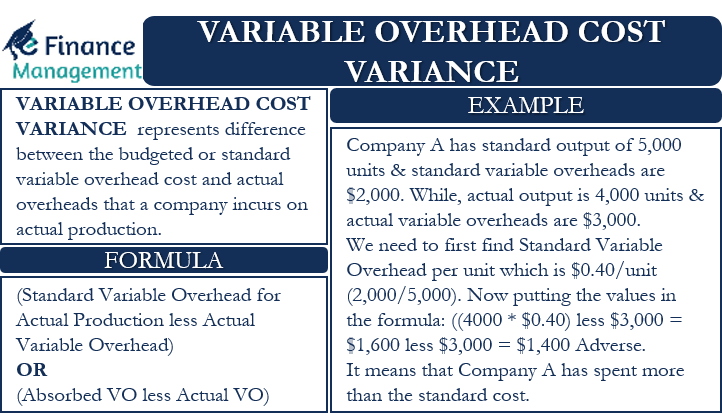

Variance, as we know, is the difference between what has been planned/budgeted or standard one and the actual one. Therefore, Variable Overhead Cost Variance (VOCV) also represents the difference between the budgeted or standard variable overhead cost and the actual overheads that a company incurs on actual production. We denote this variance as VOCV. This variance basically represents the under or over the cost of variable overhead.

VOCV is one of the parts of total variable overhead, with the other two being VOExV (variable overhead expenditure variance) and VOEfV (variable overhead efficiency variance).

VOCV can also be favorable or adverse (unfavorable) like other variances. A favorable variance is when the standard is less than the actual. It means the company spends less than the standard cost. An adverse variance is when the actual spending is more than the standard. This means a company spends more than the estimates.

We usually calculate the VOCV in total. This is because the variable overheads can only vary on the basis of units and not time. However, some believe that variable overhead does vary on the basis of time too. And because of that, the other two variances, namely variable overhead efficiency and expenditure variance, arise. Hence, they believe that they can use actual-time information to calculate such variance. In this article, however, we will talk of VOCV on the basis of units only.

Formula for Variable Overhead Cost Variance

Following is the formula to calculate Variable Overhead Cost Variance:

VOCV = (Standard Variable Overhead for Actual Production less Actual Variable Overhead) or (Absorbed VO less Actual VO)

We can calculate the Standard Variable Overhead for Actual Production using the following formula = Actual Output Units * Standard Rate per Unit.

We can get the information on the actual variable overhead from the financial statements. If the financial statements do not carry this detail, we will have to calculate it. To calculate it, however, we should know the actual overhead rate.

Usually, in the calculation of VOCV, we are provided with the absorbed cost. In case it is not given, we need to calculate it using the total absorption or standard overhead and the absorption or standard units.

There is one more formula to calculate VOCV, and it is:

VOCV = VO Expenditure Variance plus VO Efficiency variance. As it is a total of these two variances.

Example of Variable Overhead Cost Variance

Now let us attempt to understand the calculation process and concept with the help of an example.

Suppose Company A has a standard output of 5,000 units, while its standard variable overheads are $2,000. However, the actual output is 4,000 units, and the actual variable overheads are $3,000.

Now for the calculation of VOCV, we need to insert these values in our first formula. But, before that, we need to find Standard Variable Overhead for Actual Production.

So, we need to find Standard Variable Overhead per unit. This will be $0.40 per unit ($2,000/5,000).

Now putting the values in the formula = ((4000 * $0.40) less $3,000 = $1,600 less $3,000 = $1,400 Adverse.

It means that Company A has spent more than the standard cost.

Final Words

Determining and tracking Variable Overhead Cost Variance could prove very beneficial for a company. It could help in reducing or eliminating wasteful expenditure that may be the cause of the variance. However, it could be very difficult for management to hold anyone responsible for this variance after determining the variance. Because as we discussed above, this variance is a combination of various factors that can spread across the department/persons/processes, etc. So, it is not possible to hold an executive or specific department responsible for this variance.

Refer to Variance Analysis Formula with Example for various other types of variances.

RELATED POSTS

- Variance Analysis Formula with Example

- Fixed Overhead Volume Variance

- Fixed Overhead Spending Variance – Meaning, Formula, Example, and More

- Production Volume Variance: Meaning, Formula, Limitations, and More

- Fixed Overhead Calendar Variance – Meaning, Formula, and Examples

- Cost Variance – Meaning, Importance, Calculation and More