Liquidity refers to the ease with which an asset can be converted into cash without significant loss of value. It is an important concept in finance as it determines the ability of a company to meet its short-term obligations. When it comes to assessing the liquidity of assets, we often categorize assets into different levels of liquidity. Cash is the most liquid asset, as it can be used immediately for any purpose. On the other hand, assets like property or equipment are less liquid, as they may take time to sell or convert into cash. In this article, we will compare the liquidity of two common assets found on a company’s balance sheet – Account Receivable and Inventory.

Liquidity of Accounts Receivable

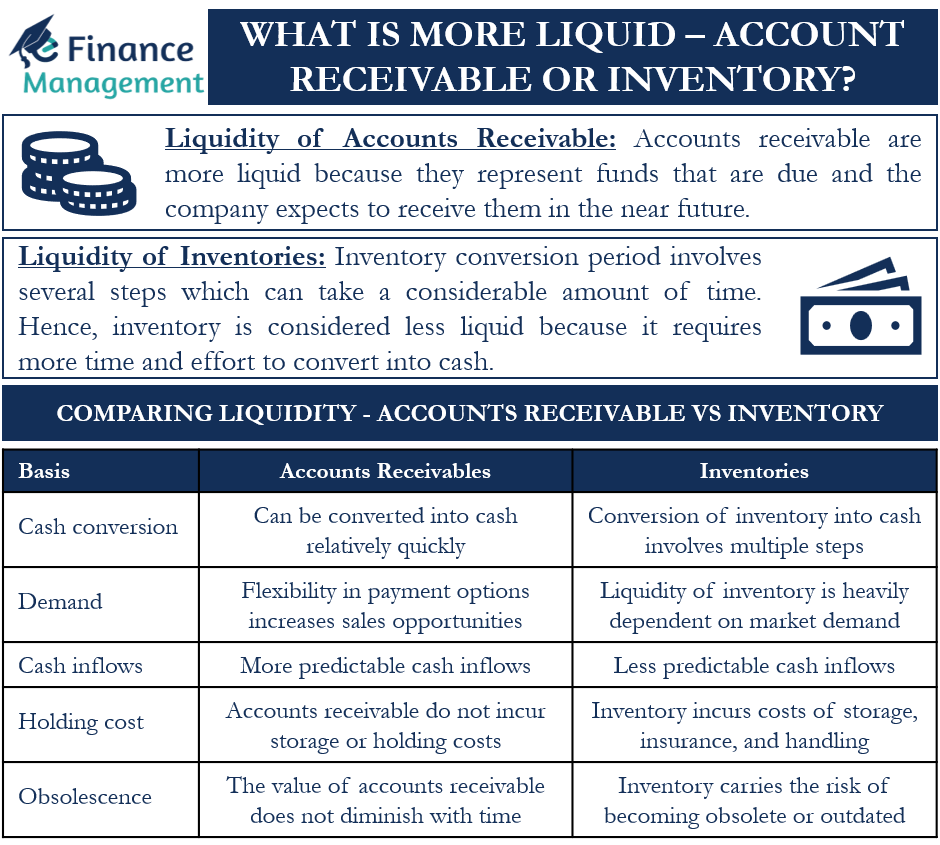

When a company sells goods or services on credit, it creates accounts receivable. The collection period for accounts receivable is typically shorter than the inventory conversion period. Once the company delivers the goods or services to the customers, it can start the process of collecting payments. Depending on the credit terms, which are usually within a few weeks or months, the company expects to receive the cash relatively quickly. Accounts receivable are more liquid because they represent funds that are due and the company expects to receive them in the near future. However, one should also be well-versed with the factors affecting the liquidity of accounts receivable.

Liquidity of Inventories

The inventory conversion period involves several steps, such as procuring raw materials, manufacturing or assembling products, storing the finished goods, and then selling them. This process can take a considerable amount of time, especially if the company deals with complex or customized products. Additionally, inventory may face risks such as obsolescence, damage, or changes in market demand, which can further delay the conversion of inventory into cash. Therefore, inventory is considered less liquid compared to accounts receivable because it requires more time and effort to convert into cash.

The simple answer to the question “What is more Liquid?” is that accounts receivable are generally considered to be more liquid than inventory. Let’s try to understand this with the help of an example.

Also Read: Factors Affecting Liquidity of Inventories

Example

Imagine you own a bakery and you have just supplied a batch of baked goods to a local café. They have promised to pay you within 30 days. This payment that you are expecting is account receivable. On the other hand, you have a stockpile of flour, sugar, and other ingredients in your pantry. Now, you will use this inventory to bake more goods in the future. Now, if you were to sell these ingredients, would you be able to obtain cash immediately?

In the given example, let’s explore how inventory first converts into accounts receivable and then into cash:

- Inventory: The bakery has a stockpile of flour, sugar, and other ingredients in its pantry. These ingredients are in inventory as their intention is to use them in the production of baked goods. The value of the inventory represents the cost incurred to acquire these ingredients.

- Sale of Baked Goods: The bakery supplies a batch of baked goods to a local café. The café agrees to pay the bakery within 30 days for the goods received. At this point, the inventory (ingredients) transforms into a finished product (baked goods), which is ready for sale.

- Accounts Receivable: The payment promised by the café becomes an account receivable for the bakery. It means that the café owes the bakery a specific amount of money for the baked goods received. The bakery issues an invoice to the café, detailing the amount owed and the payment terms.

- Conversion of Accounts Receivable to Cash: The bakery awaits payment from the café. The café fulfills its obligation by paying the bakery, resulting in an increase in the bakery’s cash balance.

If the bakery were to sell its ingredients (inventory) directly, it may not obtain cash immediately due to several reasons. Finding buyers for individual ingredients and negotiating sales might take time and effort. However, by converting the inventory into finished goods and selling them to the café, the bakery creates accounts receivable. This accounts receivable represents a claim to receive cash from the café within the agreed-upon timeframe.

Comparing Liquidity: Accounts Receivable vs Inventory

The liquidity comparison between inventory and accounts receivables depends on specific circumstances and industry factors. Let us understand why accounts receivable are more liquid in comparison to inventory.

Faster Conversion to Cash

Accounts receivable represent outstanding payments owed to a company by its customers for goods or services provided on credit. As customers settle their outstanding balances, accounts receivable can be converted into cash relatively quickly. The conversion process of accounts receivable is simpler and faster.

Also Read: Liquid Assets

On the other hand, inventory represents physical goods for selling to generate cash. The conversion of inventory into cash involves multiple steps, such as production, distribution, and sales. These processes take time and may be subject to various external factors that can impact the speed at which inventory converts into cash.

Consider the operating cycle to understand it in an easy way:

| Cash>>>>RM>>>>WIP>>>>FG>>>>Accounts Receivable>>>>Cash |

It is clearly understood from this cycle that accounts receivable gets converted into cash more quickly in comparison to inventory (be it RM, WIP, or FG). However, inventory first gets converted into accounts receivable and therefore, it takes longer to get liquid.

Market Demand and Seasonality

The liquidity of inventory is heavily dependent on market demand and seasonality. Changes in consumer preferences, economic conditions, or industry trends can affect the demand for specific products. If there is a decrease in demand for certain inventory items, it may take longer to sell them, thereby reducing their liquidity.

While, in the case of accounts receivable, offering credit terms and accepting accounts receivable provides flexibility to customers in meeting their payment obligations. By providing credit, companies can attract and retain customers who may not have immediate cash available. This flexibility in payment options increases sales opportunities and customer loyalty, further improving the liquidity of accounts receivable. Customers who have the option to buy on credit are more likely to make purchases, leading to higher sales volumes and increased revenue.

Predictable Cash Inflows

Accounts receivable generally offer more predictable cash inflows compared to inventory. The predetermined payment terms, established customer relationships, and creditworthiness assessment contribute to the predictability of cash inflows from accounts receivable. On the other hand, various factors that influence inventory’s cash inflows include market demand, sales and marketing strategies, lead time, and the seasonal or perishable nature of goods, making them less predictable.

Holding Costs

Inventory incurs costs related to storage, insurance, handling, and potential obsolescence. Holding excessive inventory ties up a company’s financial resources which can erode profitability and reduce the overall liquidity of inventory.

Unlike inventory, accounts receivable do not incur storage or holding costs, making them more cost-effective for maintaining liquidity.

Risk of Inventory Obsolescence

Inventory carries the risk of becoming obsolete or outdated, especially for industries with rapidly changing technology or consumer preferences. Holding excessive inventory increases the likelihood of holding outdated or unsellable products.

Unlike inventory, which can become obsolete or lose value over time, accounts receivable do not face the same risk. The value of accounts receivable does not diminish with time or changing market conditions. As long as customers fulfill their payment obligations, the accounts receivable retain their value, enhancing their liquidity.

Potential for Profit Margins

Proper management of inventory levels and pricing strategies can lead to higher profit margins. It compensates for the lower liquidity compared to accounts receivable.

Conclusion

While both accounts receivable and inventory contribute to a company’s liquidity, accounts receivable offer greater liquidity. On the other hand, the conversion of inventory to cash involves additional steps and potential risks. Companies must carefully manage their accounts receivable and inventory to strike the right balance between liquidity, profitability, and risk mitigation. Understanding the liquidity characteristics of these assets is essential for effective financial management and ensuring the smooth operation of a business.