Commingled Fund is very similar to a mutual fund. They are basically a single account that includes the assets of many accounts. The primary objective of such type of fund is to lower the cost of managing the funds. Also, it ensures that investors get professional help in managing their funds. The workplace retirement fund is a good example of this type of fund. We also call such funds as Pooled Funds.

These funds do not list publicly and aren’t accessible to retail investors. Instead, they are most popular for retirement plans, pension funds, and other institutional accounts.

Example

Let’s take a simple example to understand how Commingled Funds work.

Assume investors X, Y and Z come to a fund manager A to manage their portfolio separately. A, however, tells them that he would manage all their accounts as one account to reduce the expenses and his work. The money from all three will go to one pool (account), and the assets that A will buy from the money will be distributed equally among the three. And, on the reporting date, the distribution of assets among the three will be on the basis of capital contribution.

Now, lets’ say X, Y and Z invests $20,000; $30,000 and $50,000 initially. The ratio of their investment is 2:3:5. Now, A takes the total investment ($100,000) and invests in three types of assets (shares, bonds, and treasury bills) in the ratio of 4:5:1. Or, $40,000 in shares, $50,000 in bonds and $10,000 in Treasury bills.

At the end of the year, the total amount grows to $120,000 (return of 20%). Now, the investment in each asset class is $48,000 in shares, $60,000 in bonds, and $12,000 in treasury bills. For X, Y and Z, the year-end account balance will be the initial balance plus a return of 20%. So, it will be $24,000; $36,000; and $60,000, respectively.

Talking of how much of X, Y, and Z go to each asset class, it will be on the basis of the initial ratio of 4:5:1. So for X, investment is $9,600; $12,000 and $2,400, in shares, bonds and treasury bills, respectively.

For Y, the investment amount is $14,400; $18000 and $3,600 in shares, bonds, and treasury bills, respectively.

For Z, the investment amount is $24,000; $30,000 and $6,000 in shares, bonds, and treasury bills, respectively.

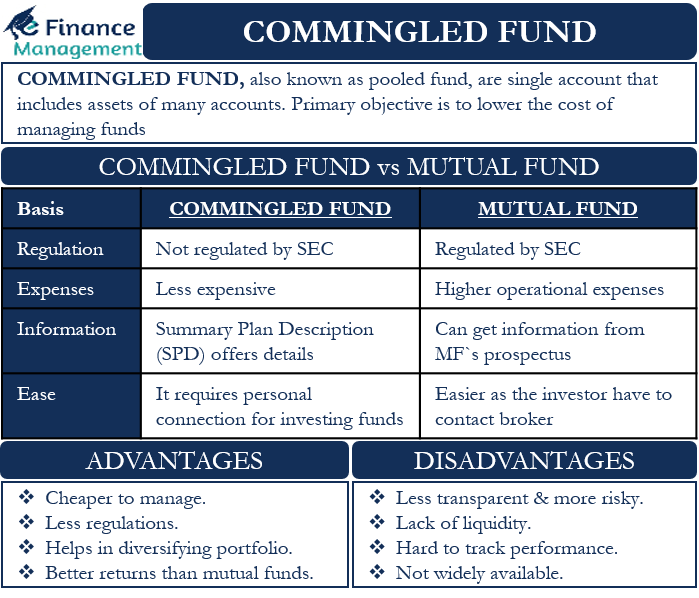

Advantages and Disadvantages of Commingled Fund

Following are the advantage of Commingled Funds:

- It does away with the need to manage multiple accounts for diverse assets.

- Such funds are cheaper to manage because of fewer operational and regulatory requirements.

- Like mutual funds, they help to diversify one’s portfolio.

- Professional fund managers oversee the account. This increases the chances of an above-average return.

- Such funds usually give a better return than mutual funds because of their lower expenses and focus on investing.

Following are the disadvantage of Commingled Funds:

- Since these funds face lower regulatory and reporting requirements, they could be less transparent and riskier.

- Not many investors have access to these funds because of the funds’ lack of liquidity and non-marketable nature. These funds are not available publicly.

- Owing to less reporting requirements, it gets hard to track such funds’ performance in real-time.

- Unlike mutual funds, investors may not get information on the holdings, expense ratios, and other details of such funds.

- Commingled Funds are not widely available as other investment options, such as ETFs (exchange-traded funds) and mutual funds.

- They are not a good investment for the short term because of the lack of liquidity.

There are a few drawbacks of these funds that investors must consider before investing. These are:

- These funds have a pre-specified holding period. This means investors must assess their liquidity needs and investment time frame and only then invest in such funds.

- Since these funds are not as liquid as mutual funds, investors may not get their money in case of an emergency.

- The SEC (Securities and Exchange Commission) does not regulate these funds. Instead, the United States Office of the Comptroller of the Currency and individual state regulators oversee the working of such funds.

Commingled Fund vs Mutual Funds

Though both types of funds work very similarly, they are very different from each other. The most basic difference is with respect to regulation. Mutual Funds face heavy regulation from the SEC. Commingled Funds, on the other hand, face fewer regulations, and the SEC doesn’t regulate them.

Another evident difference between the two is in the expenses. Mutual Funds are relatively more expensive because of their higher operational expense. Since Commingled Funds have fewer regulations, their expenses are lower.

Also Read: Discretionary and Non-Discretionary PM

From an investor’s point of view, it is relatively easier to invest in Mutual Funds. For investing in Commingled Fund, an investor needs to have a personal connection with the person managing or those investing in such fund. For a Mutual Fund, an investor needs to contact a broker. The same is not the case with Commingled Funds, and thus, investors need a personal connection.

An investor wanting to invest in a Mutual Fund can get information from that MF’s prospectus. On the other hand, Commingled Funds offer details in an SPD (Summary Plan Description). The SPD details the fund’s objectives, details of the fund manager, strategy, as well as rights, and obligations of the investors.

Another difference is that, unlike Mutual Funds, the Commingled Funds don’t have a ticker. This is because they don’t trade publicly.

Should You Invest in Commingled Funds?

Commingled Fund has proven an effective investment tool. However, they do suffer from plenty of drawbacks. Thus, it is important for investors to consider their own purpose and risk level in mind when investing in such funds. Also, investors must ensure that their purpose and risk level are in sync with the purpose and risk level of the fund.

Additionally, if you are evaluating investing in such funds, then answering the following questions will help you decide:

Do you want to invest for the long-term?

Are you looking to diversify your portfolio?

Are you looking for an efficient investment option with fewer expenses?

Are you looking to hand over your funds to a professional manager for better returns?

Whether or not you are comfortable with less liquidity and lack of transparency?

If your answer is ‘yes’ for all the above questions, then you can go ahead and invest in a Commingled Fund. But, before putting your money in, get as much information as you can, such as copies of disclosures (if any), pricing sheets, and more. Review all the information carefully to ensure the fund aligns with your investment objective and risk level.