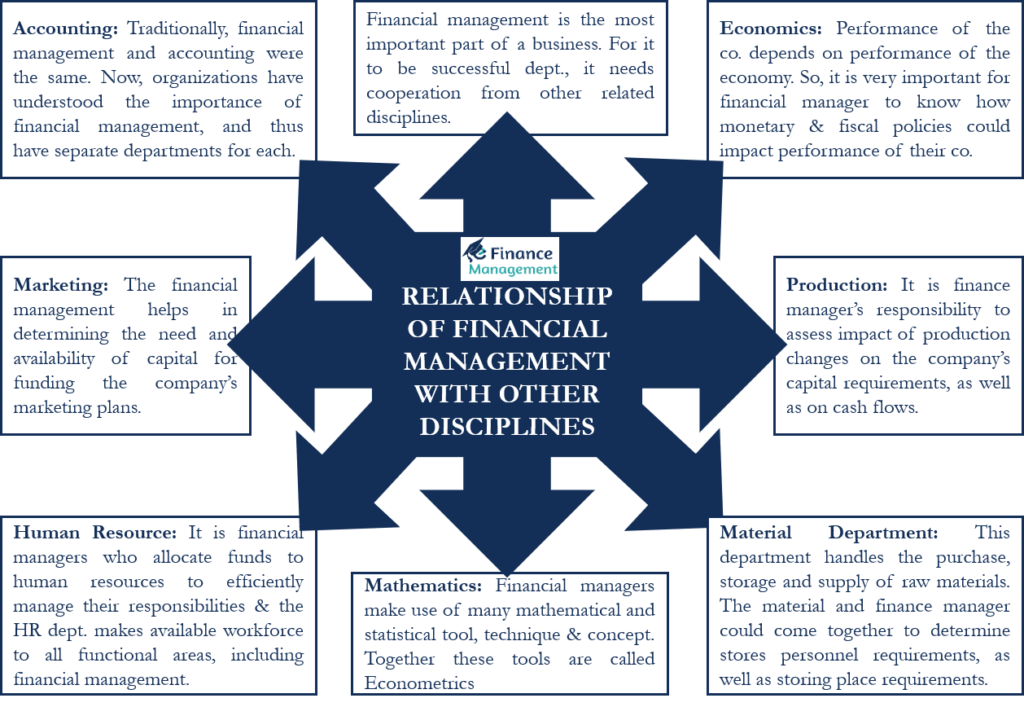

Financial management is one of the most important parts of any business. However, this area is not totally independent. Rather, it depends on or has a connection with other related disciplines, such as accounting, economics, and more. In other words, we can say that for financial management to be successful, it needs cooperation from other related disciplines or functional areas or departments. And, other departments need financial management support for their smooth functioning as well. In this article, we will take a look at the relationship of financial management with other disciplines.

Relationship of Financial Management with Other Disciplines

Discussed below is the relationship of financial management with other disciplines:

Accounting

The responsibility of the financial managers is to manage the financial and real assets of the company. Since the accounting department keeps a tab on the value of these assets, financial managers regularly require their assistance to efficiently manage the assets or make financial decisions, such as allocating resources, deciding capital structure, managing working capital, and more.

Traditionally, financial management and accounting were the same, and usually, the latter was responsible for financial management as well. Now, organizations have understood the importance of financial management, and thus have separate departments for each.

Economics

In general, the performance of a company depends on the performance of the economy (both macro and micro). Thus, it is very important for financial managers to understand how monetary and fiscal policies could impact the performance of their company. Specifically, how the performance of the economy will impact the availability and cost of funds and assets.

Also Read: Functions of Financial Management

Similarly, financial managers also use microeconomics concepts to efficiently and successfully manage their work. For instance, financial managers use the marginal cost concept, discount value, economic order quantity, and more concepts when making capital budgeting decisions.

Marketing

One aspect of financial management is managing the cash flows of businesses, and this is what connects it with marketing. For instance, financial managers should determine the impact of promotion plans and new product development on the company’s future cash flows. Also, they need to determine the capital requirements to fund the company’s marketing plans.

Production

It is the responsibility of the financial managers to assess the impact of production changes on the company’s capital requirements, as well as on cash flows. Also, all decisions by the production department, such as replacing machinery, adding safety devices, and more, have financial implications.

Moreover, it is the finance department and finance managers that allocate funds for raw materials, workers’ wages, and other production items.

Human Resource

It is the human resources department that makes available the workforce to all functional areas, including financial management. So, this way, financial management is related to human resources. Also, it is the financial managers who allocate funds to human resources to efficiently manage their responsibilities.

Also Read: Types of Financial Decisions

Mathematics

Financial managers make use of many mathematical and statistical tools, techniques, and concepts. For instance, financial managers use discount factors, ratio analysis, and more. Together these mathematical and statistical tools, techniques, and concepts that financial managers use are called Econometrics.

Material Department

This department handles the purchase, storage, and supply of raw materials. The material and finance manager could come together to determine store personnel requirements, as well as storing place requirements.

Strategic Planning

Strategic planning and financial management are very closely related, or we can say that they go hand in hand. An organization needs financial planning to meet its strategic targets. Also, it is true that a company’s strategic objectives have an influence on the company’s financial planning. For instance, if a company’s strategic goal is to open three retail outlets by next year, it would require effective financial planning to do so. And, to ensure the company doesn’t fall short of funds for the retail outlets, financial managers may cut the budget of some departments.