The fund flow statement and the balance sheet are two important financial statements that provide valuable insights into the financial health and performance of a company. While both statements serve different purposes, they complement each other by offering distinct perspectives on a company’s financial position. In this introduction, we will explore the key differences between the fund flow statement and the balance sheet.

The balance sheet is like a photo of a company’s financial situation at one particular moment. The balance sheet is like a report card for a company. It shows what the company has (assets), what it owes to others (liabilities), and how much is left over for the owners (shareholders’ equity). It’s like when you have money in your piggy bank (assets), but you also owe some of it to your friend (liabilities), and whatever is left is truly yours (equity). It reflects the company’s financial position by detailing the value of its resources and the claims against those resources.

Think of a company like a pizza shop.

- Assets are all the things the pizza shop owns, like the oven, the cash in the register, and the ingredients for making pizza.

- Liabilities are the things the pizza shop owes to others, like money borrowed from the bank or a loan to buy a new delivery car.

- Shareholders’ equity is like the ownership of the pizza shop. It represents the value of the pizza shop that belongs to the owners or shareholders.

Just like a pizza shop, a company also has these three main parts: stuff it owns (assets), debts it owes (liabilities), and what’s left over for the owners (shareholders’ equity).

The fund flow statement focuses on analyzing the movement of funds within a company over a specific period. Unlike the balance sheet, the fund flow statement provides a dynamic view of a company’s financial activities. It highlights the sources and uses of funds. It helps stakeholders understand how a company generates and deploys its current assets and current liabilities.

Also Read: Fund Flow Statement

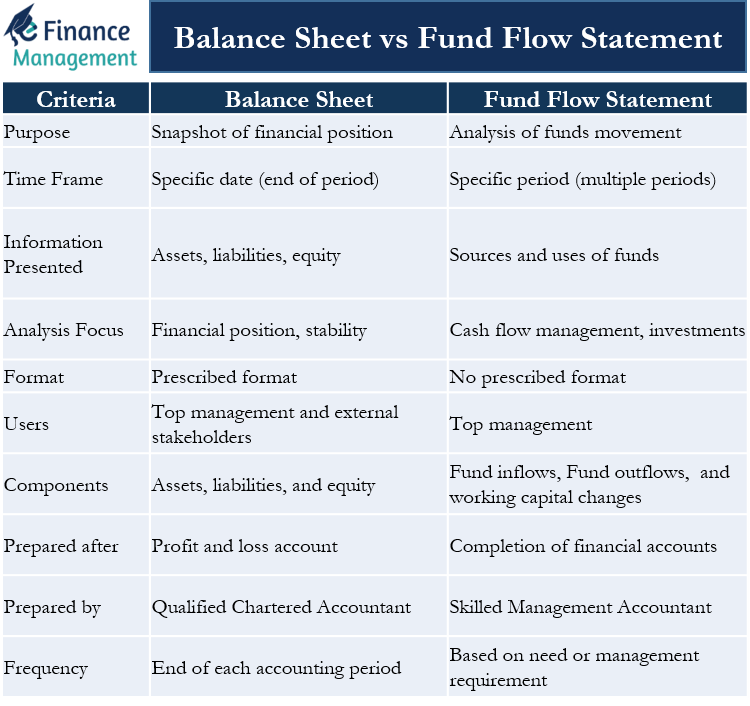

Fund Flow Statement vs Balance Sheet

The fund flow statement and the balance sheet are two distinct financial statements that serve different purposes and provide unique insights into a company’s financial position. Let’s explore the key differences between these two statements:

Purpose

- Balance Sheet: A balance sheet is like a picture that shows how much a company has assets, liabilities, and equity at one particular moment. It tells you if a company has more assets (like cash, buildings, or equipment) or more liabilities (like debts or loans).

- Fund flow Statement: The fund flow statement focuses on analyzing the movement of funds within a company over a specific period.

Time Frame

- Balance Sheet: The balance sheet represents the financial position of a company at a particular date, typically the end of an accounting period (e.g., quarterly or annually).

- Fund flow Statement: The fund flow statement covers a specific period, usually spanning multiple accounting periods, and highlights the changes in financial position during that time.

Information Presented

- Balance Sheet: The balance sheet provides a detailed breakdown of a company’s assets, liabilities, and shareholders’ equity. It showcases the value of the company’s resources, as well as its obligations, and equity.

- Fund flow Statement: The fund flow statement presents information on the sources and uses of funds. It highlights the inflows (sources) and outflows (uses) of operating funds. It focuses on changes in working capital, capital expenditures, and financing activities like issuing debt or equity.

Analysis Focus

- Balance Sheet: The balance sheet emphasizes the company’s financial position, liquidity, and solvency. This means that it helps people involved with the company get an idea of whether the company can pay its debts in the short and long term. It also gives them information about how secure the company’s finances are overall.

- Fund flow Statement: The fund flow statement is like tracking the movement of money, specifically looking at how cash is managed and deciding where to invest it. It’s kind of like keeping track of where your allowance goes and deciding how to spend or save it. It helps stakeholders understand how cash is generated and utilized within the company, providing insights into its cash flow patterns and liquidity management.

Format

- Balance Sheet: It is presented in a prescribed format, with assets on one side and liabilities and equity on the other side.

- Fund flow Statement: There is no specific way you have to do it. It’s like having a free choice on how to write or organize something without any strict rules.

Users

- Balance Sheet: It is used by the top management, as well as external stakeholders.

- Fund flow Statement: It is used by the top management.

Components

- Balance Sheet: It consists of assets, liabilities, and shareholders’ equity.

- Fund flow Statement: It includes fund inflows, fund outflows, and changes in working capital.

Prepared after

- Balance Sheet: It is typically prepared shortly after the completion of the profit and loss account.

- Fund flow Statement: The fund flow statement is prepared once the financial accounts have been finalized and completed.

Prepared by

- Balance Sheet: The balance sheet is prepared by a qualified Chartered Accountant.

- Fund flow Statement: The fund flow statement is prepared by a skilled Management Accountant.

Frequency

- Balance Sheet: The balance sheet is a document that shows a summary of a company’s financial situation at the end of a certain time period, like every three months or every year. It’s like a report card for a company’s finances.

- Fund flow Statement: The fund flow statement is prepared whenever there is a need or requirement from the top management to analyze and assess the movement of funds within the company. It may be prepared periodically or on an ad hoc basis as deemed necessary.

Conclusion

The balance sheet is like taking a picture of a company’s finances at a certain moment. The fund flow statement shows how money moves in and out over a period of time. The balance sheet is like a financial report card for a company. It tells us what the company owns (like money, assets, or properties), what it owes (like debts or loans), and how much money its owners have put into the company. It’s a way to see a snapshot of the company’s financial health at a certain time. The fund flow statement looks at where the money comes from and how it is used for the company’s daily operations. Both statements help us understand a company’s financial situation, but they focus on different aspects and are used for different purposes in analyzing and evaluating a company.

Frequently Asked Questions (FAQs)

It doesn’t consider other parameters that are part of the Balance Sheet and Profit and Loss Account. Therefore, it has to be analyzed alongside the Balance Sheet and Profit and Loss Account

Balance Sheet provides a snapshot of an organization’s financial position at a specific point in time. On the other hand, the fund flow statement captures changes in this position over a period.