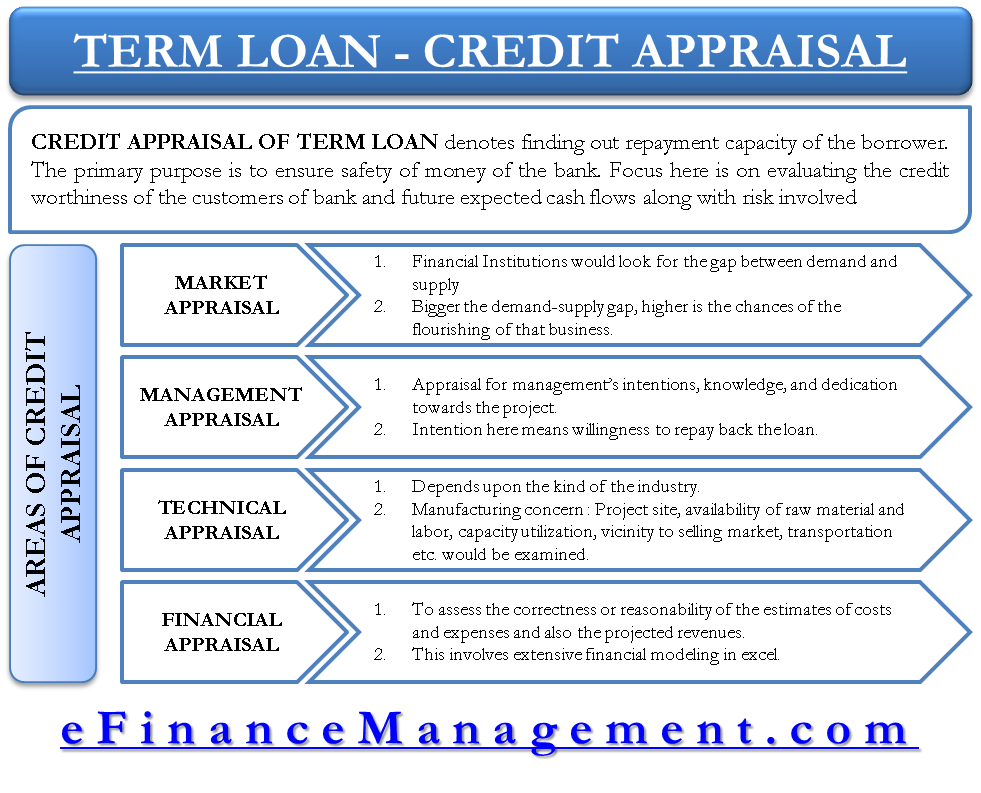

Credit appraisal of a term loan denotes evaluating the loan proposal to find out the borrower’s repayment capacity. The primary objective is to ensure the safety of the bank’s money and its customers. The process involves market, management, technical, and financial appraisal.

Getting term loans from a financial institution is not so easy. The corporate asking for the term loan has to go through several tests. The bank follows an extensive process of credit appraisal before sanctioning any loan. It analyses the loan proposal from all angles. The primary objective of credit appraisal is to ensure that the money is given in the right hands and that the capital and interest income of the bank is relatively secured.

While appraising term loans, a financial institution would focus on evaluating the company’s creditworthiness. And also the future expected stream of cash flow with the amount of risk attached to them. Creditworthiness is assessed with parameters such as the willingness of promoters to pay the money back and the borrower’s repayment capacity.

Four broad areas of appraisal by banks are market, management, technical, and management.

Market Appraisal

As part of the market appraisal, the very first thing a financial institution would look at is the gap between demand and supply. The bigger the demand-supply gap, the higher the chances of flourishing that business. The demand versus the proposed supply by the borrower should have a vast difference in demand of 50000 units against the proposed supply of 10000 units.

Another most important parameter is marketing efforts and infrastructure. This is the factor that converts a demand into sales for a business. The marketing side of the company needs to be very strong as it is very critical to the success of the venture.

Management Appraisal

Management of the company needs to be appraised for their intentions, knowledge, and dedication to the project. By intention, it means evaluating the willingness of the company’s promoters to pay the money back. It needs to assess the fundamental objective of borrowing.

Only good intentions would not generate cash flows to honor the installments of the loan. The management needs to be strong in terms of their knowledge about business, commitment towards achieving the set goals, etc.

Technical Appraisal

A technical appraisal is subject to the kind of business and industry of the borrower. If it’s a manufacturing concern, parameters like project site, availability of raw material and labor, capacity utilization, vicinity to selling market, transportation, etc., would be examined. A project needs to be technically very sound to be able to sustain all business cycles.

Financial Appraisal

After all the other kinds of appraisal, everything boils down to financial appraisal. This probably is the most important part of the credit appraisal of business loans. The reason is that it expresses everything in terms of money.

Financial appraisal tries to assess the correctness or reasonability of the estimates of costs and expenses and also the projected revenues. These may include the estimation of the selling price, the cost of machinery, the overall cost of the project, and the means of financing.

Financial appraisal involves extensive financial modeling in excel. It takes the financial statements of previous periods and forecasts the future financial position for at least till the loan matures. From that, we compare the cash flows of each year with the installment of the loan because, ultimately, the cash flows will honor the bank’s payments.

We evaluate the feasibility of the project in terms of the debt servicing capacity of the firm. The debt service coverage ratio is a key ratio that we calculate for each future financial period. And, if that ratio satisfies the norms that the banks accept, the loan will get another green signal.

It is difficult to explain the appraisal process in an article or even a set of articles. It is very extensive work at financial institutions. They have a separate team of professionals for conducting such project appraisals.

Fantastic blog!

Thats good and very educating.