Merchant Banking Vs Investment Banking – All You Need to Know

Merchant Banks and Investment Banks are financial institutions that provide services to corporate and HNIs (High Net worth Individuals) clients. And unlike Commercial or Retail Banks, these banks do not provide financial services to individual clients. Further, traditionally the function of the Investment Bank was to render underwriting services and help the companies in their IPO (Initial Public Offerings) process. Similarly, the traditional function of the Merchant Bank was to specifically provide trade finance services to Companies or HNI Clients. Over the years, both banking functions have overlapped each other, and so comes the question of Merchant Banking Vs Investment Banking.

In today’s times, there exists a thin line between the functions of Merchant Banking and Investment Banking. In today’s dynamic world, there are so many functions and activities that are incidentally both performed, Merchant Banks and Investment Banks. Moreover, both the Merchant Banks and Investment Banks charge fees and/or a share in profits/ownership in return for their services rendered.

Understanding Merchant Banking

The main and traditional role of a Merchant Bank is to provide financial and consultancy services in the field of International Trade and Trade Finance. Apart from this, Merchant Banking renders services like underwriting services, advisory services, funding services, portfolio services, insurance services, etc. And these services are mostly on the small scale level, with clients being small corporate or HNI Clients.

The main functions of Merchant Banking are as follows:-

- The basic and traditional function of Merchant Banking is to enhance International Trade and Finance. It enhances international trade when an International firm shows interest in acquiring a small domestic company. And it also provides services related to cross-border transactions.

- Merchant Bank helps its clients by providing them with portfolio management services (PMS). Also, they help these small companies and HNI clients make their investment decisions or trade on their behalf of them.

- Companies often need funds for expansion and growth purposes; in such a situation, Merchant Banks help raise funds. And this fundraising can be through shares (primary and/or secondary), debentures, or through any other instrument. Moreover, sometimes these Merchant Banks directly invest in the company by becoming Venture capitalists.

- Merchant Banking renders promotional services. When the businesses are new to the market, sometimes these Banks help the businesses in promoting their brand so as to make a presence in the market.

- The fourth function of a Merchant Bank is to provide project finance services; here, the Merchant Bank provides Loan Syndication services so that the client would get a loan from any other financial institution or a commercial bank.

- Merchant Banking helps clients in raising funds through a Private Placement or through a Public offering.

Understanding Investment Banking

The main and traditional role of an Investment Bank is to provide Underwriting and Mergers & Acquisition (M & A) services. Hence, it primarily focuses on creating wealth for the corporate, state, and/or central governments and other legal entities. Further, they act as an intermediary between the issuer of securities and the investors. The financial aspect of the corporate or the government, or the financial institution is planned and managed effectively by the Investment Bank. It identifies risks in the projects and reduces the time and expenses of the client. Apart from this intermediary role, they do provide financial services too.

Also Read: Investment Banking Vs. Commercial Banking

The main functions of Investment Banking are as follows:-

- Underwriting the security for raising funds is the main function of an Investment Bank. And this starts from underwriting the security (equity or debt), valuation, creating prospectus, pricing, paperwork, and final allocation of securities, etc.

- The second important function of an Investment Bank is to help the entity in the Mergers and Acquisition process. And that starts from analyzing the target company to closing the deal; the Investment Bank plays an essential role.

- Investment banking also provides advisory and consultancy services to clients by charging fees.

- These banks provide services like proprietary trading or trading securities. Institutional investors actively trade in hedge funds, stocks, options, etc., with the help of an Investment Bank.

- Investment Banks provide primary research and secondary research services to the clients.

- Other back-end services like risk management, financial control, corporate strategy, etc., are provided by Investment Banks.

- Investment Banks conduct restructuring of capital to make the company profitable.

Merchant Banking Vs Investment Banking – Major Differences

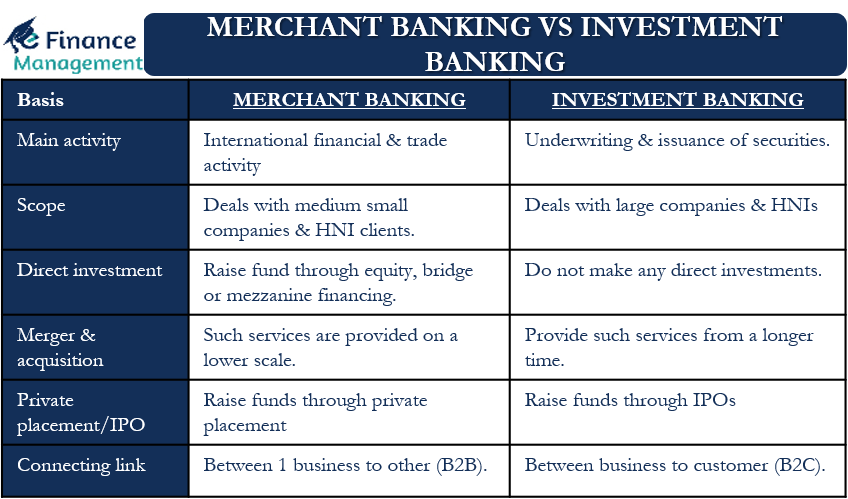

Mostly the functions of Investment Banking and Merchant Banking are interlinked today, but there are few non-exhaustive differences between Merchant Banking and Investment Banking. They are as follows:-

Main Activity

The main difference between the Merchant Bank and the Investment Bank is in their main and traditional business operations. Investment Banks are extensively involved in the underwriting and issuance of securities. At the same time, Merchant Banks are extensively involved in International Financial and Trade activities. In simple words, their basis of working is different.

In simple words, the main function of a Merchant Bank is to facilitate trade, syndication of loans, etc. At the same time, the main function of an Investment Bank is to help corporate to grow and expand and underwrite the public issue of securities.

Scope

The scope of the Investment Banks is wide in comparison to a Merchant Bank. Investment Banks mostly deal with large companies and High Net Worth Individuals (HNIs). Merchant Banks deal with medium-small companies and HNI clients.

Also Read: Types of Investment Banks

Direct Investments

Merchant Banks help small-scale companies raise funds through equity financing, bridge financing, and mezzanine financing. They sometimes directly invest in the client’s company along with the other investors. In the case of Investment banks, the clients are mostly large-scale companies with strong financial backgrounds. In simple words, Investment Banks mostly do not make any direct investments.

International Financing Activities

Investment Banks and Merchant Banks both conduct trade finance activities, foreign investments, foreign real estate investment, etc. But there are few core trade finance activities like international funds transfer and letters of credit (LOC), which are conducted only by Merchant Banks.

Mergers and Acquisitions (M & A)

Traditionally, only Investments Banks used to provide Mergers and Acquisitions (M & A) services to the clients, but these days Merchant Banks also provide M & A services. However, the M & A Services rendered by the Merchant Banks are on a lower scale with small companies only.

Fee Based or Rental Based

Merchant Banks provide services to the clients by charging fees for the same. In contrast to the same, the Investment Banks provide services on a fees and rental basis. Sometimes Investment Banks provide services on a lease rental basis or interest basis, or profit-sharing basis.

Private Placement or Initial Public Offerings

Merchant Banks mostly raise funds through private placement, as their clients are medium or small-scale enterprises. These small companies are not large enough, nor are their requirements so large to justify going for Initial Public Offerings (IPO). On the other hand, investment banks raise funds mostly through IPO and sometimes through Private Placement. The size of fund mobilization also remains relatively large.

Connecting Link

Generally, Investment Banks act as a connecting link between the entity and the investor, i.e., B2C (Business-to-Consumer). Mostly, Merchant Banks to facilitate the trade act as a connecting link between one business entity to another entity, i.e., B2B (business-to-Consumer). Merchant Banks act as a link between the entity and the investor only at the time of raising funds through the general public. This scenario is very rare.

Real-Life Examples of Merchant Banks and Investment Banks

There are many popular Investment Banks like J.P. Morgan & Co., Credit Suisse, Morgan Stanley, Merrill Lynch, Bank of America, etc.

Some popular Merchant Banks are Brown Brothers Harriman & Co., Samuel Montagu & Co., H. J. Merck & Co., Bajaj Capital Ltd., Barclay Bank PLC, Bank of Maharashtra, etc.

Merchant Banking Vs Investment Banking – Final Words

There are times when Investment Banking and Merchant Banking are considered the same. In today’s time, there are many services provided by both the Bank, but still, their primary functions are unique in nature. In simple words, Investment Banks perform underwriting of debt or equity and Mergers & Acquisitions activities. At the same time, Merchant Banks enhance International trade and finance. The scope of Investment Banking is broad in comparison to Merchant Banking.

Also, read – Investment Banking Vs. Commercial Banking