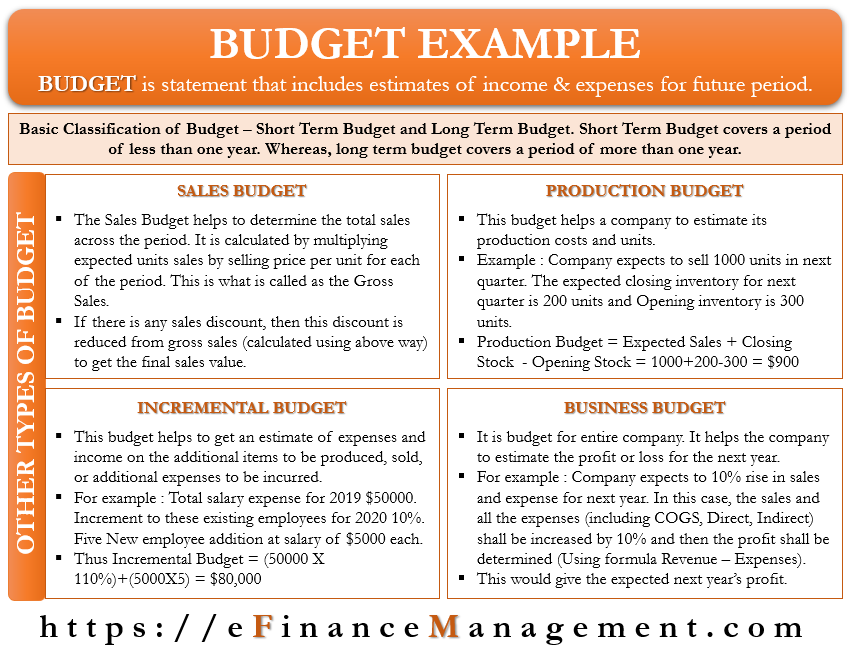

The budget is a statement that includes estimates of income and expenses for a future period. Or, we can also say it is a tool that management uses to estimate its revenue and overheads for the next financial year in line with the company’s objectives. This article will discuss the budget example to get an idea of the types of budgets and how they work.

Types of Budget

Based on duration, there are two types of budget – a short-term budget and a long-term budget. We can then further classify short and long-term budgets into a specific project, department-wise budget, company-specific budget, process budget, etc.

Short-term Budget

Such a budget usually covers one year or less. In this, the company prepares the estimate at the start. At the end of the period, it evaluates the results to see if there is any variance or not.

Long-term Budget

Such budgets usually cover more than a year. They are so generally because it gets challenging to estimate for future years. Thus, such budgets focus on significant investments and broad company goals.

Also Read: Budgeting Examples

We can further divide short and long-term budgets into activity-specific budgets. For instance, a sales budget tracks the sales growth, and the cash budget tracks the inflow and outflow of cash. Most budgets are short-term budgets, i.e., covering less than a year in the real world. In this article, we will include examples of short-term budgets.

Budget Example

Following are some of the most used budgets:

Sales Budget

Let’s take a sales budget example to understand it better.

Suppose Company A sells mobiles. For the next four quarters, it expects to sell 500, 600, 700, and 800 units, respectively. The selling price for the first two quarters will be as given in the example. Also, Company A expects to provide a sales discount of 2% on the selling price for all four quarters.

| Particulars | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 |

| Sales (units) | 500 | 600 | 700 | 800 |

| Sales (selling price) | $200 | $190 | $180 | $150 |

| Gross Sales | $100,000 | $114000 | $126,000 | $120,000 |

| Sales Discount 2% | $2,000 | $2,280 | $2,520 | $2,400 |

| Total Net Sales | $98,000 | $111,720 | $102,480 | $117,600 |

The above figure shows the net sales that Company A expects to make in the next four quarters.

Incremental Budget

This budget helps to get an estimate of expenses and income on the additional items to be produced, sold, or additional expenses to be incurred. We can use incremental budgets for almost anything, such as sales, salaries, costs, etc. Let us consider an incremental budget example to understand it better.

The total salary bill for Company A for the year 2019 was $50,000. Company A now wants to prepare a salary budget for the year 2020. The company expects to add five new employees next year at a salary of $5000 per year each. Also, the company plans to give an increment of 10% to all its present employees.

Also Read: Types of Budget

| Particulars | Amount |

| Salary 2019 | $50,000 |

| Increment of 10% | $5,000 |

| Total Salary after Increment | $55,000 |

| New Employees (5 @ $5,000) | $25,000 |

| Total Salary for 2020 | $80,000 |

Production Budget

This budget helps a company estimate its production costs and units. Let us consider a production budget example to understand it better.

Company A expects to sell 1000, 1250, 1300, and 1400 units of mobiles in the next four quarters. The production manager plans to have 250, 220, 170, and 280 units of inventory at the end of each quarter. The opening Inventory for the first quarter is 300 units. In this case, the production budget will let the company know the number of mobiles it needs to produce to meet the target.

| Particulars | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 |

| Sales (units) | 1000 | 1250 | 1300 | 1400 |

| Ending Inventory expected | 250 | 220 | 170 | 280 |

| Total Units Required (A) | 1,250 | 1,470 | 1,470 | 1,680 |

| Opening Inventory (B) | 300 | 250 | 220 | 170 |

| Units Needed to Produce (A-B) | 950 | 1,220 | 1,250 | 1,510 |

Business Budget

It is the budget for the entire company. And it helps the company to estimate the profit or loss for the next year. Let us consider a simple business budget example to understand it better.

Company A sells mobiles and expects its sales and expenses to rise by 10% next year.

| Particular | Actual 2019 | Budget 2020 |

| Sales | $50,000 | $55,000 |

| COGS | $30,000 | $33,000 |

| Gross Profit | $20,000 | $22,000 |

| Rent | $500 | $550 |

| Salary | $2,100 | $2,310 |

| Insurance | $300 | $330 |

| Electricity | $400 | $440 |

| Travel | $250 | $275 |

| Office Supplies | $100 | $110 |

| Other | $50 | $55 |

| Net Profit | $16,300 | $17,930 |

The above figure shows the net profit and gross profit that a company can expect next year based on a 10% overall increase.

Final Words

The above budget examples are just a few popular ones. In reality, there could be several types of budgets that are much more complex. But, the objective of the above examples is to give an idea of how to draw and read budgets.