What do we understand by Finance, Accounting and Economics?

Finance, accounting, and economics are three different yet interrelated and interdependent fields of study. We can use all three of them for personal, corporate as well as public, or government usage.

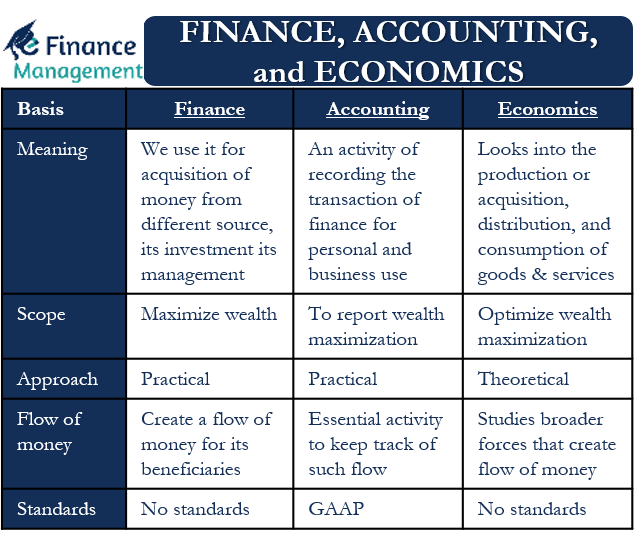

Finance is a term that we use for the arrangement of funds from different sources, their investment, and their management. The field of finance includes banking, credit, capital and money markets, and investment management. There are financial systems in place to overlook the activities of finance. Finance helps us to understand and manage the rates of return on investments, time value of money, capital, and risk, etc.

Accounting is an activity of recording the above activities of finance for personal and business use. Accountants then prepare a summary of the data that they record, analyze, and report according to set formats for the use of businesses, government, and regulatory authorities.

Economics has a much broader scope than the above two fields of study. We divide it into microeconomics and macroeconomics. It oversees and identifies trends and triggers and the status of the economy in general and particularly for production, distribution, consumption of goods and services, and channelizing of resources. It aims to allocate and utilize the scarce economic resources available to us in the best possible manner so as to maximize returns or give maximum utility. Macroeconomics has a broader outlook and takes into account the monetary and fiscal policies of the government, national income and output, factors like inflation, unemployment, etc. Microeconomics has a narrower outlook and looks into the demand and supply aspects of individuals and businesses.

Also Read: Accounting Vs Finance

The Points of Differences-between Finance, Accounting, and Economics?

Let us discuss below to understand what could be the key points of variation and differences amongst these three streams of studies related to money flow and its utilization. These differences are:

Scope

The main goal of finance and financial activities is to maximize the wealth of all to whom we are talking about. And these could be individuals, businesses, corporations, Governments, etc. While accounting tries to record and report all monetary transactions in a systematic manner and as per the established principles. And later on, consolidate and compile the results and prepare a report with regard to all the wealth maximization activities of individuals and the government. On the other hand, economics aims to optimize wealth maximization activities to provide maximum utility and satisfaction.

Finance and accounting are subsets of economics in a way. Hence, economics has a much broader scope than the other two fields. The scope of finance and accounting is limited to the financial activities and services of individuals and corporations. But economics takes into account an entire economy along with individuals and businesses. Also, it looks beyond financial activities and studies non-financial parameters too, such as unemployment, productivity, inflation and deflation, scarcity, the role of incentives, etc., that affect the welfare of individuals. Economic activities and policies have a wider impact on all and are helpful in directing and guiding the activities that ultimately lead to greater satisfaction.

Approach

Finance and accounting have a practical approach. Both the streams of study are based on the “learning by doing” philosophy. There are multiple theories and models that act as a guide in both Finance and accounting. We apply these theories and models to real-life situations and analyze and evaluate the results. We source, manage and create more money with the help of finance and financial activities. Accounting helps us to keep records, track the movement of money and analyze the financial results. Finally, we take corrective steps and measures in case of need. The results act as guiding pillars for our future course of action.

Also Read: What is Accounting?

On the other hand, Economics has more of a theoretical approach. Economists engage in extensive research and give us many theories and models that help to explain the behavior of individuals and the economy as a whole. Economics is a study of choices that people make out of the scarce resources available. Economics does not base itself on the practical application of these models and theories. Instead, it theoretically explains what to expect on the occurrence of certain events, be it in the case of individuals, corporates, government, or the entire economy as a whole.

Flow of Money

Finance and allied services create a flow of money for its beneficiaries. It looks into the raising of funds for individuals and corporations from different sources such as banks and financial institutions, private lenders, etc. The financial services then deploy the funds into investments that generate returns.

Accounting is an essential activity to keep track and record of such flow of money. It records each and every point and transaction from which people get the funds. Then it tracks every route through which this money flows out or is spent.

Economics studies the broader forces that create the flow of money into the markets and business organizations. It looks into the parameters and policies that affect a country’s National Income and GDP from where money is generated. At the micro-level, it studies the demand and supply patterns that guide the flow of money in an economy.

Standards

GAAP or Generally Accepted Accounting Principles are standards that accounting follows and adheres to while preparing and reporting data. We have a FASB or Financial Accounting Standards Board that ensures the compliance of GAAP in businesses and government organizations. This helps to standardize the methods and practices that accountants use. Implementation of GAAP helps to make comparisons and exchanges between organizations easy and free of any ambiguities.

There are no set standards and processes that we need to follow in the case of finance and economics. Of course, there are certain broad rules and regulations for conducting financial activities within and outside the country, and they both need to be complied with by all the individuals and businesses. But these rules vary across the countries as they are specific and in accordance with a country’s government and the Central bank. Also, there are no standards that economists follow across the world, nor is there any monitoring agency to oversee their activities.

Decision-Making

The power to make decisions exists with individuals in the case of finance and accounting. Financial managers can decide where to source a loan from, where to invest the funds and when to pull out of an investment. Accountants can decide what inputs to use for preparing their reports and how to prepare them as per GAAP. And, of course, the analysis and interpretation of these reports depend upon the individual’s objective, experience, knowledge, understanding, and judgment. These decisions in both the streams are easy to take as well as it is possible to alter or change those decisions mostly in a short period of time in times of need.

Decision-making in the field of economics is mostly in the hands of the government or top legal bodies and institutions. An individual person or business can not affect the entire economy and the theories and models of economics. Also, once taken, these decisions are rigid and not easy to change instantly as they affect a large portion of the population or the entire economy as well as may have a longer-term effect.

Finance, Accounting, and Economics- Are They Totally Different from each other?

We have seen above a few of the differences between the three streams of study- finance, accounting, and economics. But we should remember that these three streams are not separate or totally independent from each other. All the three streams deal with money, be it at an individual’s level in the case of finance and accounting or at an individual as well as the nation’s level in the case of economics.

All three streams intend to work for the betterment of people. They guide us to create a strong and secure financial present and future. They work hand-in-hand and are interdependent in nature. Economics act as a super-set and impacts the decisions that people make in finance as well as accounting. Moreover, the decisions and acts of financial managers and accountants guide the movement of the economy in return.

RELATED POSTS

- Difference between Financial and Management Accounting

- What is the Relationship of Financial Management with Other Disciplines?

- Branches of Accounting

- Top 10 Essential Accounting Functions

- Management Accounting – Meaning, Definition, Tools, and Limitation

- Advantages and Disadvantages of Different Types of Accounting