Managing business debts and liabilities means taking care of the money that a business owes to others. Just like how you have to manage your own money and make sure you pay back any money you borrow, businesses also have to do the same. Keeping your finances in order is like organizing your backpack before going to school. Just like you need to make sure you have all your books, pens, and other supplies in the right places, a business needs to keep track of its debts and liabilities to be successful. It’s an important task that helps the business run smoothly and effectively. Debt is money you owe to different places, like banks or suppliers. If you don’t handle it well, it can cause big problems for a company’s money situation and progress. But if a company uses good plans, it can handle its debt and decrease what they owe.

In this guide, We will explore effective strategies for managing business debts and liabilities. These strategies encompass various aspects, including budgeting, prioritization of debts, negotiation with creditors, consolidation of debts, and optimizing cash flow. We will also talk about how important it is to spend less money and make more money. It’s a smart idea to ask experts for help and keep an eye on your finances. Doing these things can help businesses fix their money issues, and reduce their chances of problems. It’s like asking a teacher for help with a difficult subject, and regularly checking your grades.

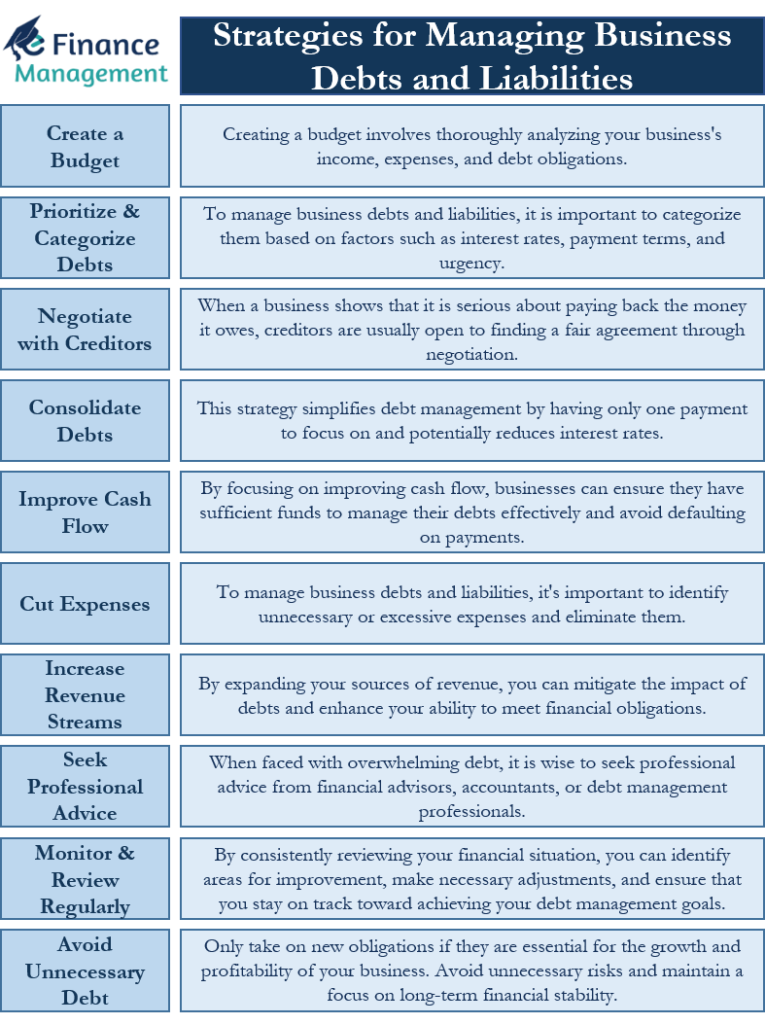

Strategies for Managing Business Debts and Liabilities

Here are some strategies to effectively manage business debts and liabilities:

Create a Budget

Creating a budget involves thoroughly analyzing your business’s income, expenses, and debt obligations. By tracking and documenting these financial aspects, you gain a clear understanding of your financial standing, enabling you to make well-informed decisions and allocate resources effectively.

Prioritize and Categorize Debts

To manage business debts and liabilities, it is important to categorize them based on factors such as interest rates, payment terms, and urgency. This categorization helps you prioritize the debts that require immediate attention, such as those with high-interest rates or strict repayment terms, ensuring that you address them promptly to avoid penalties or further financial strain.

Also Read: Debt vs Liabilities – All You Need to Know

Negotiate with Creditors

When facing difficulties in meeting debt obligations, proactive communication with creditors is crucial. By engaging in open and honest discussions, you can explore options for restructuring payment terms, reducing interest rates, or potentially settling the debt for a lump sum. Creditors are people or businesses that lend money or extend credit to other businesses. When a business shows that it is serious about paying back the money it owes, creditors are usually open to finding a fair agreement through negotiation. This means that both the business and the creditors can benefit from working together and coming to an agreement that is good for both sides.

Consolidate Debts

Imagine you owe money to different people or places. Debt consolidation is like bringing all those debts together into one big loan or credit that you need to pay off. This strategy simplifies debt management by having only one payment to focus on and potentially reduces interest rates. Consolidation can streamline your finances, making it easier to manage debt obligations and allowing you to allocate resources more efficiently.

Improve Cash Flow

Cash flow is vital for meeting debt obligations. In order to make sure they have enough money coming in, businesses can do a few different things. For example, they might give customers a discount if they pay their bills early. They could also talk to the people they buy things from and try to get more time to pay them back. Lastly, they could look for ways to sell more things and make more money. By focusing on improving cash flow, businesses can ensure they have sufficient funds to manage their debts effectively and avoid defaulting on payments.

Cut Expenses

To manage business debts and liabilities, it’s important to identify unnecessary or excessive expenses and eliminate them. Evaluate all the money you spend on things like subscriptions, office supplies, and utilities. Look for ways to spend less without making your products or services worse. Then, use the money you saved to pay off your debts faster.

Increase Revenue Streams

Finding different ways to make money is an important way to improve your financial situation. This could mean trying out new products or services, selling things in new areas, or teaming up with other people or companies. It’s like having multiple sources of water to help your garden grow – the more sources you have, the healthier your garden will be. By expanding your sources of revenue, you can mitigate the impact of debts and enhance your ability to meet financial obligations.

Seek Professional Advice

When you have a lot of money you owe to other people, it’s a good idea to get help from professionals who know about money stuff. These experts can give you advice that fits your own situation. They can assist in negotiating with creditors, developing a customized plan, and offering strategies to effectively manage your debts and liabilities.

Monitor and Review Regularly

Regular monitoring and review of your finances, debt obligations, and progress toward debt reduction are essential. Keep a close eye on your budget, cash flow, and debt repayment strategies. By consistently reviewing your financial situation, you can identify areas for improvement, make necessary adjustments, and ensure that you stay on track toward achieving your debt management goals.

Avoid Taking on Unnecessary Debt

To effectively manage debts and liabilities, exercise caution when considering new debts. Only take on new obligations if they are essential for the growth and profitability of your business. Practice prudent financial management by carefully evaluating the risks and benefits. Avoid unnecessary risks and maintain a focus on long-term financial stability.

Conclusion

It is very important for a company to handle its debts and other financial obligations properly in order to stay financially healthy and keep growing. Just like how managing our personal debts helps us stay out of trouble and build a better future. The strategies discussed in this guide provide a roadmap for businesses to navigate their debt obligations and work towards reducing liabilities.

By creating a comprehensive budget, prioritizing and categorizing debts, and negotiating with creditors, businesses can gain control over their financial situation and explore opportunities for debt restructuring or settlement. When you have debt, it can get confusing to keep track of all the different payments you have to make. Debt consolidation is like putting all of your debts together in one place, so you only have to make one payment each month. This can help make things easier to manage. It can also potentially lower the amount of money you have to pay in interest, which is like a fee for borrowing money. Consolidating your debt can also help you have enough money to pay off your debts on time, which is important so you don’t get into more trouble.

Cutting unnecessary expenses and diversifying revenue streams help create a healthier financial foundation. Seeking professional advice when overwhelmed by debt provides valuable guidance and expertise. When businesses regularly check and evaluate their financial progress, they can find ways to get better and make the changes they need. It’s like looking at a report card for your money and figuring out how to do even better.

Ultimately, by practicing prudent financial management, avoiding unnecessary risks, and prioritizing long-term financial stability, businesses can effectively manage their debts and liabilities. By implementing these strategies, businesses can reduce financial stress, regain control of their finances, and set themselves on a path toward sustainable growth and success.

Frequently Asked Questions (FAQs)

Effective management of debts and liabilities is crucial for maintaining financial stability and ensuring the long-term growth and success of a business. Failure to manage debts can lead to financial strain, missed payments, penalties, and even bankruptcy.

When you owe money, it’s important to decide which debts to pay off first. Think about things like how much interest you’re being charged when the payments are due, and if there’s a rush to pay them back. It’s smart to focus on debts with high-interest rates and strict repayment rules so you don’t end up paying more in fees or penalties.

Yes, it is advisable to proactively communicate with creditors. You can discuss options such as debt restructuring, reduced interest rates, or settling for a lump-sum payment. Many creditors are willing to work with businesses to find mutually beneficial solutions.

If you have a lot of debt and it feels like a big problem, it’s a good idea to talk to people who know about money. They can help you figure out what to do, talk to the people you owe money to, and make a plan to handle your debts in a way that works for you.

When you borrow money, be careful and think twice. Only invest in something if it will genuinely help your business to become bigger and earn more money. It’s like spending money on advertising that brings in more customers and increases your sales, rather than wasting money on unnecessary things that won’t benefit your business. It’s like buying a car: only do it if you really need it and can afford it, otherwise, it could put you in a tough spot.

While these strategies primarily focus on managing business debts, many of the principles can be applied to personal debt management. However, it is important to consult with professionals who specialize in personal finance for tailored advice.