Hedge Fund Vs Private Equity: All You Need To Know

Hedge Funds and Private Equities are popular financial instruments useful for parking funds of High-Net worth individuals (HNIs), sophisticated individuals, Banks, and Financial Institutions. And these are instruments carrying high risks and also require a large quantum of investments. Because of that, they are less popular amongst retail investors. Moreover, Hedge Funds and Private Equity both come under the head of the alternative investment instruments category. And there are times when Hedge Fund Vs Private Equity becomes the biggest question since there is a thin line between the two. Now, let us understand their individual significance and collective point of difference.

Understanding Hedge Funds

Hedge Funds are actively managed pooled funds that use various strategies to generate higher returns. Further, they have aggressively managed a basket of funds, which bears a high amount of risk. Since these Funds are highly volatile and expensive, they are accessible only for High Net-worth Individuals (HNIs) or Institutions. Moreover, in comparison to mutual funds and other financial instruments, Hedge Funds have very little regulation from the regulatory body like the Securities Exchange Commission (SEC). Hedge Funds generate high profits by trading in derivatives, commodities, equities, convertible securities, bonds, leveraging in domestic and international markets, etc. Further, the management of these funds takes place by a professional Hedge Fund Manager with the sole purpose of generating higher profits by taking advantage of the market fluctuations. These managers charge a basic fixed fee and a percentage share in the profits of the Hedge Fund Investments.

Understanding Private Equity

Private Equity is when a private company or a public company raises funds through a specific private network. This private network includes High Net worth and sophisticated individuals, Banks, Financial Institutions, and any other legal entity. However, investment in Private Equity is not open to the general public. There could be times when a publicly listed company might delist its public offerings and offer the same in private equity. The investors of Private Equity mostly get ownership of the company. Private Equity Managers manage Private Equity funds. These managers charge a basic fixed fee along with a percentage share in the profits of the Private Equity Investments. There are few Private Equity firms acting as links between the issuing body and the investing body.

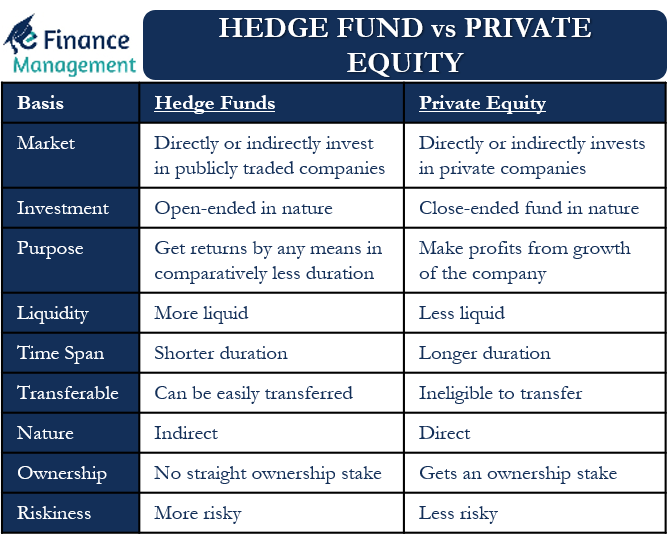

Hedge Fund Vs Private Equity: Major Differences

Both Hedge Funds and Private Equities are investment avenues for High Networth Individuals and Institutions. Although there are a few major differences between them. And they are as follows:-

Public Markets or Private Markets

Hedge Funds directly or indirectly invest in publicly traded companies. They make high profits by taking arbitrage advantage in domestic and/or international markets and investing in publicly traded derivative instruments or equities. In other words, Hedge Funds generate returns by investing in Public Companies.

Private Equity, on the other hand, directly or indirectly invests mostly in private companies. A publicly listed company can issue additional Private Equity by diluting its own stake or by diluting publicly listed stocks. But except for this situation, the parking of Private Equity money takes place in a Private Company only.

Investment Structure

Hedge Funds Investments are open-ended in nature. The investor can invest or withdraw the amount from the fund according to the requirements. There is a continuous inflow and outflow of funds in the Hedge Fund. In the event of Private Equity, the situation is the opposite. Private Equity is a close-ended fund, and the investor cannot invest any additional amount after the initial period gets over. And the exit is also not so easy or possible as with the Hedge Funds.

Purpose or Target

The ultimate target of Hedge Fund and Private Equity is to earn profits. The point of difference exists in the attitude of the investment. Private Equity Investors stay in business for a longer duration and invest in making profits from the growth of the company. The target of Hedge Fund investors is to get returns by any means in a comparatively shorter duration. Hedge Fund investors are not concerned with the long-term growth of the company.

Also Read: Hedge Fund Strategy

Liquidity and Time Span

Investments in Hedge Funds are more liquid in comparison to Private Equity. The purpose of Private Equity is to reap the profits out of the growth of the company. Private Equity Investors stay in the investment for 5-10 years to get returns. On the other hand, Hedge Fund Investors are for a shorter duration. They can anytime book the profit after a lock-in period of 1 or 2 years and exit the investment fund. This makes Hedge Fund more Liquid in comparison to Private Equity.

Fee Structure

The Hedge Fund manager and the Private Equity manager charge fees or commissions for providing their services. In Private Equity, mostly the investors are charged a 2% of fixed management fee and 20% of the incentive fee. If the Private Equity returns exceed the hurdle rate return, then only the investors are charged with an incentive fee.

For example, if the hurdle rate is 9% and the Private Equity has generated 8% of return. In this situation, since the actual return is less than the hurdle rate of return, the Private Equity manager will not charge an incentive fee. If the actual return is 10%, then the actual return has exceeded the hurdle rate of 9%. In this situation, the investor will be charged 20% of the incentive fee on the 10% return.

In the Hedge Fund, they follow the 2/20 rule. Under this rule, 1%-2% fixed fee is charged and 20% of the incentive fee. The accomplishment or performance of a Hedge Fund is calculated/determined on the basis of the Net Asset Value (NAV). For example, at the time of investment, NAV is $100, and after a year, the NAV has come to $120. Thus there is a profit of $20, and the incentive fee will be charged on the same. If the NAV after a year is $80, then incentive fees won’t be charged.

Transferability

The investors of Hedge Funds can easily transfer their funds in another name. Private Equity Investors are ineligible to transfer their investment in some other party’s name.

Participation Level

The investors of Private Equity actively participate in their investment-making process. Sometimes the Private Equity investor also gets a decision influencing right along with the ownership in the company. They often have a Board seat as well as certain confirming rights before any major capital expenditure program takes place. Hedge Fund investors are passive investors and completely give the authority to the Hedge Fund manager.

Direct or Indirect Investment

Mostly the investment in the Hedge Fund is indirect in nature. Hedge Fund investors invest in highly liquid instruments of the company. Private Equity Investor mostly directly invests in the company.

Ownership

Since Private Equity is a type of Equity, the Private Equity investor mostly gets an ownership stake in the company. Hedge Fund investors mostly do not get any straight ownership stake in the company.

Riskiness

Hedge Funds and Private Equity both are high risk-bearing financial instruments. However, in comparison to Private Equity, Hedge Funds are riskier in nature. Since the purpose of the Hedge Fund is to generate higher profits in a shorter span of time, it tends to invest in highly volatile and risky investment avenues. Private Equity Investments are comparatively less risky as the target is to generate high returns in a longer duration of time.

Short-term Capital Gain Tax

Charging of short-term capital gain tax does not take place for Private Equity funds, as they are there for a longer duration. Hedge Fund investments usually run for a short period of time. Therefore depending upon the investment period, they may be liable to pay short-term capital gains tax or long-term capital gains tax.

Capital Investment

Investment of Private Equity funds takes place one or more times, as it can happen in tranches. Depending upon the progress of the project as well as the requirements of funds. In Hedge funds, capital investment occurs only once and at the initial stage.

Control over Assets

Private Equity investors have control over the assets of the company and have decision-influencing capacity. Since they carry an ownership stake, it also gives them the normal voting rights too for various decisions of the company, like any other owner shareholder. However, these rights are not available to Hedge Fund Investors, and thus they do not have any control over the assets of the company. They are external investors with no voting rights.

Contractual Life

In Private Equity, the contractual life of the investment is decided beforehand. On that specific date, the investment matures. In the case of the Hedge Fund, there is no such contractual life. The investor can decide on the maturity of the investment.

These differences are non-exhaustive in nature.

Hedge Fund Vs Private Equity: Final Words

Hedge Funds and Private Equity are alternative investment options specific to a certain group of people. They are highly risky, expensive investments that generate higher returns. They both individually have specific unique qualities which differ from each other. Considering the risk and return profiling of the instruments, the investor is free and can use his discretion to select either of the instruments for investment.

If the target is for a longer duration, the investor can go for Private Equity. Let us say if the investor is willing to take an extremely high amount of risk, then the Hedge Fund becomes suitable. If the investor is an active investor, then Private Equity is suitable, and if the investor is a passive investor, then Hedge Fund is suitable. Thus, we cannot directly compare these two instruments and decide on the best investment avenue. Hedge Fund can be favorable for one investor, and Private Equity can be favorable for another investor. It all depends upon the quantum of investments, the time horizon of the investments, active or passive investor attitude, and of course, the opportunity and acceptability on the part of the investee too.

Frequently Asked Questions (FAQs)

Hedge Fund Vs Private Equity is a big question since there is a thin line between the two. They both differ due to their individual significance and collective point of difference. Hedge Funds are actively managed pooled funds that use various strategies to generate higher returns. Further, they have aggressively managed a basket of funds, which bears a high amount of risk. Since these Funds are highly volatile and expensive, they are accessible only for High Net-worth Individuals (HNIs) or Institutions. At the same time, Private Equity is when a private company or a public company raises funds through a specific private network. This private network includes High Net worth and sophisticated individuals, Banks, Financial Institutions, and any other legal entity. However, investment in Private Equity is not open to the general public.

Hedge Funds Investments are open-ended in nature. While, in the event of Private Equity, the situation is the opposite. Private Equity is a close-ended fund.