Recapitalization is a corporate restructuring technique companies use to change their capital structure. Companies primarily use this technique to ensure their capital structure is more stable or optimal. Such a strategy involves exchanging one type of source of finance with another. For instance, exchanging debt with equity or equity with debt. There are mainly two types of recapitalization – debt and equity. In this article, we will discuss equity recapitalization.

The main or primary objective of Equity Recapitalization is to reduce the pressure on net earnings and debt servicing by reducing the debt component in the structure. Of course, the only way is

1. To convert part of the existing debt into equity so the overall ratio improves the equity component and the existing debtor becomes the shareholder.

2. To issue further common or preference shares to the public, thereby getting fresh non-interest bearing funds into the company. These funds can be used to fund the project in hand, meet working capital needs, and/or to pay off part of the existing high-interest-bearing debt.

Also Read: Recapitalization

3. If market conditions are not favorable, private placement of equity or approaching Venture Capitalist to bring in more funds, to bring in more managerial efficiency, to part with some of the project risks with the VCs.

What is Equity Recapitalization?

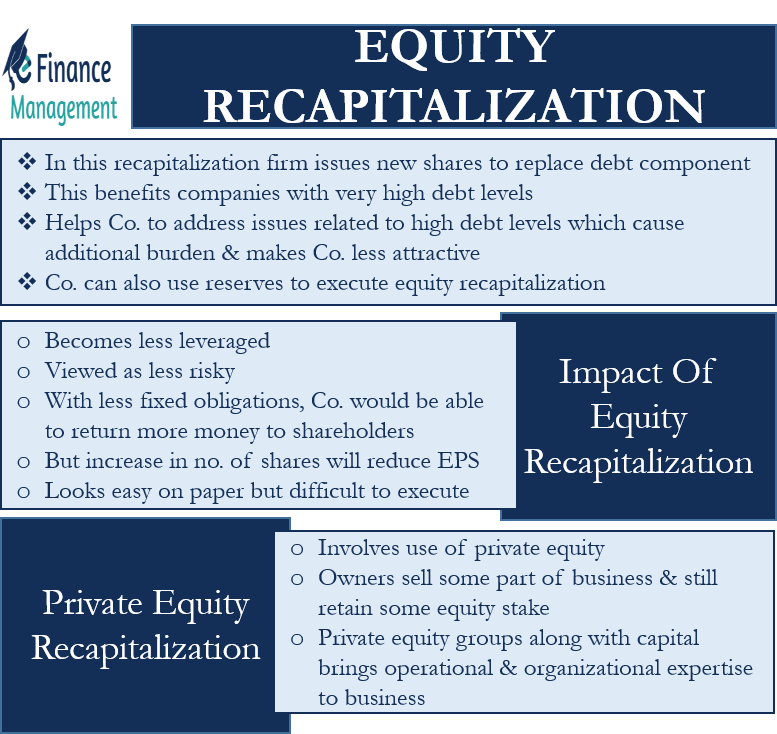

As the word suggests, in this recapitalization, the firm issues new shares to replace the debt component. Such a strategy benefits companies with very high debt levels.

Having more debt puts an additional burden on companies as they have to pay regular interest. Claims by the shareholders (both common and preference shares) come at last in the capital structure. So, in the event of liquidation, shareholders represent the least priority. Thus, replacing debt with equity eases the interest burden on the company.

Along with the interest burden, a company with a higher debt level is also perceived to be risky. And this makes the firm less attractive to investors. Thus, equity recapitalization helps a company address these issues related to high debt levels.

Apart from issuing new shares, there is another way in which a firm can execute equity recapitalization. And it is using its retained earnings to lower the debt level. Retained earnings are part of profits that a firm sets asides.

Impact of Equity Recapitalization

When a firm uses equity recapitalization, it becomes less leveraged. Moreover, it would be viewed as less risky as it now has fewer debt obligations, including interest and principal. With less fixed obligations, the company would be able to return more money to the shareholders. On the other hand, an increase in the number of shares will reduce the EPS (earnings per share).

Though this type of recapitalization looks easy on paper, it may be difficult to execute, especially for distressed companies. Distressed companies are the companies that are unattractive to capital market investors.

Private Equity Recapitalization

Such a type of recapitalization involves the use of private equity. Under this, business owners use this recapitalization to sell some part of the business and still retain some equity stake to benefit from future growth. Additionally, it allows the owners to realize the value of their remaining stake when the private equity sells the company later.

Apart from these, there are more benefits of this recapitalization. Bringing private equity makes the business more appealing. This is because private equity groups are savvy business partners who, along with capital, bring operational and organizational expertise to the business as well. Moreover, they also help to diversify some personal risks of the business owner. Another benefit is that the private equity group facilitates smoother succession as they work towards deepening the management team.