A Hedge Fund Strategy is a well-thought-out model to run an active hedge fund. Hedging means offsetting your part of the risk. In other words, safeguarding yourself against risk. Hedge Funds aim at maximizing investors’ returns and eliminating risk. Many people have mistaken hedge funds to be a retail investment options. It is for a pool of investors and is set up by a registered investment adviser or a money manager. However, you need to have a minimum threshold of income to invest.

Structure of a Hedge Fund

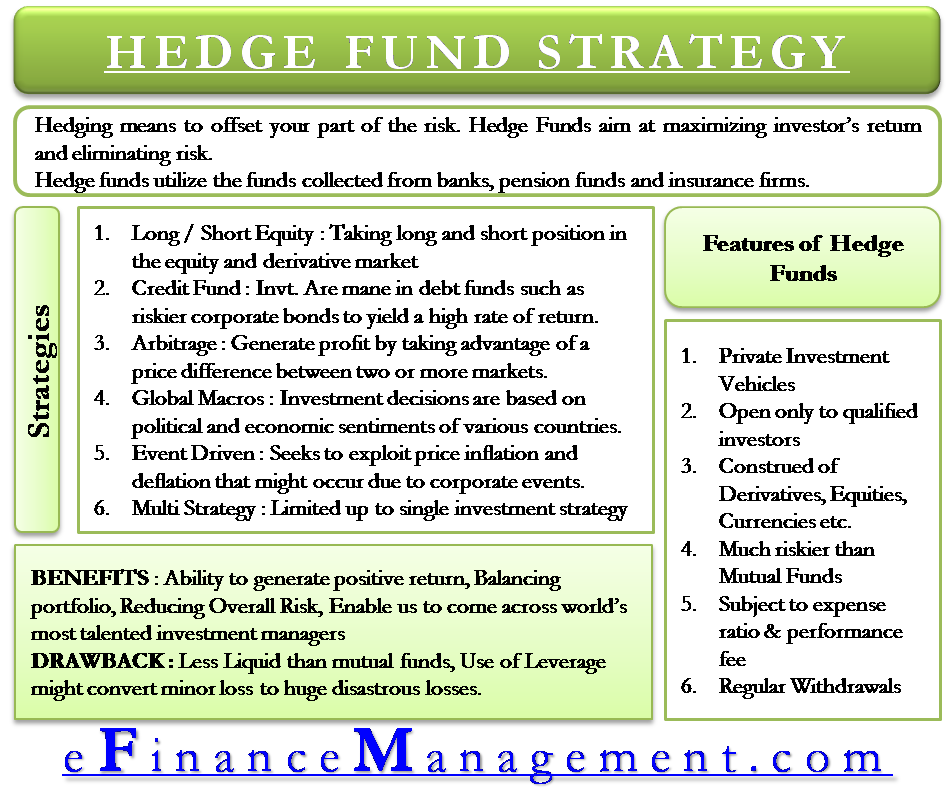

This pool of investment is recognized as a limited partnership or a limited liability company. Hedge funds utilize the funds collected from banks, pension funds, and insurance firms. Therefore, they play a role as overseas investment corporations and private investment partnerships.

A hedge portfolio is constructed of securities like derivatives, equities, currencies, bonds, and convertible securities. These securities need aggressive management as to hedge investor risk, which is the outcome of the market’s uncertain ups and downs.

Features of a Hedge Fund

Hedge funds are private investment vehicles.

They are open only to qualified investors such as one with a net worth exceeding $1 million or per annum income, which has surpassed $200,000 for the past 2 years.

Also Read: Hedging

A hedge portfolio is constructed of derivatives, equities, currencies, real estate, and other alternatives.

These funds are much riskier than mutual funds as they often borrow money to intensify their return.

The Funds are subject to an expense ratio and a performance fee, with 2% as the asset management fee and a 20% cut of any gains generated. This is a common fee structure we call “two and twenty.”

Hedge Funds allow regular withdrawals.

Strategies of Hedge Funds

Long/Short Equity

This strategy involves taking a long or short position in an equity or derivative market, i.e., purchase undervalued stock or selling overvalued once. Before going up with this strategy, fundamental and technical analysis to make an investment decision is employed. This strategy enables ease of liquidation, cash in hand when needed.

Example

Suppose you are unsure about the market movement and have invested in derivatives that is call option. You have bought a call option as you expected the market to hike, but later, you realize that is a wrong investment move. You can analyze a sharp fall upcoming. To safeguard yourself from such adverse effects, you can, instead of selling the call option you bought, can hedge your risk by selling a put option as it will hedge the upcoming risk.

Credit Funds

These invest in debt funds such as riskier corporate bonds to yield a high rate of return. Economic upturns and downturns affect the cyclical pattern of credit funds. Further, these funds consist of distressed debt strategies, fixed income strategies, direct lending, etc.

Distressed Debt

Distressed debt consists of investment in bank debts, corporate bonds, and investment in common and preferred stocks of companies in distress. Debt occurs when a company is unable to oblige with its finances or is in a financial crisis. To recognize Undervalued investments, fundamental analysis is taken up.

Fixed Income

These funds are subject to long-term investments such as banking products, corporate bonds, debentures, convertible notes, etc. These instruments generate fixed income. Some of the fixed income funds come with low-risk tolerance levels and capital preservation a priority, which leads to diversification and volatility reduction strategies.

Arbitrage

Arbitrage is a strategy where you can generate profit by taking advantage of a price difference between two or more markets. This strategy produces a constant return with low risk. Further, these funds depend on leverage to obtain significant returns. Because of too much use of leverage, one might suffer a loss when the pricing difference shifts unexpectedly. Arbitrage can be classified as fixed income arbitrage, convertible arbitrage, relative value arbitrage, and merger arbitrage.

Fixed Income Arbitrage

It exploits the pricing difference in fixed income securities by taking up opposing positions in price bonds or derivatives, with the expectation that the price might revert to its true value. Further, the fixed income arbitrage strategies consist of swap-spread arbitrage, yield curve arbitrage, and capital structure arbitrage.

Merger Arbitrage

This includes taking opposing positions in two merging companies to enable the advantage of price inefficiencies that might occur during the procedure of the merger may be before or after.

Global Macro

In this, investment decisions are based on the political and economic sentiments of various countries across the globe. This investment strategy involves directional and relative analysis. The former works to predict the rise or fall of a country’s economy, while the latter evaluates economic trends that relate to each other. These funds include various asset classes such as investment in equity, derivatives, infrastructure, and furthermore. To determine the relative currency value, currency traders depend upon global macro strategies.

Event-Driven Strategies

This strategy seeks to exploit price inflation and deflation that might occur due to corporate events. These might be events like mergers and acquisitions, restructuring, expansion, bankruptcy, and similar other things. This strategy uses the financial modeling technique. Merger arbitrage, risk arbitrage, event-based capital structure arbitrage, and distressed debt are some of the event-driven strategies. This strategy is quite related to the arbitrage strategy.

Multi-strategy

These funds are limited up to a single investment strategy, regardless of which they use various investment strategies to achieve positive returns no matter how the overall market performance is. This fund tends to preserve capital and has a low-risk tolerance level.

Benefits of Hedge Funds

These funds have various sets of investment hedge fund strategies that consist of generating a positive return in both increasing and declining markets.

Hedge funds tend to give viable returns if used in a balanced portfolio, reducing overall risk.

Hedge funds enable you to come across the world’s most talented investment managers. They use a mixture of various hedge fund strategies depending on the economies.

Many hedge funds are uncorrelated from each other, hence enabling investors with the ability to customize their investment strategy.

Drawbacks of Hedge Funds

- Hedge Funds are quite less liquid than mutual funds. And require locking up the money for quite long-term.

- The use of borrowed money or leverage might turn a minor loss to huge disastrous losses.

Conclusion

If compared with mutual funds, hedge funds are less regulated and come with minimum investment requirements; these funds operate risky strategies. The main aim of such funds is to maximize the return. Apart from this, many portfolio managers work for hedge funds. Unlike mutual funds, their fees are higher and include additional fees, i.e., incentive fees based on the profit one earns.

In the United States, hedge funds operate under various regulatory guidelines. As discussed earlier, most hedge fund investors are “accredited” – they earn a high income and have a net worth of $1 million or more.

A Hedge fund strategy is valued based on absolute returns, macro-micro economic parameters, sectoral issues, and other regulatory impacts. It is quite difficult to decide the time of investment and expected return or risk, and the aim of strategies.

Hedge Funds are a type of Alternative Investment.