/Out of the Country

The short-term instruments, such as bank deposits, are usually issued and traded outside of the nation issuing the currency.

Pricing of Instruments

The pricing of many instruments in this market depends on the benchmark, such as LIBOR.

Price Transparency

Price transparency is the highest in the international money market. And, transparency continues to improve with advancements in technology. In this market, a trader is able to directly trade with the market maker, ensuring higher transparency. Trading directly with the market maker also means that traders get a fair price on all trades.

Rules of Market

Though it is an international market, each country has its rules for the transactions in the market. These rules are for accounting, tax, payment and settlement, and banking laws.

Also Read: International Financial Markets

Physical Offices

The equity and bond markets have physical offices, such as New York Stock Exchange (NYSE) or the London Stock Exchange (LSE). However, the international money market has no physical offices. Rather, the dealers in this market are connected online and share information with each other.

So, these are the characteristics of the international money market that make it different from other financial markets in the world.