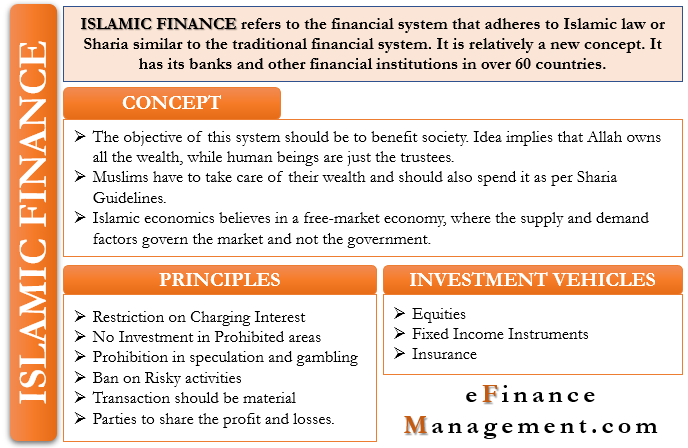

Islamic Finance refers to the financial system that adheres to Islamic law or Sharia. Similar to the traditional financial system, this economic system also has banks, insurance firms, investment companies, capital markets, and fund managers. In terms of rules, along with Islamic law, a few rules that apply to the traditional financial system also apply to Islamic finance.

Islamic Finance – History

You will be surprised to know that Islamic finance was almost non-existent some 30 years back. Even though the industry is relatively new, the Islamic theories of economics have been in existence since the mid-12th century.

Now it is a more than $2 trillion industry, which has its banks and other financial institutions in over 60 countries. As one can expect, Islamic banks are the most significant participants in the Islamic finance industry.

Though Islamic finance accounts for a minute share of the global financial assets, it is growing fast. In several regions, such as Gulf or Sub-Saharan Africa, Western banks and Islamic banks are in direct competition to get Muslim clients.

Concept

Balance is the core concept of the Islamic financial system. This concept underlines that the objective of this system should be to benefit society. Further, the idea implies that Allah owns all the wealth, while human beings are just the trustees.

Humans have to take care of this wealth as per Allah’s commands, promoting justice. Further, Islamic economics suggests that Muslims are free to enjoy their wealth. They need to spend it as per the Sharia guidelines.

Islamic economics believes in a free-market economy, where supply and demand factors govern the market, not the government. However, it does shape the market functions by imposing a few rules and ethics. These laws and ethics help to ensure social justice or balance.

Islamic finance uses the following ways to achieve social justice:

- Adherence to Islam.

- Taxing the rich and using the tax to help those in need (zakat).

- They are laying down the responsibilities of the state.

- They Bar usury or interest.

- Encourage collective risk.

Principles

Islamic financial institutions follow a set of principles to ensure they remain committed to the objectives. These principles also differentiate Islamic institutions from conventional institutions. Following are the principles:

Also Read: Advantages and Disadvantages of Bank Loans

Charging Interest

Islam strictly prohibits the charging of interest. Under Sharia law, interest is usury (riba). Islam believes that interest payments favor the lenders at the expense of the borrowers. Thus, it prohibits lenders and borrowers from charging and paying interest. Banks that are Sharia-compliant don’t give interest-based loans.

No Investment in Prohibited Activities

Islam completely disallows some activities, including dealing with alcohol or pork. As per Islam, these activities are haram (meaning forbidden). Thus, Islam does not allow investing in such activities.

Prohibition of Speculation/Gambling (maisir)

Sharia prohibits speculation or gambling in any form. Thus, Islamic financial institutions also do not participate in any activity that depends on a future uncertain event.

Uncertainty and risk (gharar)

Islam bans indulging in activities that carry too much risk and uncertainty, such as derivative contracts and short-selling.

Apart from the above prohibitions, Islamic finance follows two more principles:

Materiality of Transaction

It means that every transaction by Islamic financial institutions must relate to a real underlying economic deal.

Profit/loss Sharing

Under Islamic economics, one party can’t gain from a transaction more than the other party. It means that parties share the profit, loss, or risk in a deal.

Investment Vehicles

Sharia prohibits many traditional investment options in Islamic Finance, such as bonds, opportunities, and derivatives. Thus, there are mainly two types of investment options in Islamic Finance:

Equities

Islamic finance approves investing in the shares, as well as private equity investments. However, those firms must not deal with activities that Islamic law bans, such as gambling, alcohol, pork, and lending at interest.

Fixed-income Instruments

As Sharia prohibits interest payments, there are no conventional bonds in the Islamic system. Instead, they use Sukuk or “Sharia-compliant bonds,” which are not debt obligations but represent partial ownership.

Insurance

Islamic law does not allow traditional insurance as it means dealing with an uncertain outcome. Thus, insurers use a type of cooperative (mutual) insurance. Under this, subscribers contribute money to a pool of funds, which the insurance company invests as per Sharia principles. Companies meet the claims from these funds, while policyholder shares the profit.

How do Islamic Banks Survive?

A question that naturally arises is if the Islamic banks don’t charge interest, then how do they survive. Such banks use the deposit money to buy assets. They then lease or re-sell (Ijara), usually higher than the initial market value. The underlying concept is that rather than profiting from the interest, these banks use the customers’ money to buy the assets.

Rather than giving loans, these banks buy assets on behalf of the clients. They then lease it to the same client. The ownership rests with the bank. After the end of the lease period, the customer gets ownership of the property.

Also, Islamic banks don’t charge interest when investing in a business. Instead, they go for profit sharing (Mudarabah).

Is Islamic Finance Crisis Proof?

Yes, Sharia-compliant institutions can survive the crisis. Since these institutions do not engage in speculation, they do not deal with derivative instruments such as futures or options. Instead, they deal with the real economy. It helped the Islamic banks to survive the 2008 financial crisis as they didn’t have exposure to toxic assets. A 2010 IMF (International Monetary Fund) report made a similar conclusion as well.

“Adherence to Shariah principles—which precluded Islamic banks from financing or investing in the kind of instruments that have adversely affected their conventional competitors—helped contain the impact of the crisis on Islamic banks,” the report said.

Final Words

Despite being centuries old, Islamic Finance is growing its presence globally. It is even attracting many outside of the Muslim community. Given its growing acceptance and ethical and economic principles, we expect this financial system to gain more acceptance and emerge as a formidable component to the conventional players.