“What does Equity Carve Out mean? What’s the idea behind the concept of this, and what are the effects? What are its advantages & disadvantages? What are the points to consider before exercising the option of this option?”. This article gives a quick insight into the topic of Equity Carve-Outs.

Before understanding all the above, we need first to consider what Equity Carve-Outs is all about?

What is Equity Carve-Out?

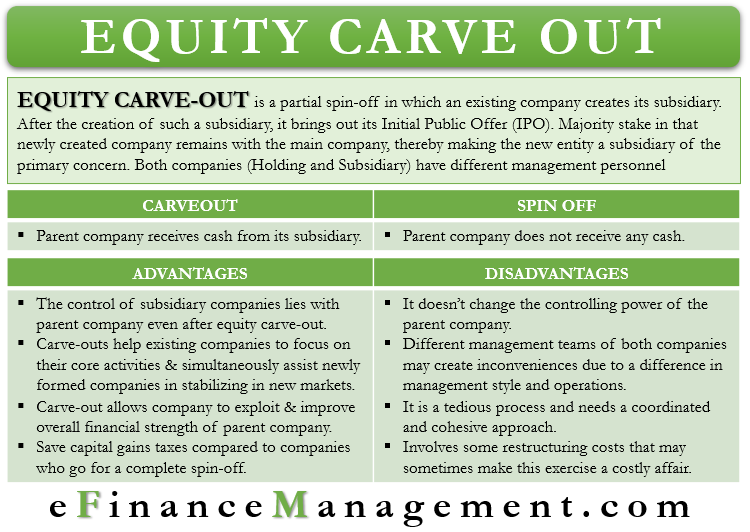

Equity Carve-Out is a partial spin-off in which an existing company creates its subsidiary. After creating such a subsidiary, it brings out its Initial Public Offer (IPO). The reason why we call it a partial spin-off is that it does not give away its control of the subsidiary. Only a part, i.e., near about 20-30% of the equity stake, is issued to the new shareholders or investors. In other words, a company takes out one of the businesses and creates a separate company to handle that part of the business.

Moreover, the majority stake in that newly created company remains with the main company, thereby making the new entity a subsidiary of the primary concern. Therefore, thru equity carve-outs, a part of the existing business is divested. The concept of partial sell-off gives this reorganization a complex structure.

It has various alternative synonyms like “Partial Spin-Off’, ‘Subsidiary IPO,’ ‘IPO Carve-Out,’ ‘Split off IPO,’ etc.

Background

The transaction mentioned above gives birth to two kinds of entities i.e.

- the parent company (holding company) and;

- the child company (subsidiary company).

Both companies have different management personnel to control the affairs of the business. Both companies have their standalone financial statements. The process of equity carve out generally takes four to six months.

Equity Carve-Out Vs. Spin-Off

There’s a slight difference between spin-off and carve-outs. In the spin-off, the parent company does not receive any cash as the shares are issued to the existing shareholders in dividends, which is also known as a stock dividend. While in carve-outs, the parent company receives cash from its subsidiary. As in this case, part of the equity stake is sold to new shareholders/investors or the public thru IPO. The carve-outs are strategies to introduce cash into the parent company. The companies carry out the equity carve-out strategy to use this cash to improve their existing main businesses.

However, it is not always possible that the equity carve-outs have only positive effects on business. In the absence of correct planning or evaluation, it can be disastrous also.

Total spin-offs usually follow equity carve-outs. So, this exercise of equity carve-outs can be a step toward such a complete spin-off at a later point in time.

Advantages

The equity carve-outs provide the advantages mentioned below:

- The control of the subsidiary companies lies with the parent company even after the equity carve-out. Only a part of equity is divested to the new pool of investors. So there is no threat of competitors entering the business or acquiring a significant stake or control over the business that may affect the interest of the parent company.

- Carve-outs help the existing companies to focus on their core activities and simultaneously assist the newly formed companies in stabilizing themselves in the new markets. Again the carved-out business also gets its due focus that may have been missing so far.

- A carve-out allows a company to exploit and improve the overall financial strength of the parent company. It is by way of capitalizing (creating value) on the secondary business, not its core operations. It is an opportunity for the parent company to earn more than before, as it still retains control over subsidiary operations.

- The companies that adopt the equity carve-out method of restructuring can save capital gains taxes compared to companies that go for a complete spin-off.

Disadvantages

While the equity carve-outs provide the above advantages, they also have their share of disadvantages. The following are a few disadvantages-

- The dilution of ownership doesn’t change the controlling power of the parent company. Hence, the subsidiary company cannot function in a completely independent manner despite having a separate legal existence.

- The different management teams of both companies may create inconveniences due to a difference in management style and operations. There may be a lack of coordination in the working of both organizations.

- The equity carve-outs are quite complex. Its successful implementation is quite a tedious process and needs a coordinated and cohesive approach.

- It also involves some restructuring costs that may sometimes make this exercise a costly affair.

Do’s & Don’ts

Not all equity carve-outs turn out to be a significant success, so some points need careful consideration before going for this strategy so that both parent and subsidiary companies enjoy a win-win situation.

- The purpose behind such equity carve-out should be clear. There should be a roadmap for execution post-carve-out. The seller and buyer should know in advance what they are going to gain from such exercise. One should not play a blind game that involves high uncertainties and risks. The risks should be calculated risk.

- Preparation of the proforma financial statements should be on the basis of reliable data. This involves all necessary and correct disclosures regarding all the costs for this exercise to arrive at a fair and justifiable valuation.

- We need to identify and evaluate the post-impact analysis of carve-outs on the business of parent and subsidiary well in advance.

- The tax implications should be studied before carve-outs. If new shares are issued, then the event is not taxable as it is just an increase in capital. However, if there is a partial sell-off of the existing equity shares, then capital gains tax may be attracted.

- All the accounting entries should be appropriately incorporated at appropriate figures in the books of parent and subsidiary companies. Negligence or misstatement in financial statements misleads the information it serves to the users of the accounts.

- Due diligence exercise is a must before planning equity carve-out. It will help decide the viability of the restructuring proposal from different perspectives.