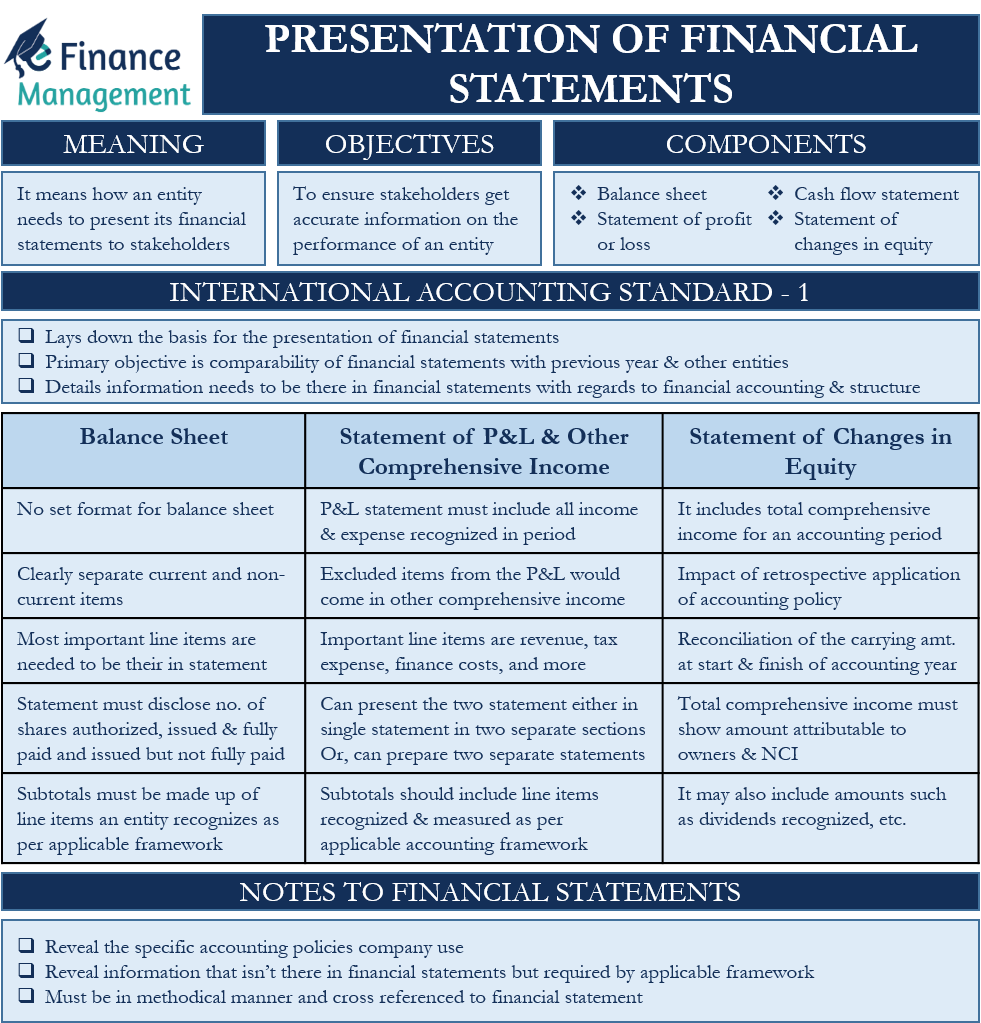

Every entity needs to prepare and present its financial statements for the accounting year adopted by it. Presentation of financial statements means how an entity needs to present its financial statements to the stakeholders. The IAS 1 (International Accounting Standard) deals with this topic and lays down overall requirements for the financial statements.

International Accounting Standard-1

Basically, IAS 1 lays down the basis for the presentation of financial statements. Its primary objective is to make sure the financial statements of a company are comparable with the previous years, as well as with other entities. IAS 1 details what all would be considered as financial statements, what all information needs to be there with regard to the basic accounting concepts as well as the structure of the financial statements.

Over the years, several amendments have been made to the IAS 1. The latest amendment was made in July 2020. And it was related to the Classification of Liabilities as Current or Non-current.

Presentation of Financial Statements: Objective

The objective of the presentation of financial statements is multifold. It is to provide

- cacurate information

- in a proper and transparent manner

- to the various stakeholders-management, regulatory authorities, investors, lenders, creditors, and so on.

- so that these stakeholders can get necessary information about the entity with regard to – its operational performance, earning potential, financial strength,

- and compare its performance with similar entities.

To achieve such an objective, these statements need to offer details on the various items. And these are assets, liabilities, equity, income and expenses, cash flows, and contribution as well as distribution of owners.

Also Read: Types of Financial Statements

Presentation of Financial Statements: Components

Generally, the following statements together are considered the annual financial statements and the company needs to prepare and present these. These are:

- Income Statement or Statement of Profit & Loss;

- Balance Sheet ;

- Cash Flow Statement; and

- Statement of changes in equity.

A company is free to use any title for its financial statements other than those stated in the IAS 1.

Beyond these statements, an entity can provide environmental reports, value-added statements, and financial reviews by management. These reports, however, are not part of the presentation of financial statements.

A company needs to prepare its financial statements at least annually. In case of a change in the annual reporting period, a company needs to reveal the reason for a change and other disclosures when presenting its financial statements.

Balance Sheet

There is no set format from IAS 1 for preparing the balance sheet. For example, a net asset presentation (assets less liabilities) is acceptable as well. But it is important that whatever format an entity follows, it should be consistent be with the past years.

Classification

Every entity must make a clear and categorical classification between the current and non-current assets and liabilities in its balance sheet. An entity may get an exemption from splitting the current and non-current assets and liabilities if the arrangement made based on liquidity is trustworthy.

Also Read: Accounting Information

Line Items

Some of the most important line items that need to be there in the balance sheet are property, plant, and equipment; financial assets; intangible assets; inventories; trade and other receivables; cash and cash equivalents, and more.

Classification of Line Items

An entity is free to add more line items and headings if there is a need for them to accurately present the financial position of the entity. Moreover, an entity may further sub-classify a line item in the statement itself, or detail in the notes.

Subtotals

In the case of subtotals, these must be made up of line items of the amount that an entity recognizes as per the applicable framework. Also, an entity must present and label these subtotals in an easy-to-understand and reasonable manner. These subtotals must be consistent with earlier years. And, a company must not display them more boldly than other subtotals and totals.

Shares Capital and Reserve

With regards to the issued share capital and reserves, there are a few disclosures that an entity needs to make in the balance sheet. The statement of position should clearly and separately show the authorized share capital and number of shares, issued and fully paid-up share capital, and the number of shares. And similarly details of partly paid-up shares – value and quantum. It should also include a reconciliation of the number of shares that were outstanding at the start and at the end of the period. It should also list treasury shares, shares by subsidiaries, and associates. With this, it should also list shares that an entity holds for issuance under options and contracts. Moreover, an entity needs to describe the nature and use of every reserve.

Statement of Profit or Loss and Other Comprehensive Income

Recognition of Income and Expenses

The profit and loss statement must include all the income and expense items that an entity recognizes in a period. It is possible that an applicable standard may allow some items to be excluded from the profit or loss. Rather, such items would come in other comprehensive income. For instance, changes in revaluation surplus may not come in profit or loss. However, it has to come under the other comprehensive income part. Moreover, any impact due to a change in accounting policies must not be taken to the profit or loss account for the current period.

Presentation

An entity has two choices concerning presenting the profit or loss and other comprehensive income. These are:

- The first option is to prepare a single statement consisting of and combining the profit and loss and other comprehensive income. In this case, however, an entity needs to present profit or loss and other comprehensive income in two separate sections.

- The second option is to prepare two separate statements – the profit or loss statement and the statement of comprehensive income. As a sequence the profit and loss statement should be followed by the other comprehensive statement.

Important Line Items

A company needs to include various important line items in its profit and loss statement or in the statement of profit or loss. These are revenue, tax expense, finance costs, and more.

Recognition of Expenses by Nature and Functions

Moreover, an entity can recognize the expenses in profit or loss either by nature or by function. In case an entity recognizes based on function, then it needs to reveal more information on the nature of expenses. In the other comprehensive income section (or statement), an entity needs to show the line items based on their nature.

Subtotals

The subtotals (in the profit or loss and other comprehensive income) should include the line items that represent amounts recognized and measured as per the applicable accounting framework. Moreover, these subtotals must be clearly labeled so that they are easily understandable. Other presentation requirements of subtotals are the same as discussed in the balance sheet.

Disclosable Items

There are a few items that an entity needs to disclose separately, either in other comprehensive income statements or in the notes. These are disposals of investments, litigation settlements, disposals of assets (property, plant, and equipment), and more.

Statement of Changes in Equity

This is also part of the annual financial statement presentation and this should include the following items:

- Opening and Closing balances of equity capital and the changes that took place during the year.

- It will also include the quantum of profit or loss earned and booked by the company. There should be a classification of income between owners and others, if some amount of income is attributable to non-controlling interests.

- It also shows the details of the dividends and divident per share. And the same is a deduction from the addition of profits during the year.

- The impact, if any, of a retrospective application of accounting policy.

- Any impace due to any revaluation exercise and creation of any revaluation reserve.

Presentation of Financial Statements: Notes to Financial Statements

Usually, the accounting notes should carry the basic details regarding the preparation of the financial statements. They must also reveal the specific accounting policies that a company uses.

Moreover, these notes should also reveal information that is not there in the financial statements but the applicable framework requires the company to do so. Also, the notes should reveal any other information that financial statements do not reveal like management discussion and analysis. But it is important to get the accurate financial position of the company.

A company must methodically give these notes. Not only does it need to be in sequential order but should have a proper cross-reference to the applicable line items in the respective financial statements.

Apart from the notes, a company also needs to disclose the summary of vital accounting policies. The company needs to disclose any judgment it made while applying the accounting policies and that judgment had a material impact on the financial statements.