Investment banks and commercial banks are very different entities; the difference is wide and expands to the scope of work, type of customers, target markets, and regulations. However, because both the entities come under one area, “BANKS,” most people get confused between them. In today’s article, we will try to list the differences between investment banks vs. commercial banks and explain them in detail:

Difference between Investment Banking and Commercial Banking

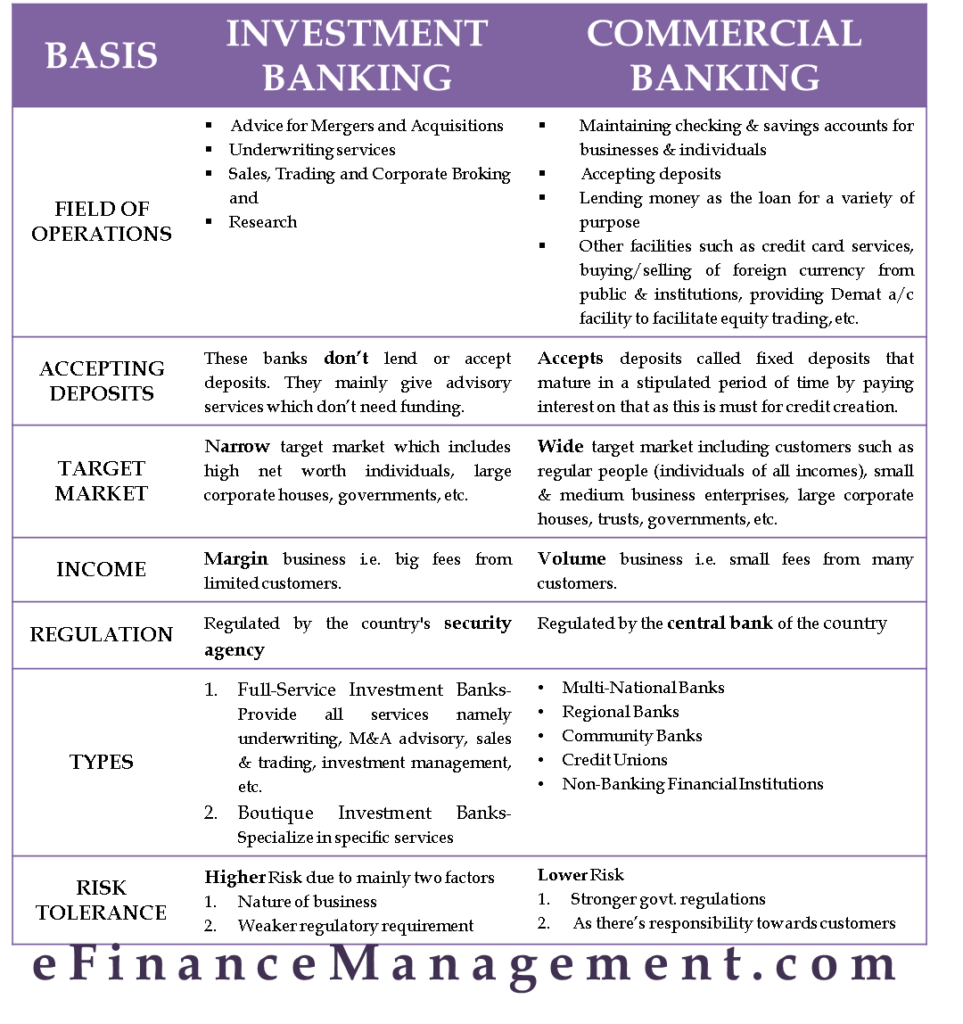

THe following are the various differences between investment and commercial banking:

Field of Operations

The first, foremost, and the major difference that can tell an investment bank and a commercial bank apart is its field of operations.

The chief operations of commercial banks include–

- Maintaining checking and savings accounts for businesses and individuals

- Accepting deposits

- Lending money as a loan for a variety of purposes such as business, buying a new car or house, or personal expenses

They also provide other ancillary services such as credit card services, buying and selling of foreign currency from public and institutions, providing Demat account facility to facilitate equity trading, etc.

Whereas the chief operation of investment banks is to provide services to big corporate houses and governments in the area of:

- Advice for Mergers and Acquisitions

- Underwriting services

- Sales, Trading, and Corporate Broking and

- Research

Accepting Deposits

Another major difference between a commercial bank and an investment bank is that a commercial bank accepts deposits. These deposits are known as fixed deposits that mature in a stipulated period of time, and commercial banks have to pay interest on these deposits. These deposits are necessary for commercial banks to fund their lending business and in process of credit creation.

Investment banks do not accept deposits as they don’t need these. Investment banks are not in the business of lending. They mainly give advisory services, so they don’t need such funding.

Also Read: Types of Investment Banks

Target Market

The target markets of both commercial banks and investment banks are completely different.

While commercial banks have a very wide target market, and their customers include regular people (individuals of all incomes), small & medium business enterprises, large corporate houses, trusts, governments, etc. They may provide different types of services to different entities, but they cover all under one umbrella of the commercial bank customer base.

On the other hand, investment banks only tend to large entities. These entities may include high net worth individuals, large corporate houses, governments, etc. This is mainly because the services provided by investment banks are limited and useful to a minute segment of the market. For example, a plumber making USD 50,000.00 an annum will never need any of the investment banking services.

Furthermore, the size of the customer base is also different for both commercial banks and investment banks. Commercial banks have a large number of customers, numbers ranging from a few hundred thousand to millions depending on the size of the bank. Conversely, investment banks have very few customers; the number most likely is a few hundred.

Income Structure

The fee structure of a commercial bank and an investment bank is completely different.

A commercial bank usually charges interest and/or fixed charges on its services. For example, a commercial bank charges 10% interest per year on a loan of USD 100,000.00. That makes its income USD 10,000.00 per year on that particular loan. Commercial banks give out hundreds, maybe thousands of such loans every year to build a substantial income.

In contrast, investment banks work on a commission basis. For example, an investment bank charges a 1% commission to advise on a merger deal worth USD 100 million. Their commission income on this deal alone is USD 1 million.

Therefore by business principle, the philosophy of commercial banks is volume business, i.e., small fees from many customers. In contrast, the philosophy of investment banks is margin business, i.e., big fees from limited customers.

Regulations

Commercial banks and investment banks come under different covers of governance and regulations. Usually, commercial banks are regulated by the central bank of the country; on the other hand; investment banks are regulated by the country’s security agency. For example, commercial banks in the USA are regulated by a variety of federal authorities such as the Federal Reserve & the Federal Deposit Insurance Corporation (FIDC); however, U.S. Securities and Exchange Commission (SEC) governs and regulates the investment banks.

Sometimes an investment bank is a division of a commercial bank. For example, Bank of America Merrill Lynch has both a commercial bank division and an investment bank division. In such cases, each division has to work according to applicable regulations. It is important to note that if a bank has both commercial and investment divisions, it is actually profitable for them.

Types

Commercial banks have many sub-types, some of which are –

- Multi-National Banks

- Regional Banks

- Community Banks

- Credit Unions

- Non-Banking Financial Institutions

These institutions may or may not be known as commercial banks, but they are all a type of commercial bank conducting their operations of accepting deposits and lending. They also come under the same federal regulations.

Investment banks are only two types –

- Full-Service Investment Banks – These banks provide all the services of an investment bank, namely underwriting, M&A advisory, sales and trading, and investment management. Some such banks are – Goldman Sachs, JP Morgan Chase, Barclays, etc.

- Boutique Investment Banks – These banks specialize in specific services such as investment management for a particular sector or underwriting for a particular city. Examples of such banks are Miller Buckfire & Co., Capstone Partners, Montgomery & Co., etc.

Risk Tolerance

The business model of an investment bank carries a high intrinsic risk compared to a commercial bank. It is mainly because of two things – first, the nature of the business of an investment bank, and second is, the weaker regulatory requirement.

Comparatively, commercial banks have much lower risk exposure. The strong government regulations that the commercial banks must adhere to make them less prone to risk. Furthermore, the nature of the work of a commercial bank implicitly involves responsibility towards its customers, especially those who have trusted the bank with their hard-earned money. Thus commercial banks tend to avoid risk. In contrast, investment banks are paid to create value for their customers by taking high risks.

Also, read – Merchant Banking Vs. Investment Banking.