Banking and Finance delve into the world of investments, credit, stocks, and money. This sector forms the backbone of any economy; it keeps the economy running. It chases the movement of money and has the institutions in place to manage it. The stronger this sector is, the more developed an economy will be. To say the least, this sector provides assets to businesses and individuals and promotes their growth. These best books on banking and finance cover this sector in great detail.

So, for you to make sense of this complex world with thousands of intermediaries, here are the best books on banking and finance. This list covers books that are not textbooks. We picked these books after reading hundreds of user reviews to make sure that the list presents the best of them available.

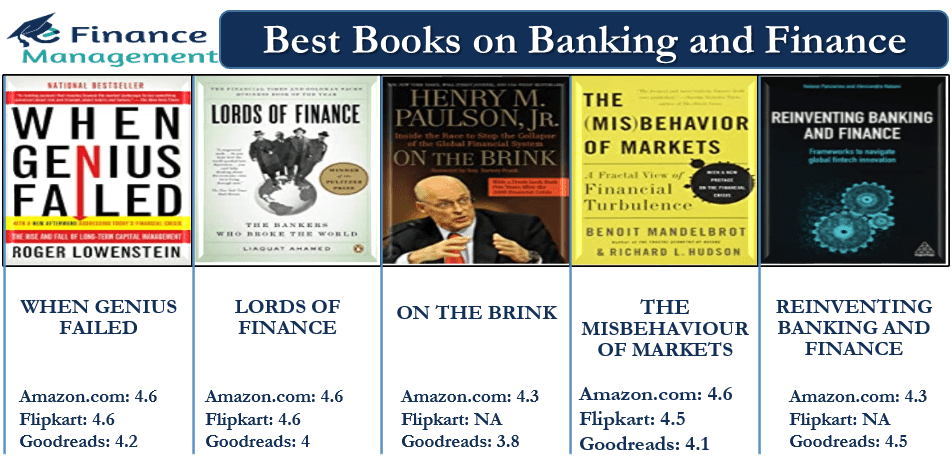

When Genius Failed: The Rise and Fall of Long-Term Capital Management

Author: Roger Lowenstein

This book is a very interesting tale of the toss of Long Term Capital Management (LTCM). Using the then cutting-edge technology of computer models, this firm found its way of making impressive amounts of profits. These profits, however, impressed the LTCM team much more than they should and fuelled arrogance. They failed to learn those basic lessons which every trader needs to. The result was the crash of the corporate burning billions of dollars. A consortium of investment banks come to the rescue of this bank, funding millions of dollars each. They came to the rescue of a private fund out of the fear that the fund’s crash will undermine the entire stock market with it.

This book is not about what happens. But it is a magnificent tale of why it happens and how it happens. You need a basic knowledge of finance to fully comprehend this book. For beginners, this book can be a bit difficult to follow.

Also Read: Best Books on Corporate Finance

Ratings On:

- Amazon.com: 4.6

- Flipkart: 4.6

- Goodreads: 4.2

Lords of Finance

Author: Liaquat Ahamed

This book is a tale of the Great Depression of the 1930s. Many believe that the great depression was a result of the turn of events that were beyond any one person or country’s control. But, the author Liaquat Ahamed argues otherwise. In this book, he tells us how the heads of the world’s four largest central banks: the US, Britain, Germany, and France, were responsible for the great depression. The author himself describes how problematic things had gotten for the West after the great war and how the heads of the central bank failed to work together and respond properly to the challenges.

This book also emphasizes how significant and consequential the decisions of central banks are. It makes us aware of the misery these decisions can cause when they are wrong.

Ratings On:

- Amazon.com: 4.6

- Flipkart: 4.6

- Goodreads: 4

On the Brink: Inside the Race to Stop the Collapse of the Global Financial System

Author: Henry Paulson

This book presents an interesting tale of the unfolding of the 2008 financial crisis. The author, Henry Paulson, was the US Treasury Secretary at that time. He presents the government’s side of the story and his role in saving the US banking system from collapsing down completely. This book becomes more engaging when you understand how critical each of the decisions was in the middle of the storm.

In telling the account of the crises, he gives his readers a very good understanding of how the financial markets work and the key role that confidence in the market plays.

Also Read: Best Books on Investment Banking

Since Paulson spent his life first as a businessman and then as a public servant, so, you cannot expect the same thrill in his storytelling of this book as you might in some others written by renowned authors.

Ratings On:

- Amazon.com: 4.3

- Flipkart: Not Available

- Goodreads: 3.8

The Misbehaviour of Markets

Author: Benoit B. Mandelbrot

Benoit B. Mandelbrot, one of the most prominent mathematicians of this time, tells us how the predominant way of thinking about the way markets behave does not work. He uses mathematical models to suggest a new and more precise way of looking at how the markets behave. The author shows how the existing models underestimate the risks of investing in security. He comes up with new methods to look at how risky an investment proposition is. He says that a well-behaving market is not the norm; it is a special case. Turbulence is the norm of the markets. He also admits the controversies surrounding his theories in the book. Sufficiently enough, he defends them.

In the end, the author rewards the readers with a very interesting concluding chapter. This concluding chapter shows all the practical applications of his theories.

This book does use some jargon. But it provides enough explanation of the difficult terms he uses for you to make sense of them. It has a bit of math but not too much for you to sleep. Also, he balances the match with anecdotes to make the book interesting—an integral part of the best books on banking and finance.

Ratings On:

- Amazon.com: 4.6

- Flipkart: 4.5

- Goodreads: 4.1

Reinventing Banking and Finance

Author: Alessandro Hatami and Helene Panzarino

This book by authors Alessandro Hatami and Helene Panzarino will take you through the history of banking when the first of the banks came into existence. It discusses how the banking system that we see today evolved and developed. How the new technologies have shaped it and how the future of banking in this digital world will shape. It also talks about the latent opportunities in the financial industry today. The authors present how banks and financial institutions all over the world are facing the compelling need to innovate their product and service offerings in order to remain alive in the industry in the face of the threats of much smaller but agile fintech companies.

Readers will also get exposure to the global banking system of today, the innovative technologies, the business models, and the distribution channels. Also, the authors do all this work in a simple and jargon-free style. Hence, this book is for anybody regardless of his background and knowledge of the banking and finance industry.

Ratings On:

- Amazon.com: 4.3

- Flipkart: Not Available

- Goodreads: 4.5