The sanctioned limit is the total exposure that a bank can take on a particular client for facilities like cash credit, overdraft, export packing credit, non-funded exposures, etc. On the other hand, drawing power refers to the amount calculated based on primary security less margin on a particular date. It is an amount that the client can use for a particular period from the sanctioned limit.

Drawing power applies only to fund-based working capital financing facilities. Drawing power calculation also helps the lending institutions keep a time-to-time watch on the company’s performance. By tracking its inventory turnover and its book debts periodically. It is used as a part of the credit monitoring practices of the lending institution. Let us see in detail drawing power v/s sanctioned limit.

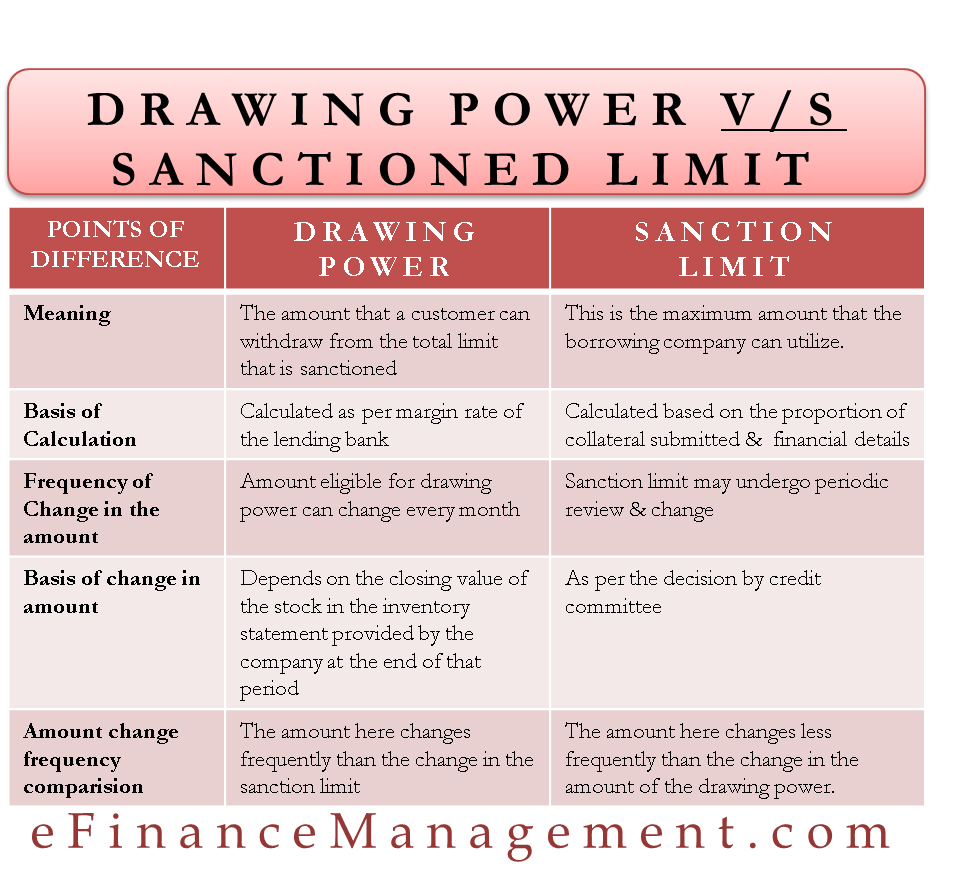

Differences between Drawing Power and Sanctioned Limit

Let us now look at the differences between drawing power v/s sanctioned limit that distinguishes them from each other:

| Sr. No | Drawing Power | Sanctioned Limit |

| 1. | Drawing power is the amount that a customer can withdraw from the total limit that is sanctioned to him by the lending bank. | The sanctioned limit is the total limit allotted to a customer by the financial institution for working capital requirements. This is the maximum amount that the borrowing company can utilize. The limit is usually given at the time of commencement of credit facilities after doing the credit appraisal of the borrower/company. |

| 2. | The Drawing power amount is calculated as the per margin rate of the lending bank; i.e., The amount is usually calculated after deducting margin from primary security for working capital (usually cash credit limit), i.e., “Stock fewer Creditors + Book Debts.” | The sanctioned limit is calculated based on the proportion of collateral submitted and financial details provided by the borrower (individual or company) to the lending bank. |

| 3. | The amount eligible for drawing power can change every month and is a fluctuating amount that depends on the closing value of the stock in the inventory statement provided by the company at the end of that period (Generally every month or every quarter). | The sanction limit may undergo periodic review, and it changes as per the decision by the credit committee. Still, the change is at a lesser frequency than drawing power. |

While drawing power and sanctioned limits are longer tenure arrangements to meet the working capital requirements of the client as they require temporary financing for meeting short-term requirements. Hence, a tailor-made arrangement is made available to the clients as a one-off overdraft facility. Generally, it is for a period of not more than 30 days. This is called a Temporary Overdraft facility (TOD).

A Temporary Overdraft facility is made available to the customer to meet his immediate credit requirements. TOD is short-term and is generally not backed by any security. The bank usually charges slightly higher interest rates for the given TOD facility, to which certain terms and conditions are attached. TOD amount is over and above the sanctioned regular limit. However, it is still supposed to be within the drawing power at the time of “TOD sanction” based on the updated stock, creditors, and book debts position.

Also Read: Drawing Power

Keep reading – Advantages and Disadvantages of Drawing Power

Conclusion

Working capital limit sanctioned by the company is normally given the basis of strict credit appraisal of the client. Taking into consideration the company’s own funds, debtors, stock, and other securities provided. While drawing power is the highest amount allowed to be drawn from the limits sanctioned.

Why we subtract creditor from stock to calculate drawing power?please explain