The straight-line depreciation method is the simplest method for calculating an asset’s loss of value or, in other words, depreciation over a period of time. This method is helpful in bookkeeping as it helps in spreading the cost of an asset evenly over the useful life of the asset. This method is also useful in calculating the income tax deductions, but only for some assets such as patents and software.

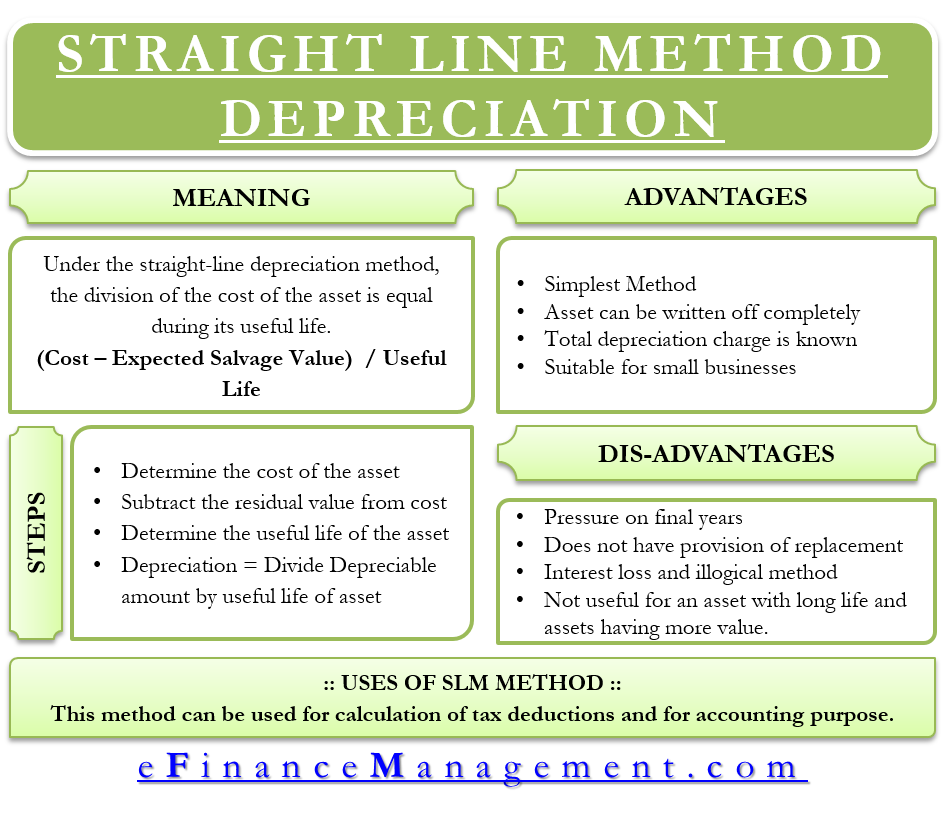

Under the straight-line depreciation method, the division of the cost of the asset is equal during its useful life. So that depreciation charged is equal for every year for the entire useful life of that asset. At the end of the useful life of the asset, its value is nil or equal to the residual value. Therefore, this method is also known as Fixed Installment or Fixed Percentage on cost method.

When we mark the amount of depreciation charge and the charging periods on the graph, the result is a straight line. Thus, this method gets the name straight-line method.

This method is very useful in the case of the assets where the useful life and the residual value are easy to calculate accurately. However, in cases wherein the initial years, the cost of repairs is low and will increase in the following years, the straight-line method will increase the charge on profit.

Also Read: Depreciation

Also, to apply this method, the period for which the asset is underuse need to be considered. For example, when an asset is under use for 3 months in a year, then the depreciation charge will be only for 3 months. But, in the case of income tax purposes, if the asset is in use for more than 180 days, the depreciation charge will be for the full year.

Uses of Straight Line Method

There are two reasons for the use of the straight-line depreciation method :

To Calculate Tax Deductions

When a business purchases a fixed asset, such as a vehicle, furniture, or computer, the entire amount cannot be written off in the first year. Instead, the entire amount is spread out across the time span of the asset when it is of use.

For Accounting Purposes

The businesses may record the depreciation in their books. If the business is using the cash basis accounting method, then they do not need to depreciate the assets in their books for accounting purposes. But, they still have to calculate the depreciation for tax deduction purposes. However, when the business purchases an expensive asset and does not record the depreciation in the books, the business’s financial statement may not accurately reflect the performance of the business. Therefore, many businesses maintain two sets of books.

Formula

To calculate the depreciation through the straight-line method, the formula is:

Straight-line depreciation for the period= cost-expected residual value/expected useful life of an asset

This method depreciates the value of an asset at a constant rate; therefore, it is best to apply this method in a situation where the asset is reaping benefits at a constant rate. However, in reality, this assumption does not hold right. In reality, it is not possible for the asset’s use and efficiency to remain the same throughout its life. Because the efficiency of an asset suffers due to the normal wear and tear of the asset, thus, the rate of benefit that the asset reaps will decline with the passage of time.

Also Read: Double Declining Depreciation

Calculation of Straight Line Depreciation

- Steps to calculate the depreciation

- Determine the cost of the asset

- Subtract the residual value from the cost of the asset to derive the total depreciable amount

- Determine the useful life of the asset

- Divide the total depreciable amount by the useful life of the asset to get the annual depreciation amount.

Example

A tourism company acquires a vehicle costing $30000. The useful life of the vehicle is 10 years. And the residual value is $1000.

Calculate the depreciation for the first year using the straight-line depreciation method

Solution

The depreciable amount of the vehicle is $29000 (30000-1000). Having a useful life of 10 years, the calculation of depreciation per year is as follows:

Annual Depreciation per year= $29000/10= $2900 per year

The depreciation charge on the vehicle will be $2900 every year for 10 years.

Advantages and Disadvantages of Straight-line Depreciation Method

Advantages

Simplicity

The straight-line method is the simplest method for calculating depreciation. An ordinary person can understand this method easily. The calculations for this method are very easy and simple.

Assets can be Written Off Completely

Under this method, assets can be written off completely (i.e., to zero). As the depreciation in this method is calculated on the original cost of the asset at the constant rate, so the value of an asset is equally spread out over the useful life of the asset.

Total Depreciation Charge is Known

The total amount of depreciation charge can be easily calculated by multiplying the yearly amount of depreciation by the total number of years the asset is under use.

Suitable for Small Businesses

This method is suitable for small businesses. Because this method is easy and simple, therefore it suits firms that are small in size.

Useful for Assets of Lesser Value

This method is very useful for calculating the depreciation charge on the assets of lesser value like furniture and fixtures.

Disadvantages

Pressure on Final Years

In the final years of the asset’s life, it bears more repairs and maintenance charges than the initial years. But, the depreciation charge is equal for all years. This put undue pressure on the asset in the final years.

Does not have the Provision of Replacement

Under this method, there is no provision for the replacement of the asset. The business retains the depreciation charge and uses it to perform regular affairs. The firm has to make efforts to arrange the funds for replacing the asset.

Interest Loss

Under this method, the firm does not invest the depreciation charge from the asset outside the firm. Therefore, it does not receive any interest.

Illogical Method

This method is considered as an illogical method because it seems illogical to depreciate the asset on the original cost when the balance of the asset is declining every year.

Not Useful for an Asset with a Long Life and More Value

The straight-line depreciation method is not useful in the case of the assets where additions and expansions can be made, such as land, plant, machinery, or buildings. Also, for the assets that are expansive and have more value, this method is not suitable.

Quiz on Straight Line Depreciation.

This quiz will help you to take a quick test of what you have read here.