The money market is the market where organizations, governments, and financial institutions invest for a short period of time, and the duration of investments could be as short as a day to a maximum of up to one year. So, we also call it the Cash Market. The purpose of investing in the money market differs from individual to organization. Individuals invest to gain profit, or we can say speculative trading. However, organizations want to invest, rather park their excess cash in a return-bearing instrument. The money market is the market where organizations, governments, and financial institutions invest for a short period of time, and the duration of investments could be as short as a day to a maximum of up to one year. So, we also call it the Cash Market.

The purpose of investing in the money market differs from individual to organization. Individuals invest to gain profit, or we can say speculative trading. However, organizations want to invest, rather park their excess cash in a return-bearing instrument. This is the market for the short term and mostly for investing surplus cash. Therefore, the two common characteristics of the money market are safety and low rates of returns.

The money market is one of the pillars of the global financial system. Banks, governments, and companies transact massive amounts to suffice the situational need of the respective organizations. The transfer of funds between companies, banks, financial institutions, and the government takes place on a wholesale basis, which retail investors later enjoy via mutual funds and other investments. A few examples of money market instruments include municipal notes, treasury bills, commercial paper, certificates of deposits, etc.

Meaning: International Money Market

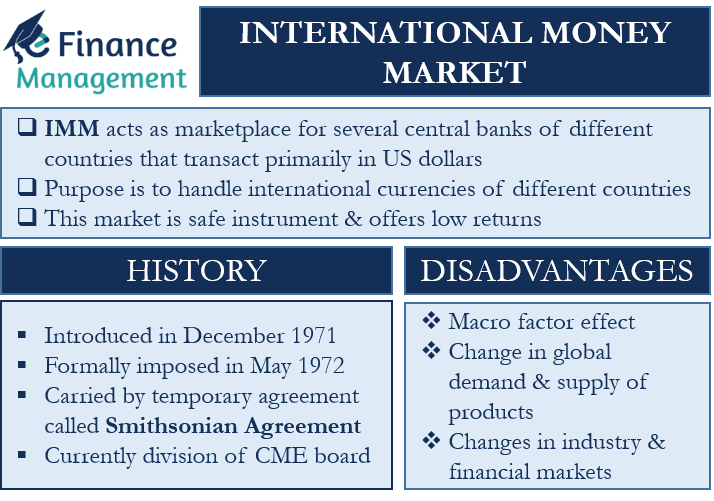

The international money market acts as a marketplace for several central banks of different countries that transact primarily in US dollars. As a result, the transactions involve depositing, borrowing, or lending money internationally. Mainly, the purpose of the international money market is to handle the international currencies of different countries. Similarly, the international money market is a safe instrument and offers low returns. The users of the money market are mainly big players like central banks of various countries, big corporations, and financial institutions. Individuals are not a part of the international market like the domestic money market. The common instruments include money market, mutual funds, and treasury bills.

History of International Money Market

The international monetary market first came up in December 1971 and was formalized in May 1972. This was carried out by a temporary agreement called the ‘Smithsonian Agreement’ between 10 developed nations which adjusted norms under Bretton Woods Agreement. While under the Bretton woods system, the exchange between countries was done using gold which is removed by the Smithsonian agreement. In the 1960s, the shortage of gold started complicating the situation of international transactions and was not sufficient for the global demand. The international money market emerged as one of the solutions for trading in future financial contracts, currencies, and other commodities through the Chicago Board of Trade. IMM is currently a division of the CME board (the largest platform for derivatives trading). Eurodollar time deposits, 90-day treasury bills, and LIBOR are the few commonly traded money market instruments on the IMM.

Disadvantages of the International Monetary Market

IMM looks attractive and pays off rewards for significant risks. However, there are certain disadvantages that are important to look into.

1. Firstly, the role of macro factors of the global markets like economic, political, and trade relations of various countries. The war between Ukraine and Russia will negatively impact both economies, which will also carry an effect on the global markets.

2. Secondly, another risk factor is the change in global demand and supply of products. Pandemic has shaken the demand and supply of many products, affecting IMM massively.

3. Third prime reason is the changes in the industry and financial markets. Disruptive technologies, new industry trends, and ideas can change industry patterns and affect IMM. Furthermore, along with industrial changes, other changes like shifts in price levels, foreign exchange risk, and interest rates impact IMM.

Also, read – Characteristics of the International Money Market.