What is Management Buyout?

A management buyout (MBO) refers to a transaction where the existing management team of a company purchases a controlling stake from its current owner(s). This concept appeals to higher-level managers owing to the greater rewards they will receive by owning the business rather than serving as employees. MBO primarily takes place in private businesses where the owner wishes to retire. Large businesses that wish to sell out the redundant divisions of their entity also opt for MBO. People often get confused between the terms management buy-in and management buyout. However, the terms management buy-in and management buyout appear similar the difference lies in the buyer’s position. In the case of a management buy-out, the management team is hired from outside the company.

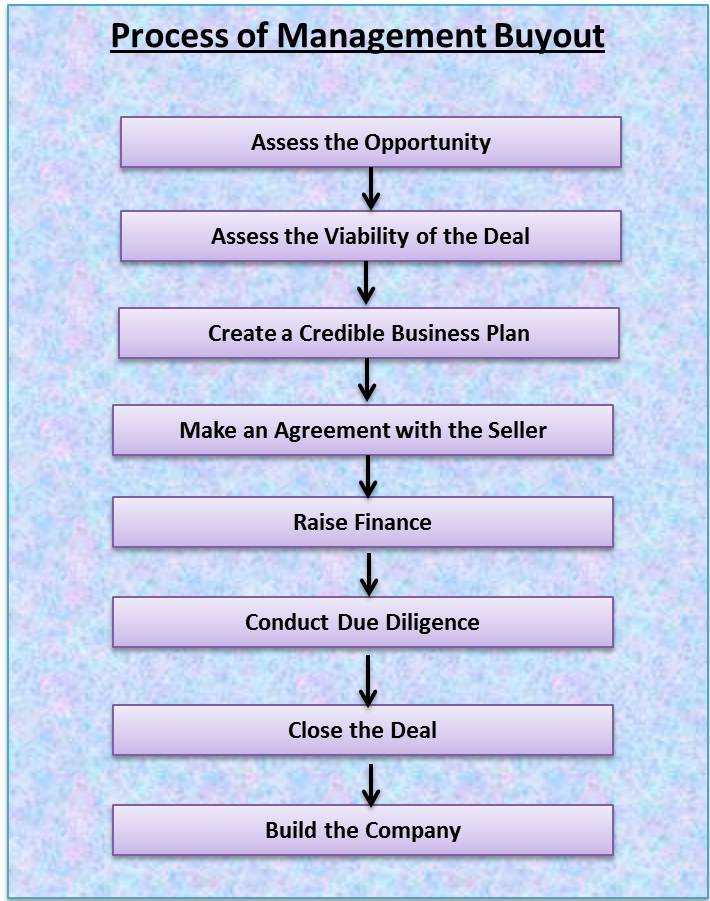

On understanding the meaning of MBO, let’s look at the process for commencing the same.

Process Of Management Buyout

Management buyouts are a popular form of exit strategy adopted by both large corporates and owner-managed businesses. After considering if the MBO is suitable for the owner, it requires the commencement of a number of steps.

The following are the eight steps in the management buyout process:

Assess the Opportunity

The buyer should be sure about going ahead with the MBO. It requires an investment equivalent to a year’s salary. If the finance is borrowed, the repayment will be manageable as the salary can increase in the future to help pay off dues. However, the buyer will have to bear the risk of capital investment in the business. Full commitment towards the business is required at the buyer’s end.

Assess the Viability of the Deal

Analyze the growth prospects of the business. The buyer should also work out a plan for wealth maximization. This will enable the buyer to grow the value of his shareholding in the business.

Also Read: Management Buy-in

Create a Credible Business Plan

The buyer should draft a worthy business plan. Decisions should be chalked out on actions to be taken once the deal is done. A good business plan will determine the initial budget needed for the business’s operations.

Make an Agreement with the Seller

Negotiations with the seller are done. A middleman may be involved to negotiate and reach a common ground as these negotiations may get uptight.

Raise Finance

Raising finance for the deal is a time-consuming process. Striking a good deal is essential. Raising capital from an external source is equivalent to developing a business partner. Thus the buyer must make a wise decision.

Conduct Due Diligence

Financiers may require due diligence to support the process. Therefore, the buyer must conduct due diligence for the company.

Close the Deal

The buyer seals the deal and enjoys benefits. Hard work will follow in the days to come.

Build the Company

The company is in the ownership of the buyer. If the deal is conducted wisely and at the right price, it serves as a great beginning. The appointment of a good adviser may help in further operations of the entity.

After gaining an insight into the process of MBO, let’s look at the advantages and disadvantages of the same.

Advantages of Management Buyout

The following are the advantages of management buyouts:

Retention of Key Talent

Management buyouts help retain key management personnel who have a deep understanding of the business, its operations, and its potential. This helps ensure the continuity of the company’s strategy and operations.

Also Read: Process of Acquisition

Greater Focus on Long-Term Value Creation

As the management team has a long-term interest in the company, it tends to focus on creating sustainable value rather than short-term gains. This can be beneficial for the company’s growth and profitability over time.

Improved Flexibility

Management buyouts allow the new owners to make changes to the company’s operations and strategy quickly and efficiently without the need for approval from external shareholders.

Better Alignment of Interests

In a management buyout, the interests of the management team and the company are more closely aligned, as the management team has a personal financial stake in the success of the company.

Reduced Transaction Costs

Compared to other forms of mergers and acquisitions, management buyouts typically involve lower transaction costs since the management team already has a deep understanding of the company’s operations and financials.

Disadvantages of Management Buyout

The following are the disadvantages of management buyout:

High Levels of Debt

In many cases, management teams need to borrow a significant amount of money to finance the purchase of the company. This can result in high levels of debt and interest payments, which can limit the company’s ability to invest in growth or adapt to changing market conditions.

Potential for Conflicts of Interest

In an MBO, the management team becomes both the owners and the employees of the company, which can create potential conflicts of interest. For example, the management team may prioritize their personal financial interests over the best interests of the company or its other shareholders.

Lack of Diversification

In an MBO, the management team typically focuses on a single company or industry, which can limit diversification and increase risk. This can be particularly risky if the company operates in a volatile or cyclical industry.

Limited Access to Capital

As a private company, the MBO may have limited access to capital compared to a publicly-traded company. This can make it more difficult to raise funds for expansion or investment in new projects.

Limited Expertise

The existing management team may not have the necessary expertise to manage the company effectively or may lack experience in certain areas, such as finance, marketing, or technology.

Let’s move on and see an example of MBO to gain a clearer view of the concept.

Example of Management Buyout

In the year 2011, the management of Menzies Hotel purchased the entity. Lloyds Banking Group provided financial assistance in the MBO. The hotel went through financial restructuring and formed a new company, Cordial Hotels, which is majority-owned by its management.

Conclusion

A management buyout ensures a smooth continuation for the entity. The transfer of ownership is to the management, who already has a good understanding of the potential held by the company. The management is already well-known by suppliers, financial partners, and clients. These multiple benefits lead to profit maximization for the entity. However, the management buyout structure holds a setback as well. The managers are required to make a transition from being employees to owners. This transition requires a change in mindsets. Not all managers can become successful owners.

Keep reading Corporate Restructuring to learn about various other strategies.